LFI BDC Portfolio News 7/25/23: Wave of refinancing, repricing, dividends sweeps up BDC-held credits including CoAdvantage, Dun & Bradstreet

The recent run-up in secondary prices spurred a fresh wave of loan launches last week, including repricing activity and the widely anticipated Arconic LBO loan as loan investors continued to pounce on what remains a paltry amount of new money. Notable among last week’s business was a comprehensive refinancing effort for BrandSafway, which essentially cuts in half the borrower’s institutional loan exposure courtesy of an equity infusion from the sponsors to repay $1 billion of debt and a secured bond deal. High-yield accounts, as well, oversubscribed the $3.2 billion of issuance after weeks of low supply, a fresh run-up in trading, and generally a lower-rates backdrop with signs inflation is coming down.

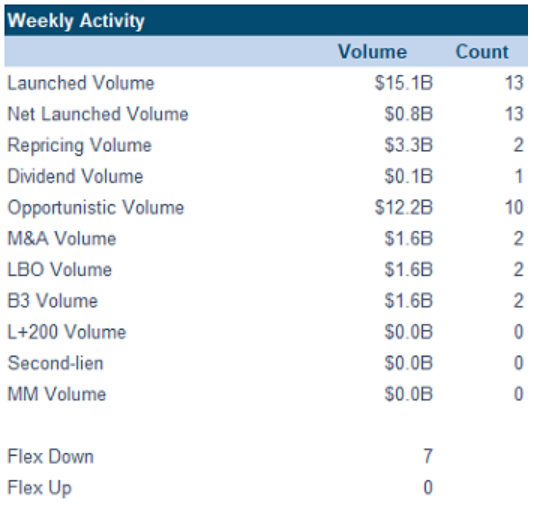

Powered by a big push last Monday with the largest single-day tally of gross launched loan volume since January 2022, launched volume soared to $15.1 billion last week, the most since the week of January 28, 2020. But that was then, and the current focus on refinancings and extensions yielded a mere $800 million of net volume versus $12.27 billion in the 2022 week as BrandSafway’s refinancing—which represents a roughly $1.3 billion net paydown—offset some of the new money on offer, such as Arconic.

Portfolios in brief: Holds reflect the most recent reporting period available

Steele Creek: Citadel Securities (Baa3/BBB-) – Refi

J.P. Morgan launched a revised financing for Citadel Securities, which now proposes a $3.5 billion, seven-year term loan to refinance both of its existing term loans due 2028 into a single tranche. As reported, the issuer had previously proposed a 50 bps repricing of its $600 million incremental TLB-1 due 2028, which would have lowered the margin on that tranche from S+CSA+300 and made the incremental debt fungible with the approximately $2.9 billion term loan due February 2028, which is currently priced at S+250 with a CSA of 11/26/43. The repriced debt was offered at 99.5 and the issuer was offering to reset the 101 soft call protection on the entire tranche for six months. Instead, the borrower is now looking to refinance both existing loans into a single $3.5 billion, seven-year tranche. As before, the coupon on offer is S+250 with an 11/26/43 CSA and a 0% floor, though the OID is 99-99.25. Holders of the existing 2028 loan include Steele Creek Capital Corp. ($1.2M).

Audax: CoAdvantage (B2/B) – Refi, dividend

A Deutsche Bank-led arranger group went out with price talk of S+550-575 with a 1% floor and a 98 OID on the $550 million term loan B for CoAdvantage. The six-year loan would include the same flat 10 bps CSA as the existing loan, while lenders are offered one year of 101 hard call protection. At the proposed guidance, the loan would yield about 11.93%-12.2% to maturity based on three-month SOFR of 525 bps. Proceeds would refinance the issuer’s first- and second-lien debt and fund a dividend. The six-year loan would carry 12 months of 101 hard call protection. In January, the issuer amended its existing first-lien term loan B due September 2025 to SOFR-based pricing—S+500 instead of L+500, with a 1% floor—with a flat 10 bps CSA. Audax Credit BDC Inc. holds $3.9M of the existing 2025 loan.

Ares, BCRED: Dun & Bradstreet (B2/B+/BB-) – Repricing

Investors received allocations of Dun & Bradstreet’s repriced $2.666 billion term loan (S+CSA+300) which was issued at par. BofA Securities was left lead on the deal, which priced at the wide end of guidance and lowers pricing from S+325. Dun & Bradstreet (NYSE: DNB) is a commercial data and analytics company. Ares Strategic Income fund holds $3.1M of the existing term loan due February 2028, while BCRED Emerald JV LP holds nearly $8M.

FSEN: HESM/GIP II Blue (Ba3/BB-) – Dividend

Accounts have received allocations of HESM Holdco’s drive-by $100 million add-on term loan (S+CSA+ 450, 1% floor). The OID wasn’t disclosed. Morgan Stanley was left lead on the deal, which funds a dividend to sponsor Global Infrastructure Partners. The borrower is a holding company with a 45% interest in Hess Midstream Operations. Global Infrastructure Partners and Hess Corp. created a joint venture in 2015 that gave the sponsor a 50% stake in Hess Infrastructure Partners. Holders of the existing September 2028 term loan include FS Energy & Power Fund ($5.8M).

Steele Creek: Janus International (B1/B) – Refi

A Goldman Sachs-led arranger group accelerated the commitment deadline on Janus International Group’s $625 million term loan B due 2030 to noon ET today, from Wednesday, July 26. There’s no update to guidance of S+350-375 with a 1% floor and a 98 offer price on the loan, which includes a 10 bps flat CSA and a 25 bps step-down at B1/B+ corporate ratings. Investors are offered six months of 101 soft call protection. The loan refinances the issuer’s TLB due February 2025, which recently shifted to SOFR at S+325 with a 1% floor and a flat 10 bps CSA. Steele Creek holds $821K of the existing term debt.