SOLVE for Underwriting

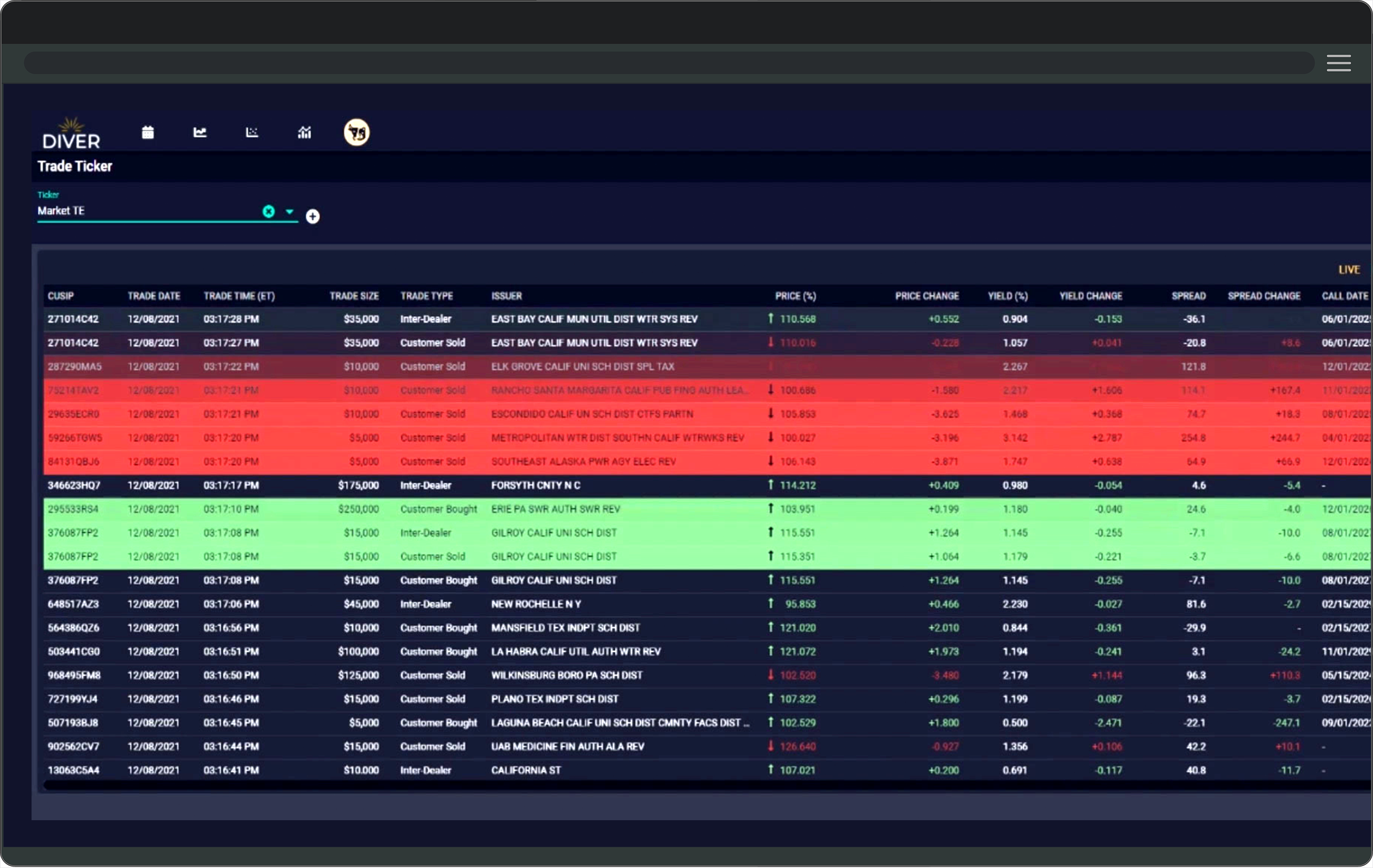

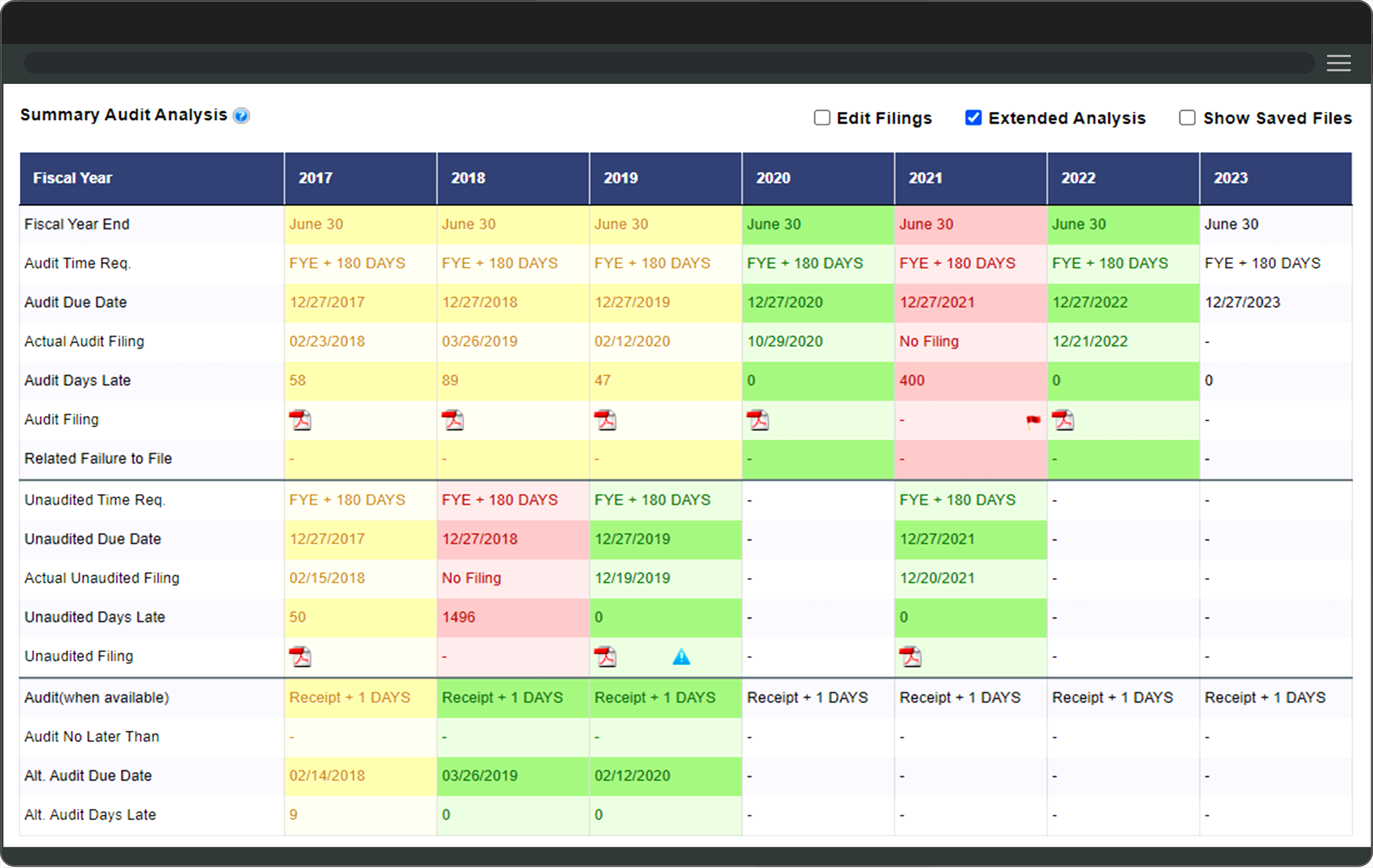

Efficiently manage indicative scale requests, generate final scales for new issues and bid more deals by identifying market comps using the most sophisticated tools and accurate new issue and secondary market data. Satisfy your 15c2-12 diligence obligation.

The SOLVE Platform, which includes the DIVER suite of modules, is the leader in combining relevant primary and secondary market data, to give Underwriters the edge to inform primary market pricing, efficiently price different structures, and bid more deals.

Address indicative pricing requests from Bankers efficiently, source relevant comps quickly, instantly produce baseline scales to bid more competitive deals, and have 15c2-12 analyses ready for review.

See How Underwriting is Powered by SOLVE with Deep Market InsightTM

See How Underwriting is Powered by SOLVE with Deep Market InsightTM

Hundreds of institutions rely on SOLVE to perform new issue pricing analyses, identify primary and secondary trade opportunities, monitor market activity, value fixed income positions, and comply with securities regulations.

Hundreds of institutions rely on SOLVE to perform new issue pricing analyses, identify primary and secondary trade opportunities, monitor market activity, value fixed income positions, and comply with securities regulations.

Explore More of The SOLVE Platform

with Deep Market Insight™

with Deep Market Insight™

Explore More of The SOLVE Platform

with Deep Market Insights™

The SOLVE Platform represents a powerful combination of data, analytics, and workflow tools that save time, reduce risk and drive the growth of your fixed income business.

The SOLVE Platform represents a powerful combination of data, analytics, and workflow tools that save time, reduce risk and drive the growth of your fixed income business.