SOLVE for Municipal Advisors

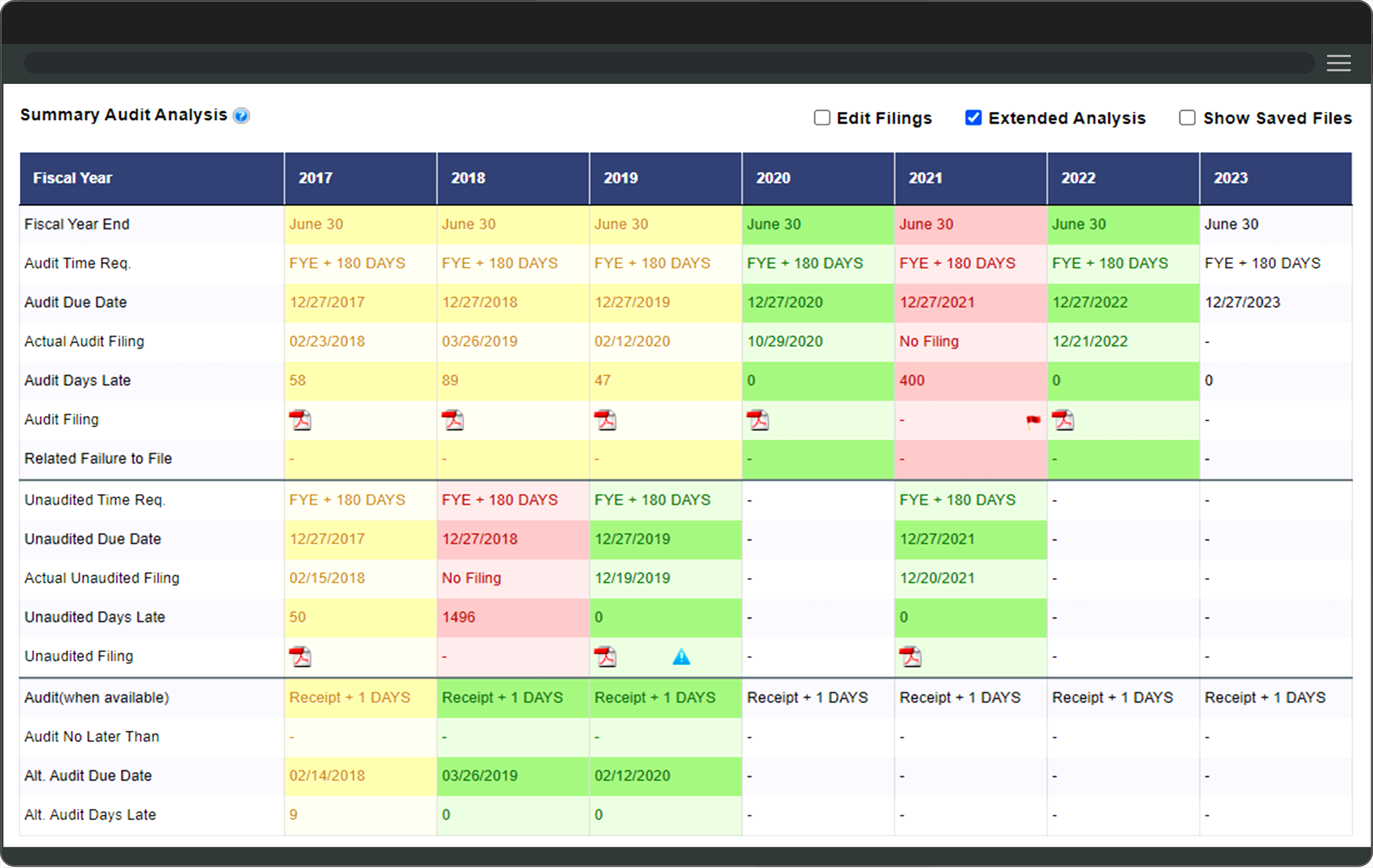

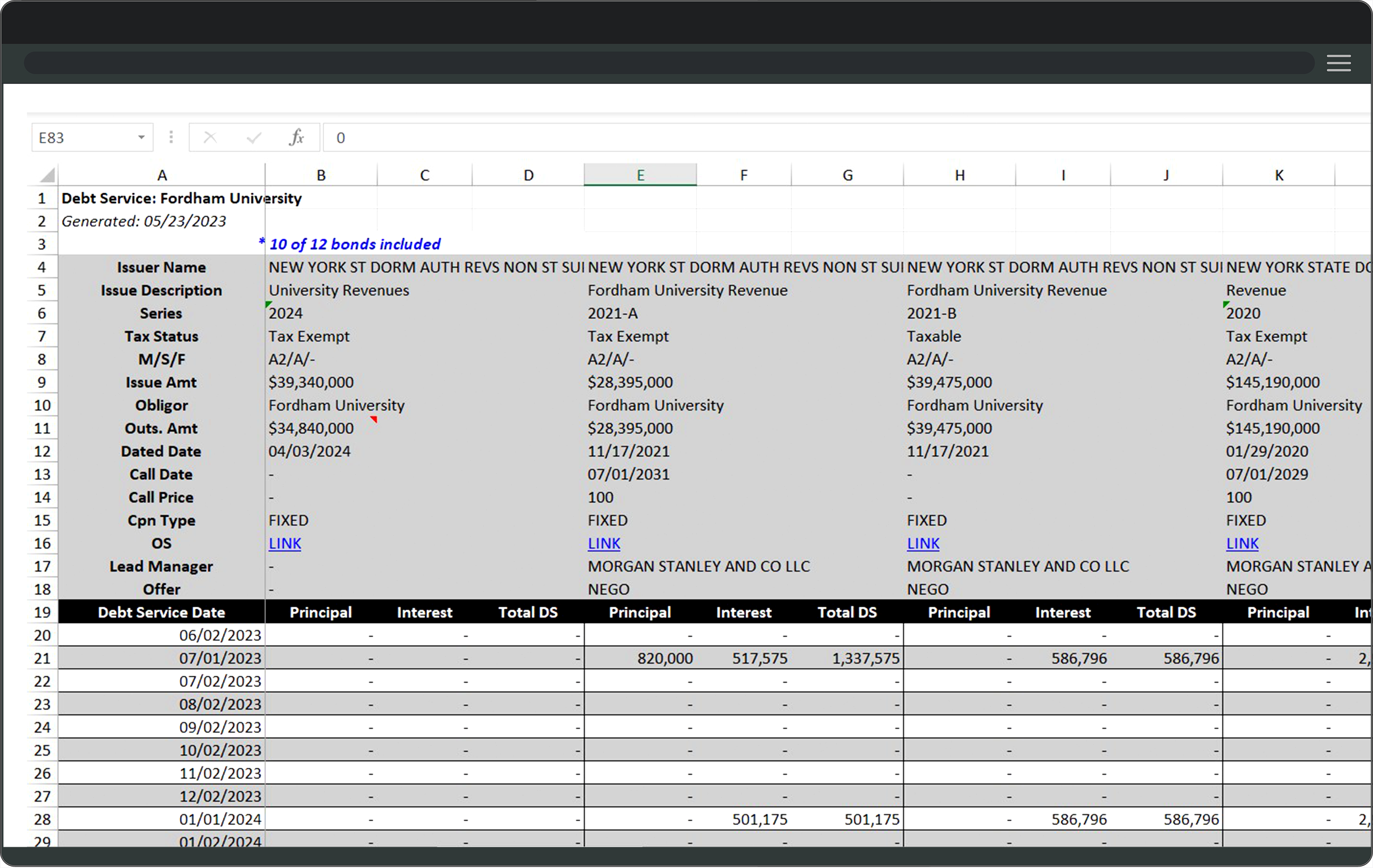

Save time and win more business by identifying opportunities and efficiently creating the best finance proposals for your Municipal Issuer clients.

Save time generating debt analyses, sourcing pricing activity for your Issuer client and comparable Issuers and producing baseline scales for any municipal deal or market segment based on relevant structural and credit characteristics.

With comprehensive and timely primary and secondary pricing information, DIVER by SOLVE provides tools to serve your client’s best interests and helps support your regulatory obligations.

“The Debt Analysis saves us 90% of the time previously spent creating and maintaining debt profiles for clients and prospects”

See How MUNICIPAL ADVISORS ARE Powered by SOLVE with Deep Market InsightTM

See How MUNICIPAL ADVISORS ARE Powered by SOLVE with Deep Market InsightTM

Hundreds of institutions rely on SOLVE to perform new issue pricing analyses, identify primary and secondary trade opportunities, monitor market activity, value fixed income positions, and comply with securities regulations.

Hundreds of institutions rely on SOLVE to perform new issue pricing analyses, identify primary and secondary trade opportunities, monitor market activity, value fixed income positions, and comply with securities regulations.

Explore More of The SOLVE Platform

with Deep Market InsightTM

with Deep Market InsightTM

Explore More of

The SOLVE Platform

with Deep Market InsightTM

The SOLVE Platform

with Deep Market InsightTM

The SOLVE Platform represents a powerful combination of data, analytics, and workflow tools that save time, reduce risk and drive the growth of your fixed income business.

The SOLVE Platform represents a powerful combination of data, analytics, and workflow tools that save time, reduce risk and drive the growth of your fixed income business.