Syndicated Bank Loans

GET OUR BANK LOAN MARKET SUMMARIES STRAIGHT TO YOUR INBOX. LEARN MORE

Syndicated Bank Loan Market Summary:

March 2024

Our newsletter presents key trends derived from observable Syndicated Bank Loan pricing data over a monthly period.

![]()

New Issues

Loans issued during the month ending 3/31//24

| ISSUER | AMOUNT (MM) | LOAN TYPE | MATURITY | RATE |

| Ankura Consulting Group LLC | 577 | Term Loan | 3/17/2028 | S+400 |

| Avantor Performance Materials Inc. | 772 | Term Loan | 11/1/2027 | S+200 |

| Tekni Plex Inc. | 876 | Term Loan | 9/17/2028 | S+400 |

| Sharp Midco LLC | 851 | Term Loan | 12/1/2028 | S+375 |

| NRG Energy Inc. | 875 | Term Loan | 3/19/2031 | S+200 |

| Ovation Parent Inc | 815 | Term Loan | 3/15/2031 | S+350 |

| Kaman Corp. | 815 | Term Loan | 3/15/2031 | S+350 |

| Perforce Software Inc. | 375 | Term Loan | S+475 | |

| Truist Bank | 3100 | Term Loan | 3/7/2031 | S+325 |

| StandardAero | 1993 | Term Loan | 8/24/2028 | S+350 |

| Sequa Corp. | 900 | Term Loan | 3/11/2031 | S+375 |

| Aramark Svcs Inc. | 730 | Term Loan | 4/6/2028 | S+200 |

| Aramark Svcs Inc. | 1095 | Term Loan | 6/22/2030 | S+200 |

| Medline Industries Inc. | 6143 | Term Loan | 10/21/2028 | S+275 |

| Kindercare Learning Ctrs Inc. | 265 | Term Loan | 6/12/2030 | S+500 |

| Beacon Roofing Supply Inc. | 975 | Term Loan | 5/19/2028 | S+200 |

| Vistra Operations Co LLC | 700 | Term Loan | 3/6/2031 | S+275 |

| Supplyone, Inc. | 770 | Term Loan | 3/19/2031 | S+450 |

| Particle Investments SA R.L. | 540 | Term Loan | 3/12/2031 | S+400 |

| Kodiak BP LLC | 450 | Term Loan | 3/12/2028 | S+375 |

| IVIGRO | 550 | Term Loan | 3/15/2029 | E+450 |

| Alterra Mountain | 1988 | Term Loan | 3/18/2028 | S+325 |

| Alterra Mountain | 498 | Term Loan | 3/18/2030 | S+350 |

| Windsor Holdings III LLC | 2754 | Term Loan | 8/1/2030 | S+400 |

| Apex Tool Group LLC | 232 | Term Loan | 2/8/2030 | S+1000 |

| Univar Inc. | 2754 | Term Loan | 8/1/2030 | S+400 |

| TransDigm Group Inc. | 4525 | Term Loan | 8/1/2028 | S+275 |

| TransDigm Group Inc. | 1708 | Term Loan | 3/1/2030 | S+275 |

| HotelBeds | 760 | Term Loan | 9/1/2028 | L+450 |

| Hilton Grand Vacations Borrower LLC | 1271 | Term Loan | 8/2/2028 | S+250 |

| Ekaterra BV | 175 | Term Loan | 6/14/2029 | E+650 |

| Boluda Towage SL | 1100 | Term Loan | 1/1/2030 | |

| Vertical Midco GmbH | 2841 | Term Loan | 4/30/2030 | S+350 |

| Tibco Software Inc. | 1000 | Term Loan | 3/14/2031 | S+450 |

| Icon PLC | 238 | Term Loan | 7/3/2028 | S+200 |

| Icon PLC | 593 | Term Loan | 7/2/2028 | S+200 |

| Air Canada | 1175 | Term Loan | 3/11/2031 | S+250 |

| Empire State Realty Trust Inc. | 620 | Revolving Credit | 3/8/2028 | S+130 |

| DAE Aviation Hldg Inc. | 769 | Term Loan | 8/1/2028 | S+350 |

| DAE Aviation Hldg Inc. | 1793 | Term Loan | 8/1/2028 | S+350 |

| Connect Finco Sarl | 1300 | Term Loan | 9/1/2029 | S+450 |

| Canister Intl. Group Inc. | 500 | Term Loan | 3/1/2029 | S+400 |

| Stubhub | 1953 | Term Loan | 3/1/2030 | S+500 |

| Rackspace Technology Global Inc. | 1312 | Term Loan | 5/15/2028 | S+275 |

| Topgolf Callaway Brands Corp | 1241 | Term Loan | 3/16/2030 | S+300 |

| Marriott Ownership Resorts Inc. | 800 | Term Loan | 3/11/2031 | S+225 |

| LifePoint Health Inc | 1850 | Term Loan | 11/1/2028 | S+475 |

| Creative Artists Agency LLC | 125 | Term Loan | 11/26/2028 | S+325 |

Largest Loans

Highlights the monthly price movements and quote depth for the 20 largest bank loans between 3/1/24 – 3/31/24

| RANK | SIZE (MM) | NAME | CHANGE | PRC | PRC-1M | DEALERS |

| 1 | 7,270 | MEDLINE TL B | 0.16% | 99.98 | 99.82 | 12 |

| 2 | 4,860 | HUB INTL LTD TL B | -0.06% | 99.86 | 99.91 | 16 |

| 3 | 4,750 | ZAYO TL | 6.64% | 89.89 | 84.29 | 15 |

| 4 | 4,741 | INTERNET BRANDS TL B | 0.54% | 98.34 | 97.82 | 12 |

| 5 | 4,559 | TRANSDIGM INC. TL I | 0.18% | 100.20 | 100.02 | 22 |

| 6 | 4,050 | CITRIX TL B | 1.06% | 99.08 | 98.05 | 12 |

| 7 | 3,900 | DIRECTV TL | -0.06% | 99.83 | 99.90 | 14 |

| 8 | 3,580 | CDK GLOBAL TL B | 0.10% | 100.20 | 100.09 | 14 |

| 9 | 3,500 | WESTINGHOUSE TL B | 0.24% | 99.63 | 99.38 | 11 |

| 10 | 3,500 | PILOT TRAVEL TL B | 0.13% | 99.96 | 99.83 | 12 |

| 11 | 3,500 | AMERICAN AIRLINES TL B | 0.99% | 103.36 | 102.35 | 12 |

| 12 | 3,450 | GOLDEN NUGGET INC TL B | 0.32% | 100.01 | 99.68 | 14 |

| 13 | 3,420 | RCN GRANDE TL | 1.26% | 81.86 | 80.84 | 15 |

| 14 | 3,380 | SOLERA TL B | 0.40% | 97.76 | 97.38 | 14 |

| 15 | 3,300 | NTL CABLE PLC TL N | 0.97% | 98.95 | 98.00 | 11 |

| 16 | 3,200 | COMMSCOPE TL B2 | 2.58% | 89.52 | 87.26 | 12 |

| 17 | 3,175 | MAGENTA BUYER LLC TL | -9.00% | 59.81 | 65.73 | 10 |

| 18 | 3,000 | DELTA SKYMILES TL B | 0.56% | 102.79 | 102.21 | 14 |

| 19 | 3,000 | CITRIX TL A | 1.08% | 98.89 | 97.84 | 11 |

| 20 | 2,985 | HARBOR FREIGHT TL B | 0.48% | 99.26 | 98.78 | 15 |

| AVERAGE | 3,856 | 0.43% | 95.96 | 95.46 | 13.4 |

Top 10 Outperformers

Showcases the top 10 loan “outperformers” based on the largest bid price increases between 3/1/24 – 3/31/24

| RANK | NAME | CHANGE | PRC | PRC-1M | DEALERS |

| 1 | SOUND PHYSICIANS TL | 23.03% | 55.00 | 44.70 | 7 |

| 2 | HDT GLOBAL TL B | 17.40% | 58.36 | 49.71 | 6 |

| 3 | MICHAELS STORES TL | 9.47% | 89.53 | 81.79 | 15 |

| 4 | FRANKLIN ENERGY TL | 9.11% | 98.45 | 90.23 | 6 |

| 5 | PRETIUM PACKAGING 2ND LIEN TL | 6.10% | 60.39 | 56.92 | 10 |

| 6 | TOSCA SERVICES TL | 5.95% | 87.17 | 82.27 | 11 |

| 7 | AIR MEDICAL TL B2 | 5.90% | 93.27 | 88.07 | 8 |

| 8 | HARLAND CLARKE TL | 5.27% | 96.90 | 92.05 | 11 |

| 9 | CORELOGIC 2ND LIEN TL | 4.79% | 93.86 | 89.58 | 7 |

| 10 | COMMERCEHUB 2ND LIEN TL B | 4.53% | 83.76 | 80.13 | 6 |

Top 10 Underperformers

Showcases the top 10 loan “underperformers” based on the largest bid price decreases between 3/1/24 – 3/31/24

| RANK | NAME | CHANGE | PRC | PRC-1M | DEALERS |

| 1 | RACKSPACE HOSTING TL B | -28.95% | 30.90 | 43.48 | 10 |

| 2 | HEUBACH GMBH TL B | -25.81% | 25.88 | 34.88 | 9 |

| 3 | ASTRA ACQUISITION CORP TL B | -16.77% | 40.35 | 48.48 | 9 |

| 4 | SIRVA WORLDWIDE TL | -16.76% | 69.92 | 84.00 | 6 |

| 5 | HUBBARD RADIO TL B | -15.79% | 64.00 | 76.00 | 6 |

| 6 | PHYSICIAN PARTNERS TL | -15.66% | 74.16 | 87.93 | 8 |

| 7 | WEIGHT WATCHERS TL B | -15.41% | 44.60 | 52.73 | 12 |

| 8 | SANDVINE TL | -15.26% | 69.29 | 81.77 | 10 |

| 9 | NUMERICABLE TL B12 | -12.47% | 85.94 | 98.19 | 8 |

| 10 | SITEL LLC / SITEL FIN CORP EUR TL B | -11.96% | 85.38 | 96.98 | 11 |

Avg Bid PX by Sector

Displays the average loan bid price by sector between 3/1/24 – 3/31/24

Results are based on 5 select industry sectors, however, we offer data across 36 sectors

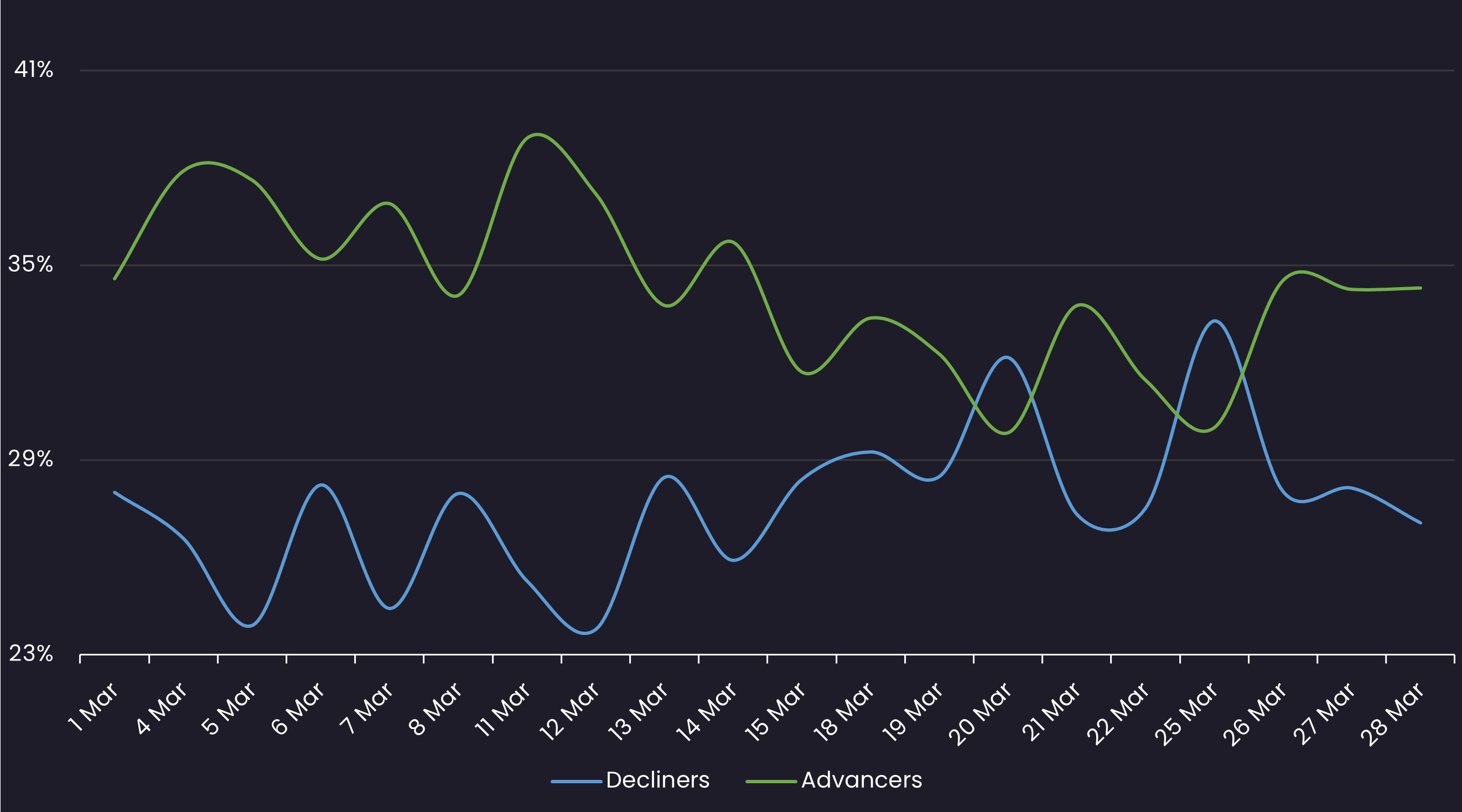

Sentiment

Reveals the percent of loans increasing in price (advancers) vs. loans decreasing in price (decliners) between 3/1/24 – 3/31/24

Top Quote Volume Movers: This Month vs Last Month

Exhibits the loans with the largest increase in quote volume for the month ending 2/29/23 vs. the month ending 3/31/24

| RANK | TRANCHE | PRIOR MONTH | THIS MONTH | INCREASE | % INCREASE |

| 1 | HILEX POLY TL B | 251 | 450 | 199 | 79% |

| 2 | SS&C TECH TL B | 224 | 393 | 169 | 75% |

| 3 | ADVISOR GROUP TL B | 14 | 158 | 144 | 1029% |

| 4 | HYPERION TL B | 248 | 391 | 143 | 58% |

| 5 | TRANSUNION TL B | 236 | 378 | 142 | 60% |

| 6 | CROSBY TL | 48 | 180 | 132 | 275% |

| 7 | PLANET US BUYER TL B | 36 | 159 | 123 | 342% |

| 8 | ONE CALL TL B | 6 | 126 | 120 | 2000% |

| 9 | BUCKEYE TL B3 | 142 | 253 | 111 | 78% |

| 10 | ADIENT GLOBAL TL B | 166 | 272 | 106 | 64% |

Most Quoted Loans

Ranks the loans that were quoted by the highest number of dealers between 3/1/24 – 3/31/24

| RANK | TRANCHE | DEALERS |

| 1 | TRANSDIGM INC. TL I | 19 |

| 2 | ALKEGEN TL B | 18 |

| 3 | FRONERI TL B | 17 |

| 4 | ZAYO TL | 17 |

| 5 | TRANSDIGM INC. TL J | 17 |

| 6 | HUB INTL LTD TL B | 17 |

| 7 | ZIGGO EUR TL H | 17 |

| 8 | TELENET EUR TL | 17 |

| 9 | GATES GLOBAL TL B3 | 17 |

| 10 | EKATERRA EUR TL B | 17 |

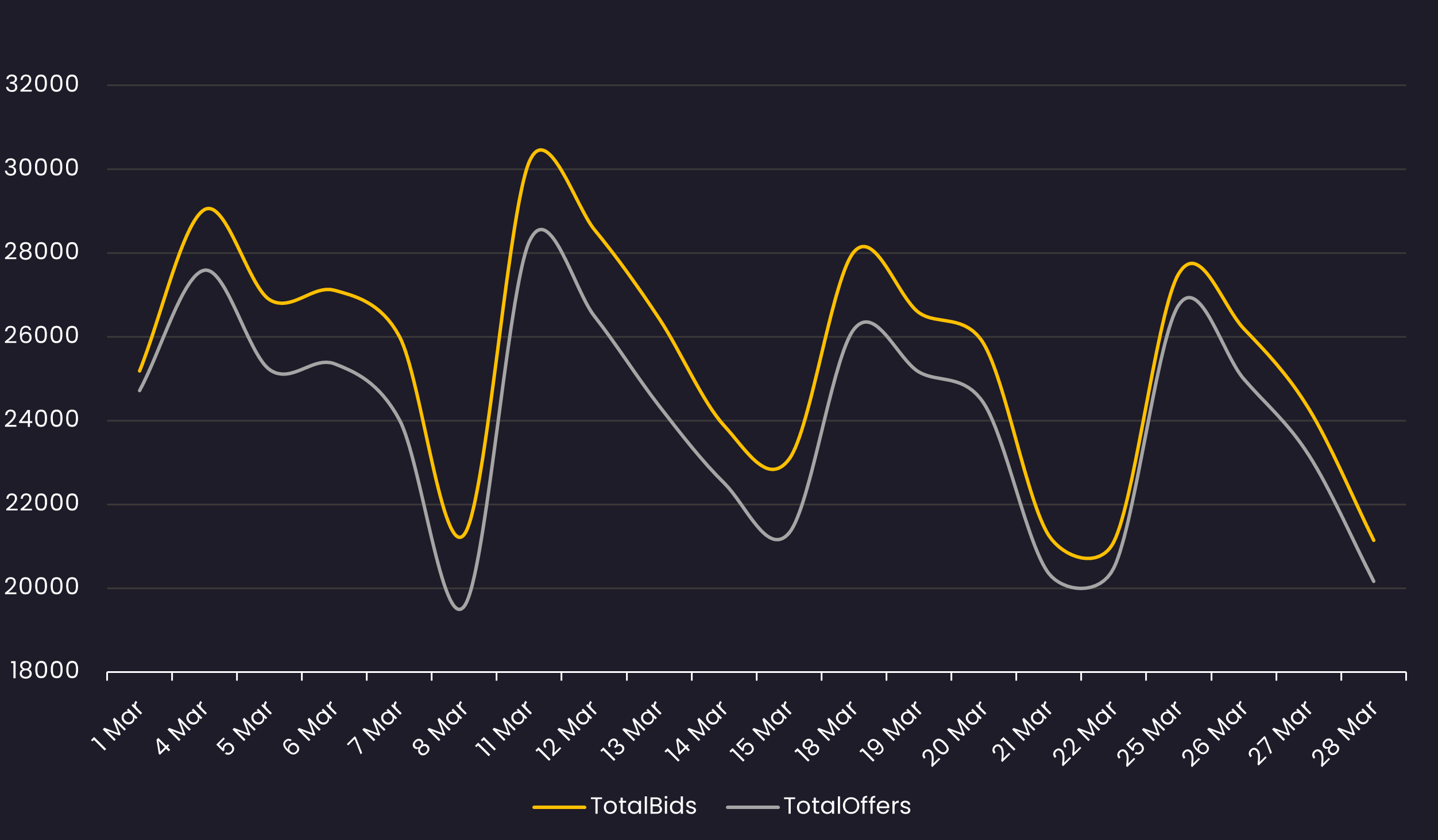

Bid and Offer Volume

Reveals the total number of quotes by bid and offer between 3/1/24 – 3/31/24

Sector Bid-Offer Spread

Displays the bid-offer spread by sector between 3/1/24 – 3/31/24

Results are based on 5 select industry sectors, however, we offer data across 36 sectors

Stay up-to-date with weekly summaries.

BDCs

BDCs  SOLVE Insights

SOLVE Insights  SOLVE Newsroom

SOLVE Newsroom