Syndicated Bank Loans

GET OUR BANK LOAN MARKET SUMMARIES STRAIGHT TO YOUR INBOX. LEARN MORE

Syndicated Bank Loan Market Summary:

April 2024

Our newsletter presents key trends derived from observable Syndicated Bank Loan pricing data over a monthly period.

![]()

New Issues

Loans issued during the month ending 4/30/24

| ISSUER | AMOUNT (MM) | LOAN TYPE | MATURITY | RATE |

| Thryv Inc. | 350 | Term Loan | 4/5/2029 | S+675 |

| Nouryon | 744 | Term Loan | 4/1/2028 | S+350 |

| Nouryon | 650 | Term Loan | 4/1/2028 | S+350 |

| Tronox Inc. | 741 | Term Loan | 4/4/2029 | S+275 |

| GVC Holdings PLC | 1740 | Term Loan | 10/1/2029 | S+275 |

| Asplundh Tree Expert LLC | 1000 | Term Loan | 4/24/2031 | S+175 |

| House of HR | 1299 | Term Loan | 11/1/2029 | E+500 |

| Pointclickcare Technologies Inc. | 437 | Term Loan | 12/1/2027 | S+300 |

| Modena Buyer LLC | 2600 | Term Loan | 4/2/2031 | S+450 |

| Kindercare Learning Ctrs Inc. | 792 | Term Loan | 6/12/2030 | S+450 |

| Carnival Corp. | 1748 | Term Loan | 4/16/2028 | S+275 |

| Carnival Corp. | 1000 | Term Loan | 4/16/2027 | S+275 |

| Franklin Square | 700 | Term Loan | 4/15/2031 | S+225 |

| Cedar Fair LP | 1000 | Term Loan | 4/11/2031 | S+200 |

| Infoblox Inc. | 1690 | Term Loan | 12/1/2029 | |

| Infoblox Inc. | 455 | Term Loan | 12/1/2030 | S+600 |

| United Natural Foods Inc. | 500 | Term Loan | 4/16/2031 | S+475 |

| Trace3 LLC | 225 | Term Loan | 10/8/2028 | S+425 |

| Press Ganey LLC | 1825 | Term Loan | 4/30/2031 | S+350 |

| Les Schwab Tire | 1918 | Term Loan | 4/15/2031 | S+325 |

| LS Group Opco Acquistion LLC | 1918 | Term Loan | S+300 | |

| SSH Group Hldg Inc. | 848 | Term Loan | 10/1/2030 | S+400 |

| City Brewing Company LLC | 292 | Term Loan | 4/5/2028 | S+350 |

| Utz Quality Foods | 630 | Term Loan | 1/20/2028 | S+275 |

| Savage Enterprises LLC | 275 | Term Loan | 9/1/2028 | S+325 |

| SUSE | 673 | Term Loan | 11/1/2030 | S+400 |

| Buyers Edge Platform LLC | 560 | Term Loan | 4/4/2031 | S+375 |

| Anticimex Intl. | 367 | Term Loan | 11/1/2028 | S+350 |

| Advantage Sales & Marketing Inc. | 1146 | Term Loan | 10/28/2027 | S+425 |

| Endo Pharmaceuticals Hldg Inc. | 1500 | Term Loan | 4/9/2031 | S+450 |

| Endo Luxembourg Finance I Co. Sarl | 1500 | Term Loan | 4/1/2031 | S+450 |

| ECL Entertainment LLC | 379 | Term Loan | 8/1/2030 | S+425 |

| ECL Entertainment LLC | 61 | Term Loan | 8/1/2030 | S+400 |

| DaVita Inc. | 1640 | Term Loan | 4/11/2031 | S+200 |

| AmaWaterways | 525 | Term Loan | 4/2/2031 | S+350 |

| Radnet Mgmt Inc. | 875 | Term Loan | 4/3/2031 | S+250 |

| Samsonite Intl. SA | 500 | Term Loan | S+200 | |

| VC GB Holdings Inc | 275 | Term Loan | 7/1/2028 | S+350 |

| Brand Energy & Infra Services | 1428 | Term Loan | 8/1/2030 | S+500 |

| American Greetings Corp. | 800 | Term Loan | 10/31/2029 | S+575 |

| Lumen Technologies Inc. | 1629 | Term Loan | 4/16/2029 | S+235 |

| Lumen Technologies Inc. | 1629 | Term Loan | 4/15/2030 | S+235 |

| Veeam Software | 2000 | Term Loan | 4/1/2031 | S+325 |

| Restaurant Brands Intl. Inc. | 750 | Term Loan | 9/21/2030 | S+225 |

| RHP Hotel Properties | 295 | Term Loan | 5/18/2030 | S+225 |

| MyEyeDR. Inc. | 1400 | Term Loan | 3/26/2031 | S+400 |

| Herbalife LTD | 400 | Term Loan | 3/22/2029 | S+675 |

| Genesee & Wyoming Inc. | 2725 | Term Loan | 3/26/2031 | S+200 |

Largest Loans

Highlights the monthly price movements and quote depth for the 20 largest bank loans between 4/1/24 – 4/30/24

| RANK | SIZE (MM) | NAME | CHANGE | PRC | PRC-1M | DEALERS |

| 1 | 8,572 | GEO GROUP TL1 | -1.19% | 101.27 | 102.49 | 11 |

| 2 | 6,143 | MEDLINE TL B | -0.01% | 100.23 | 100.24 | 14 |

| 3 | 5,385 | ULTIMATE SOFTWARE TL B | 0.01% | 100.47 | 100.46 | 15 |

| 4 | 4,860 | HUB INTL LTD TL B | 0.43% | 100.48 | 100.05 | 16 |

| 5 | 4,750 | ZAYO TL | -0.96% | 86.72 | 87.56 | 14 |

| 6 | 4,741 | INTERNET BRANDS TL B | 0.27% | 99.59 | 99.32 | 13 |

| 7 | 4,525 | TRANSDIGM INC. TL I | 0.17% | 100.48 | 100.31 | 17 |

| 8 | 4,260 | NUMERICABLE TL B14 | -7.19% | 74.46 | 80.23 | 12 |

| 9 | 4,050 | CITRIX TL B | 0.52% | 99.97 | 99.46 | 13 |

| 10 | 3,900 | DIRECTV TL | 0.12% | 100.46 | 100.33 | 17 |

| 11 | 3,580 | CDK GLOBAL TL B | 0.06% | 100.38 | 100.32 | 16 |

| 12 | 3,500 | AMERICAN AIRLINES TL B | 0.13% | 103.95 | 103.82 | 14 |

| 13 | 3,500 | SEDGWICK TL B | 0.22% | 100.37 | 100.15 | 10 |

| 14 | 3,500 | WESTINGHOUSE TL B | 0.20% | 100.05 | 99.85 | 16 |

| 15 | 3,420 | RCN GRANDE TL | -3.71% | 80.08 | 83.16 | 13 |

| 16 | 3,380 | SOLERA TL B | 0.23% | 99.24 | 99.02 | 16 |

| 17 | 3,300 | NTL CABLE PLC TL N | -0.36% | 98.07 | 98.43 | 13 |

| 18 | 3,242 | GOLDEN NUGGET INC TL B | -0.04% | 100.18 | 100.21 | 12 |

| 19 | 3,175 | MAGENTA BUYER LLC TL | -15.98% | 50.20 | 59.74 | 10 |

| 20 | 3,100 | ASURION TL B8 | -0.10% | 97.71 | 97.81 | 10 |

| AVERAGE | 4,244 | -1.36% | 94.72 | 95.65 | 13.6 |

Top 10 Outperformers

Showcases the top 10 loan “outperformers” based on the largest bid price increases between 4/1/24 – 4/30/24

| RANK | NAME | CHANGE | PRC | PRC-1M | DEALERS |

| 1 | ASTRA ACQUISITION CORP TL B | 43.81% | 58.03 | 40.35 | 9 |

| 2 | BAUSCH HEALTH COMPANIES INC. TL B | 15.18% | 89.59 | 77.78 | 11 |

| 3 | LUMILEDS EXIT TL | 13.72% | 28.31 | 24.90 | 9 |

| 4 | ELECTRONICS FOR IMAGING TL | 12.22% | 84.55 | 75.34 | 10 |

| 5 | CPV SHORE TL B | 7.86% | 91.08 | 84.44 | 7 |

| 6 | NATIONAL MENTOR TL | 6.82% | 86.56 | 81.04 | 5 |

| 7 | CARESTREAM HEALTH TL B | 5.54% | 89.71 | 85.00 | 7 |

| 8 | HALO BUYER TL | 5.08% | 75.42 | 71.77 | 5 |

| 9 | ACCELERATED HEALTH SYSTEMS LLC TL B | 4.89% | 77.75 | 74.12 | 9 |

| 10 | ANVIL INTERNATIONAL 2ND LIEN TL | 4.46% | 88.01 | 84.25 | 5 |

Top 10 Underperformers

Showcases the top 10 loan “underperformers” based on the largest bid price decreases between 4/1/24 – 4/30/24

| RANK | NAME | CHANGE | PRC | PRC-1M | DEALERS |

| 1 | LIFESCAN TL B | -39.36% | 36.46 | 60.12 | 9 |

| 2 | MAGENTA BUYER LLC TL | -15.98% | 50.20 | 59.74 | 10 |

| 3 | MOLD-RITE TL | -14.01% | 64.83 | 75.39 | 9 |

| 4 | EOS US FINCO LLC TL B | -13.88% | 71.00 | 82.44 | 9 |

| 5 | SKILLSOFT TL B | -11.54% | 78.85 | 89.14 | 8 |

| 6 | SITEL LLC / SITEL FIN CORP TL B | -10.04% | 76.79 | 85.36 | 10 |

| 7 | CBS RADIO INC TL B | -8.37% | 52.46 | 57.25 | 9 |

| 8 | SCIONHEALTH TL B | -8.04% | 39.32 | 42.76 | 3 |

| 9 | SPRINGS WINDOW TL B | -7.92% | 84.46 | 91.73 | 11 |

| 10 | RUNNER BUYER TL B | -7.84% | 69.78 | 75.72 | 10 |

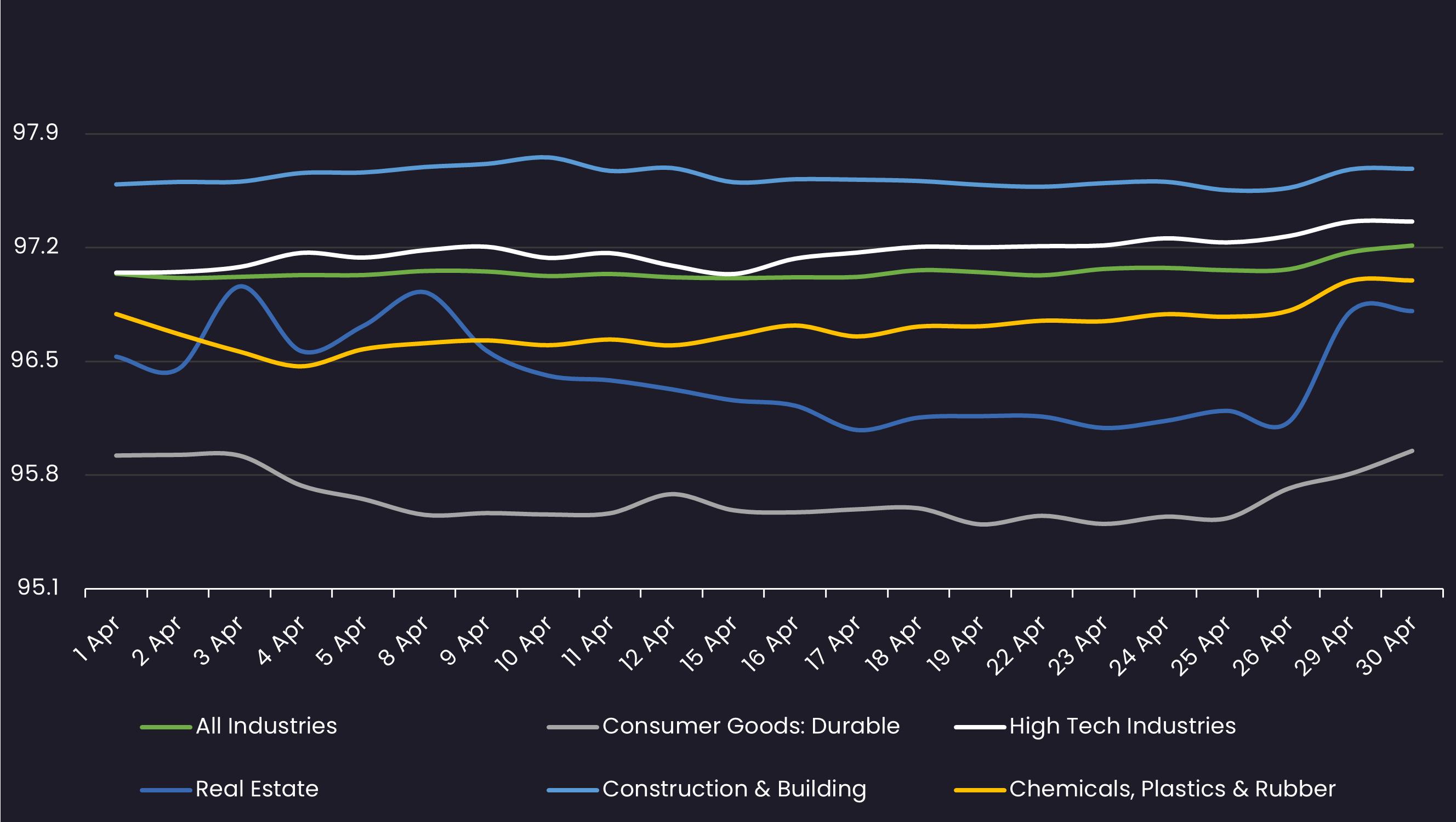

Avg Bid PX by Sector

Displays the average loan bid price by sector between 4/1/24 – 4/30/24

Results are based on 5 select industry sectors, however, we offer data across 36 sectors

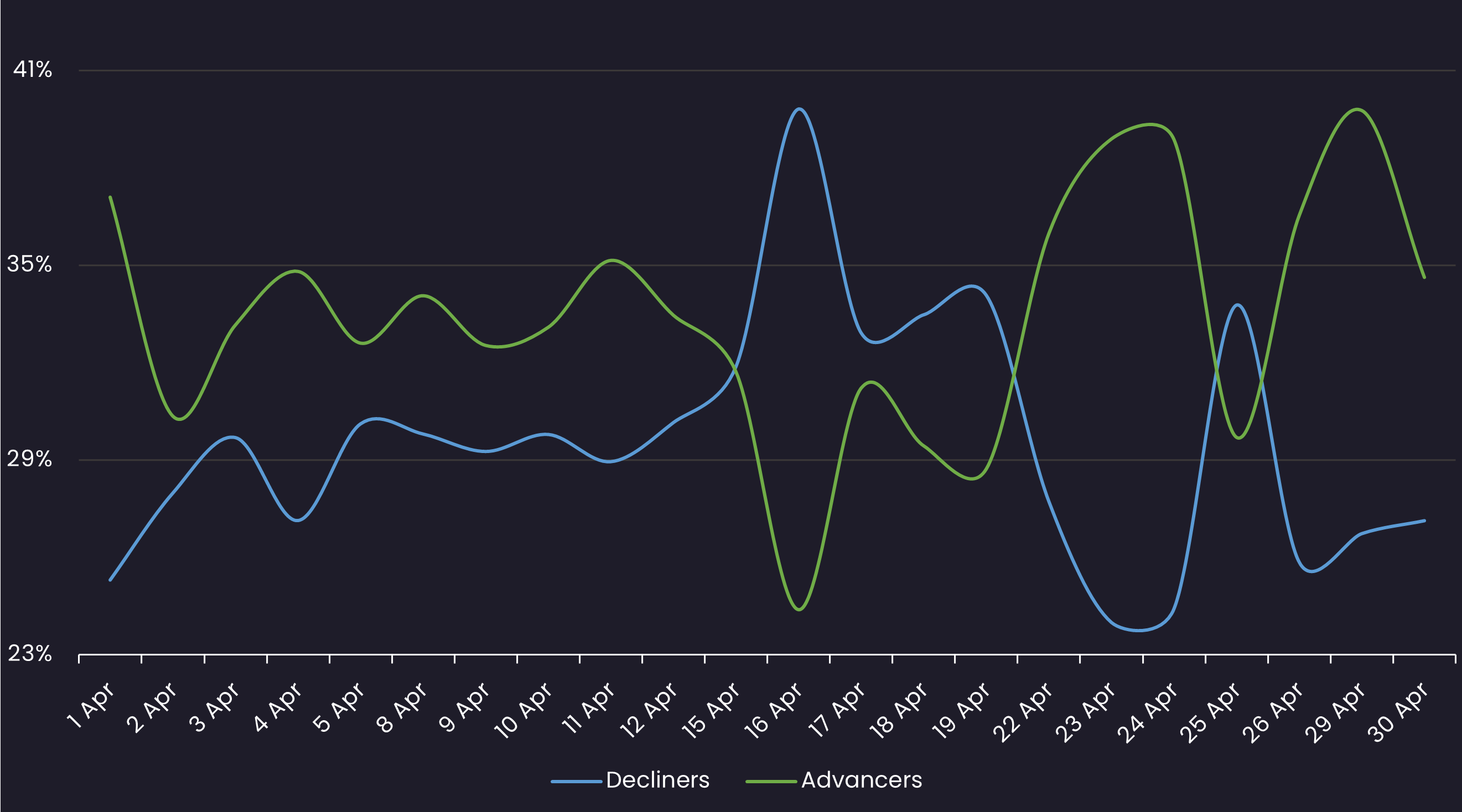

Sentiment

Reveals the percent of loans increasing in price (advancers) vs. loans decreasing in price (decliners) between 4/1/24 – 4/30/24

Top Quote Volume Movers: This Month vs Last Month

Exhibits the loans with the largest increase in quote volume for the month ending 3/31/23 vs. the month ending 4/30/24

| RANK | TRANCHE | PRIOR MONTH | THIS MONTH | INCREASE | % INCREASE |

| 1 | GOLDEN NUGGET INC TL B | 161 | 361 | 200 | 124% |

| 2 | AXALTA COATING SYSTEMS TL B6 | 79 | 256 | 177 | 224% |

| 3 | CALPINE CORP TL B9 | 300 | 460 | 160 | 53% |

| 4 | UNIVAR TL B | 8 | 164 | 156 | 1950% |

| 5 | CLEAR CHANNEL OUTDOOR TL B | 118 | 271 | 153 | 130% |

| 6 | NORTHRIVER MIDSTREAM TL B | 16 | 158 | 142 | 888% |

| 7 | APPLIED SYSTEMS TL B | 278 | 412 | 134 | 48% |

| 8 | SITEL LLC / SITEL FIN CORP TL B | 199 | 332 | 133 | 67% |

| 9 | NAVACORD CAD TL B | 42 | 171 | 129 | 307% |

| 10 | TENNECO TL B | 414 | 540 | 126 | 30% |

Most Quoted Loans

Ranks the loans that were quoted by the highest number of dealers between 4/1/24 – 4/30/24

| RANK | TRANCHE | DEALERS |

| 1 | TRANSDIGM INC. TL J | 18 |

| 2 | ALKEGEN TL B | 18 |

| 3 | FRONERI TL B | 18 |

| 4 | TENNECO TL B | 18 |

| 5 | KLOECKNER EUR TL B | 17 |

| 6 | DIRECTV TL | 17 |

| 7 | BERRY PLASTICS TL | 17 |

| 8 | BMC SOFTWARE TL B | 17 |

| 9 | TRANSDIGM INC. TL I | 17 |

| 10 | DELTA SKYMILES TL B | 17 |

Bid and Offer Volume

Reveals the total number of quotes by bid and offer between 4/1/24 – 4/30/24

Sector Bid-Offer Spread

Displays the bid-offer spread by sector between 4/1/24 – 4/30/24

Results are based on 5 select industry sectors, however, we offer data across 36 sectors

Stay up-to-date with weekly summaries.

BDCs

BDCs  SOLVE Insights

SOLVE Insights  SOLVE Newsroom

SOLVE Newsroom