Syndicated Bank Loans

GET OUR BANK LOAN MARKET SUMMARIES STRAIGHT TO YOUR INBOX. LEARN MORE

Syndicated Bank Loan Market Summary:

february 2024

Our newsletter presents key trends derived from observable Syndicated Bank Loan pricing data over a monthly period.

![]()

New Issues

Loans issued during the month ending 2/29/24

| ISSUER | AMOUNT (MM) | LOAN TYPE | MATURITY | RATE |

| Triton Water Hldg Inc. | 400 | Term Loan | 3/31/2028 | S+400 |

| K-MAC Hldgs Corp. | 115 | Term Loan | 7/1/2028 | S+425 |

| Blackhawk Network Holdings Inc. | 1900 | Term Loan | 2/14/2029 | S+500 |

| United Airlines Inc. | 2500 | Term Loan | 2/14/2031 | S+275 |

| Wrench Group LLC | 744 | Term Loan | 10/30/2028 | S+400 |

| AccentCare Inc. | 179 | Term Loan | 6/20/2028 | S+550 |

| Ultimate Software Group | 5385 | Term Loan | 1/31/2031 | S+350 |

| Cotiviti Corp. | 4250 | Term Loan | 2/28/2031 | |

| Wrench Group LLC | 893 | Term Loan | 10/30/2028 | S+400 |

| Playcore Inc. | 1100 | Term Loan | 2/2/2030 | S+450 |

| Osaic Hldg Inc. | 500 | Term Loan | 8/16/2028 | S+450 |

| Interstate Waste Services Inc. | 150 | Term Loan | 2/8/2030 | S+450 |

| BrightSpring Health | 2566 | Term Loan | 2/1/2031 | S+325 |

| Rosen Group | 1150 | Term Loan | 2/13/2031 | S+350 |

| United Airlines Inc. | 2500 | Term Loan | 2/22/2031 | S+275 |

| Roper Technologies Inc. | 1224 | Term Loan | 11/22/2029 | S+400 |

| Amer Sports Corp. | 700 | Term Loan | 2/1/2031 | L+350 |

| Amer Sports Corp. | 500 | Term Loan | 2/1/2031 | S+325 |

| Jane Street | Term Loan | 1/26/2028 | ||

| Consolidated Energy Finance SA | 745 | Term Loan | 10/29/2030 | S+450 |

| AssuredPartners Inc. | 500 | Term Loan | 2/6/2031 | S+350 |

| Touchdown Acquirer Inc | 350 | Term Loan | 1/26/2031 | L+400 |

| Covanta Energy Corp. | 549 | Term Loan | 11/30/2028 | S+275 |

| Artera Services LLC | 930 | Term Loan | 1/24/2031 | S+450 |

| Applied Systems Inc. | 2420 | Term Loan | 2/1/2031 | S+350 |

| Applied Systems Inc. | 565 | Term Loan | 2/1/2032 | S+525 |

| AccentCare Inc. | 851 | Term Loan | 9/20/2028 | S+400 |

| Nord Anglia Education Finance LLC | 600 | Term Loan | 2/12/2031 | S+375 |

| Eleda Group | 153 | Delayed-draw Term Loan | 2/6/2031 | E+450 |

| Eleda Group | 765 | Term Loan | 2/6/2031 | E+450 |

| Genesys SA | 800 | Term Loan | 12/1/2027 | S+400 |

| Fitness International LLC | 675 | Term Loan | 1/17/2029 | S+525 |

| Cano Health LLC | 150 | Delayed-draw Term Loan | 10/5/2024 | S+1100 |

| Science Applications | 510 | Term Loan | 1/19/2031 | S+187.5 |

| Renaissance Learning Inc. | 2015 | Term Loan | 4/7/2030 | S+425 |

| Core & Main LP | 750 | Term Loan | 2/5/2031 | S+225 |

| Copeland Sports | 1519 | Term Loan | 5/1/2030 | S+250 |

| AP Gaming I LLC | 550 | Term Loan | 2/15/2029 | S+375 |

| Howden Group Holdings Limited | 2925 | Term Loan | 2/1/2031 | S+350 |

| Crosby US Acquisition Corp. | 1000 | Term Loan | 8/15/2029 | S+400 |

| Argus Media | 1200 | Term Loan | 1/22/2031 | S+325 |

Largest Loans

Highlights the monthly price movements and quote depth for the 20 largest bank loans between 2/1/24 – 2/29/24

| RANK | SIZE (MM) | NAME | CHANGE | PRC | PRC-1M | DEALERS |

| 1 | 7,270 | MEDLINE TL B | 0.16% | 99.98 | 99.82 | 12 |

| 2 | 5,000 | UNITED CONTINENTAL TL B | -0.49% | 99.93 | 100.42 | 14 |

| 3 | 4,860 | HUB INTL LTD TL B | -0.06% | 99.86 | 99.91 | 16 |

| 4 | 4,750 | ZAYO TL | 6.64% | 89.89 | 84.29 | 15 |

| 5 | 4,741 | INTERNET BRANDS TL B | 0.54% | 98.34 | 97.82 | 12 |

| 6 | 4,559 | TRANSDIGM INC. TL I | 0.18% | 100.20 | 100.02 | 22 |

| 7 | 4,050 | CITRIX TL B | 1.06% | 99.08 | 98.05 | 12 |

| 8 | 3,900 | DIRECTV TL | -0.06% | 99.83 | 99.90 | 14 |

| 9 | 3,580 | CDK GLOBAL TL B | 0.10% | 100.20 | 100.09 | 14 |

| 10 | 3,500 | WESTINGHOUSE TL B | 0.24% | 99.63 | 99.38 | 11 |

| 11 | 3,500 | PILOT TRAVEL TL B | 0.13% | 99.96 | 99.83 | 12 |

| 12 | 3,500 | AMERICAN AIRLINES TL B | 0.99% | 103.36 | 102.35 | 12 |

| 13 | 3,450 | GOLDEN NUGGET INC TL B | 0.32% | 100.01 | 99.68 | 14 |

| 14 | 3,420 | RCN GRANDE TL | 1.26% | 81.86 | 80.84 | 15 |

| 15 | 3,380 | SOLERA TL B | 0.40% | 97.76 | 97.38 | 14 |

| 16 | 3,300 | NTL CABLE PLC TL N | 0.97% | 98.95 | 98.00 | 11 |

| 17 | 3,200 | COMMSCOPE TL B2 | 2.58% | 89.52 | 87.26 | 12 |

| 18 | 3,175 | MAGENTA BUYER LLC TL | -9.00% | 59.81 | 65.73 | 10 |

| 19 | 3,000 | DELTA SKYMILES TL B | 0.56% | 102.79 | 102.21 | 14 |

| 20 | 3,000 | CITRIX TL A | 1.08% | 98.89 | 97.84 | 11 |

| AVERAGE | 3,957 | 0.38% | 95.99 | 95.54 | 13.4 |

Top 10 Outperformers

Showcases the top 10 loan “outperformers” based on the largest bid price increases between 2/1/24 – 2/29/24

| RANK | NAME | CHANGE | PRC | PRC-1M | DEALERS |

| 1 | PRETIUM PACKAGING 2ND LIEN TL | 34.89% | 56.92 | 42.20 | 9 |

| 2 | ELECTRONICS FOR IMAGING TL | 15.37% | 74.09 | 64.22 | 8 |

| 3 | HEALTHCHANNELS TL | 15.31% | 71.45 | 61.96 | 6 |

| 4 | AVISON YOUNG TL | 15.15% | 36.10 | 31.35 | 7 |

| 5 | CARESTREAM DENTAL TL | 13.83% | 86.63 | 76.11 | 11 |

| 6 | WHEEL PROS TL | 8.76% | 81.13 | 74.59 | 8 |

| 7 | IQOR PIK SO TL | 8.43% | 81.55 | 75.21 | 5 |

| 8 | SI GROUP TL | 7.88% | 74.07 | 68.66 | 9 |

| 9 | INNOVATIVE XCESSORIES TL | 6.77% | 94.35 | 88.37 | 10 |

| 10 | ZAYO TL | 6.64% | 89.89 | 84.29 | 15 |

Top 10 Underperformers

Showcases the top 10 loan “underperformers” based on the largest bid price decreases between 2/1/24 – 2/29/24

| RANK | NAME | CHANGE | PRC | PRC-1M | DEALERS |

| 1 | ACCELL GROUP EUR TL B | -35.07% | 40.36 | 62.16 | 12 |

| 2 | LOPARX INTERNATIONAL EUR TL B | -28.98% | 50.13 | 70.59 | 8 |

| 3 | APEX TOOLS TL B | -26.85% | 64.45 | 88.10 | 12 |

| 4 | LUMILEDS EXIT TL | -24.85% | 21.24 | 28.26 | 8 |

| 5 | ASTRA ACQUISITION CORP TL B | -19.92% | 48.48 | 60.54 | 10 |

| 6 | MAGENTA BUYER LLC 2ND LIEN TL | -14.41% | 30.57 | 35.72 | 4 |

| 7 | DELL SOFTWARE GROUP 2ND LIEN TL | -12.88% | 45.15 | 51.83 | 9 |

| 8 | DUPAGE MEDICAL GROUP TL B | -12.50% | 77.91 | 89.05 | 8 |

| 9 | RESEARCH NOW TL | -10.35% | 57.12 | 63.71 | 8 |

| 10 | COX ENTERPRISES, INC. TL B | -9.12% | 84.12 | 92.56 | 8 |

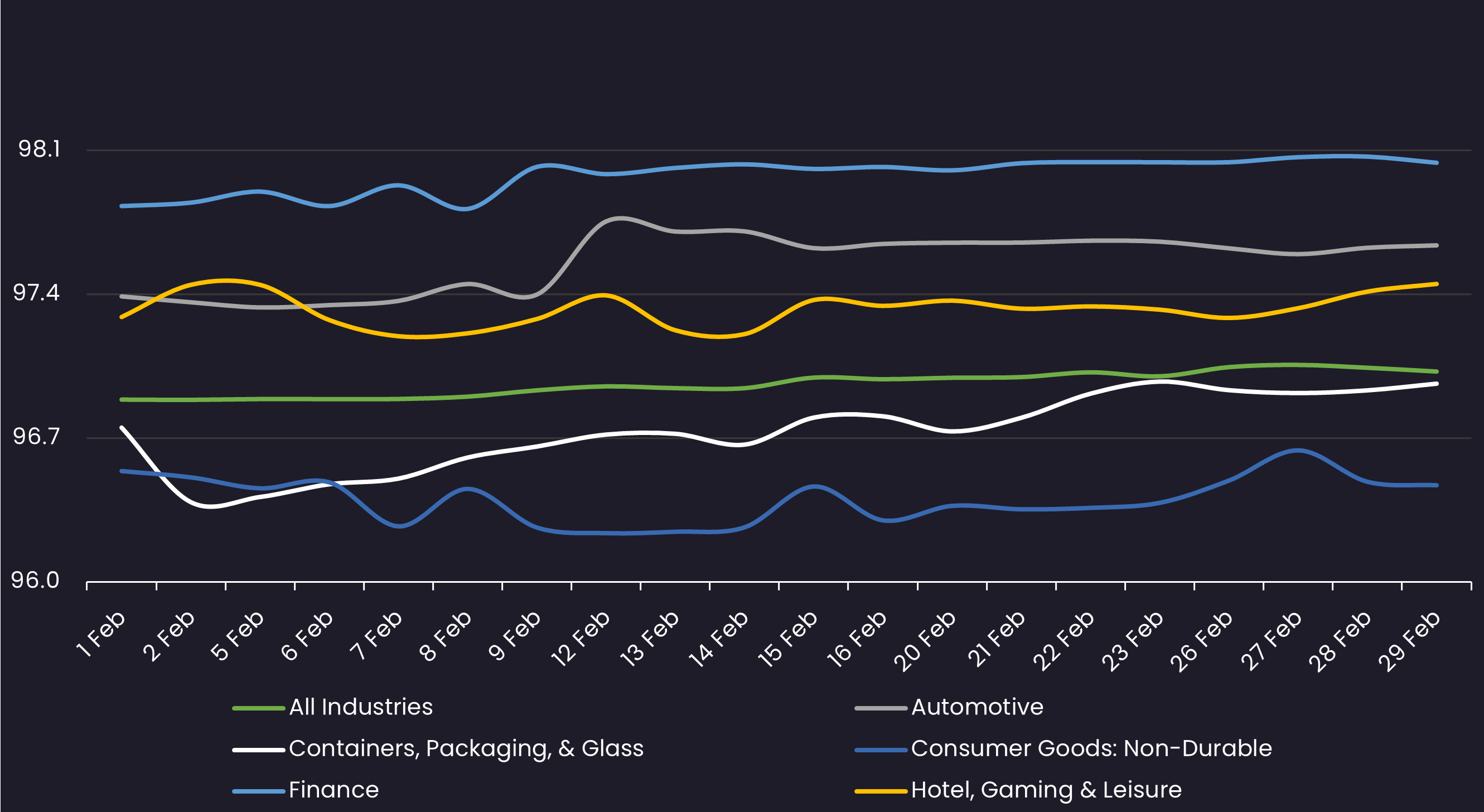

Avg Bid PX by Sector

Displays the average loan bid price by sector between 2/1/24 – 2/29/24

Results are based on 5 select industry sectors, however, we offer data across 36 sectors

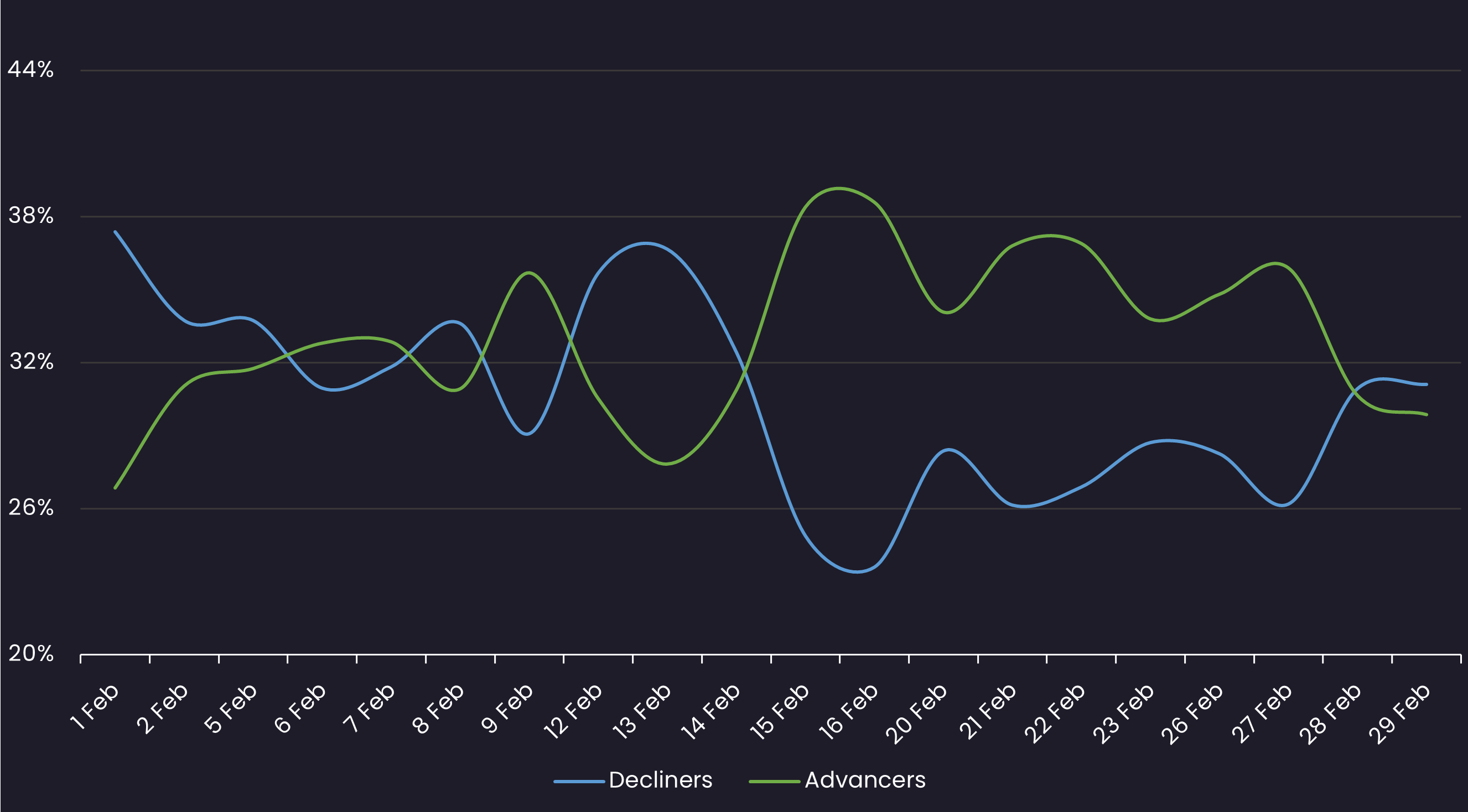

Sentiment

Reveals the percent of loans increasing in price (advancers) vs. loans decreasing in price (decliners) between 2/1/24 – 2/29/24

Top Quote Volume Movers: This Month vs Last Month

Exhibits the loans with the largest increase in quote volume for the month ending 1/31/23 vs. the month ending 2/29/24

| RANK | TRANCHE | PRIOR MONTH | THIS MONTH | INCREASE | % INCREASE |

| 1 | HUB INTL LTD TL B | 76 | 369 | 293 | 386% |

| 2 | CITADEL TL B | 64 | 340 | 276 | 431% |

| 3 | NUTRISYSTEM TL B | 32 | 268 | 236 | 738% |

| 4 | GO DADDY TL B | 94 | 326 | 232 | 247% |

| 5 | PRO MACH TL B | 92 | 319 | 227 | 247% |

| 6 | JANE STREET TL B | 126 | 340 | 214 | 170% |

| 7 | INSPIRE BRANDS TL | 38 | 248 | 210 | 553% |

| 8 | SS&C TECH TL B | 15 | 224 | 209 | 1393% |

| 9 | EOC GROUP TL B | 26 | 234 | 208 | 800% |

| 10 | TRANSUNION TL B | 4 | 210 | 206 | 5150% |

Most Quoted Loans

Ranks the loans that were quoted by the highest number of dealers between 2/1/24 – 2/29/24

| RANK | TRANCHE | DEALERS |

| 1 | TRANSDIGM INC. TL I | 22 |

| 2 | ALKEGEN TL B | 19 |

| 3 | EKATERRA EUR TL B | 17 |

| 4 | ZIGGO EUR TL H | 17 |

| 5 | BELLIS ACQUISITION CO PLC EUR TL B | 17 |

| 6 | HILEX POLY TL B | 17 |

| 7 | TRANSDIGM INC. TL H | 16 |

| 8 | TENNECO TL B | 16 |

| 9 | FRONERI TL B | 16 |

| 10 | HEARTHSIDE FOODS TL B | 16 |

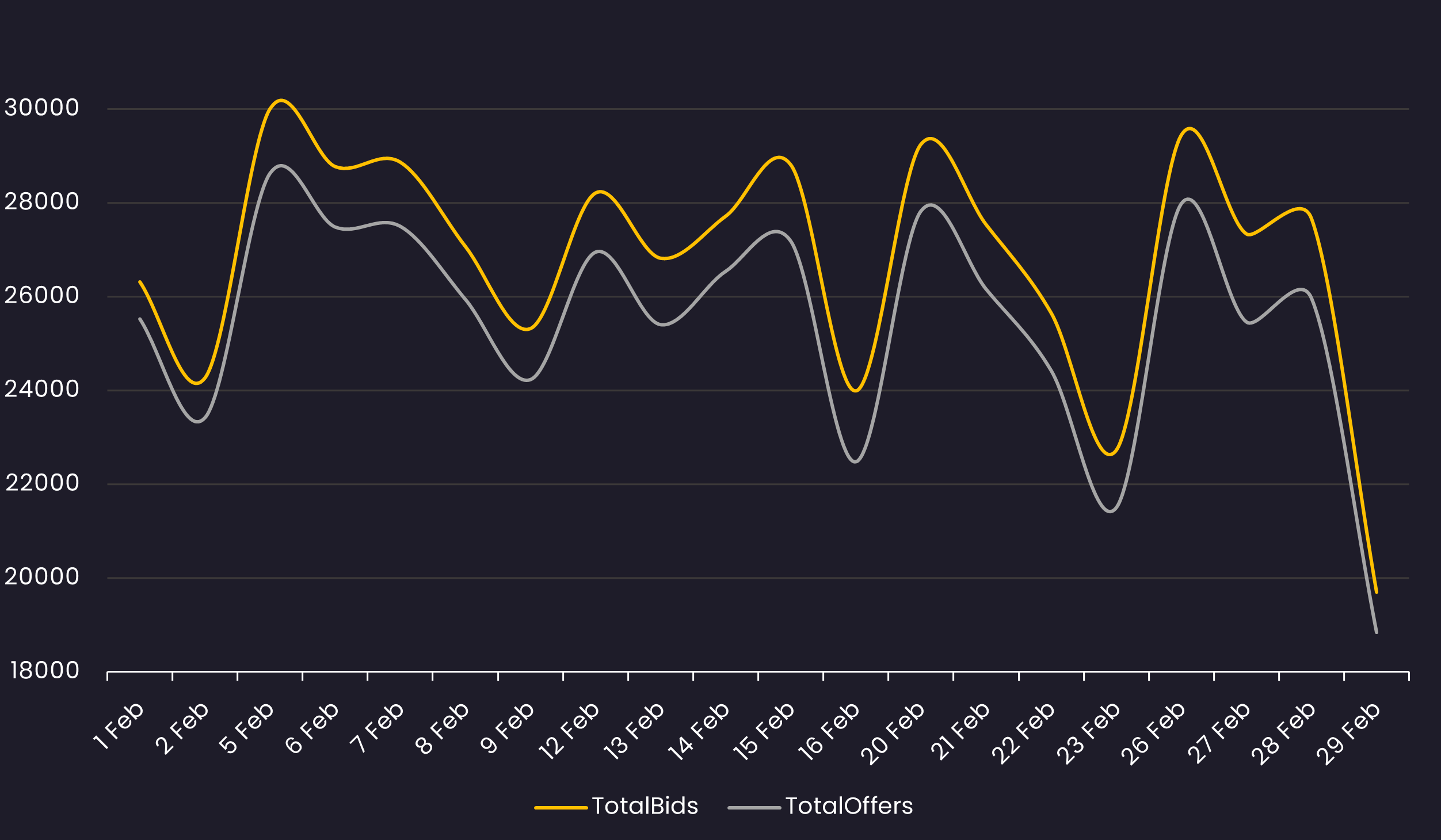

Bid and Offer Volume

Reveals the total number of quotes by bid and offer between 2/1/24 – 2/29/24

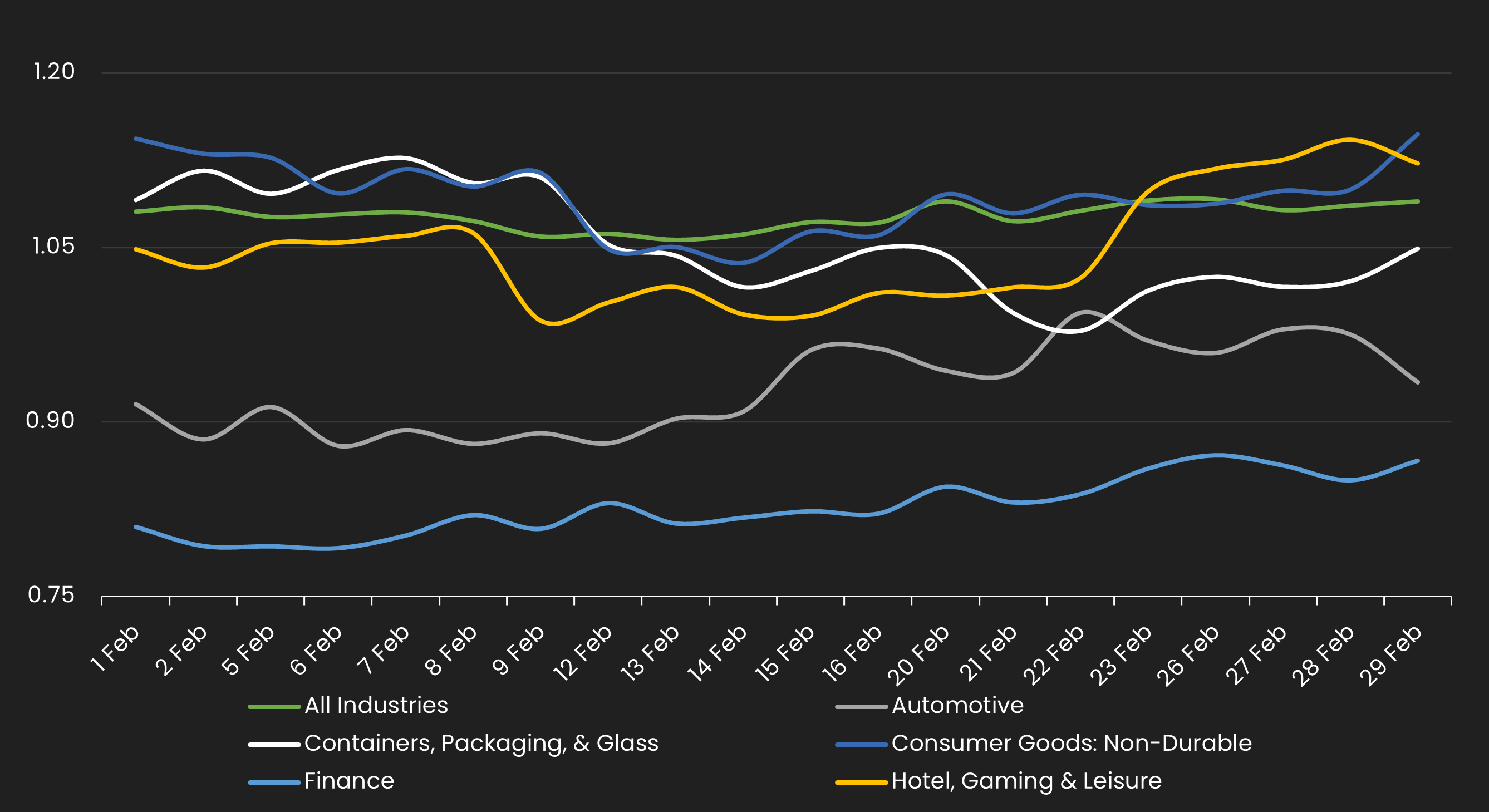

Sector Bid-Offer Spread

Displays the bid-offer spread by sector between 2/1/24 – 2/29/24

Results are based on 5 select industry sectors, however, we offer data across 36 sectors

Stay up-to-date with weekly summaries.

BDCs

BDCs  SOLVE Insights

SOLVE Insights  SOLVE Newsroom

SOLVE Newsroom