Fixed Income Forum,NEWS ROOM

Rescued Amid Turmoil: First Republic Bank receives $30B Influx

By Solve Fixed Income

With nearly two thirds of their deposits uninsured by the FDIC, Moody’s placed First Republic Bank on a downgrade watch earlier this week. To stabilize First Republic Bank’s deposits, several of the industry’s largest firms, including Wells Fargo, BofA, JPMorgan and Citigroup stepped in with $30B. This influx of cash took place shortly after Janet Yellen met with JPMorgan CEO Jamie Dimon yesterday.

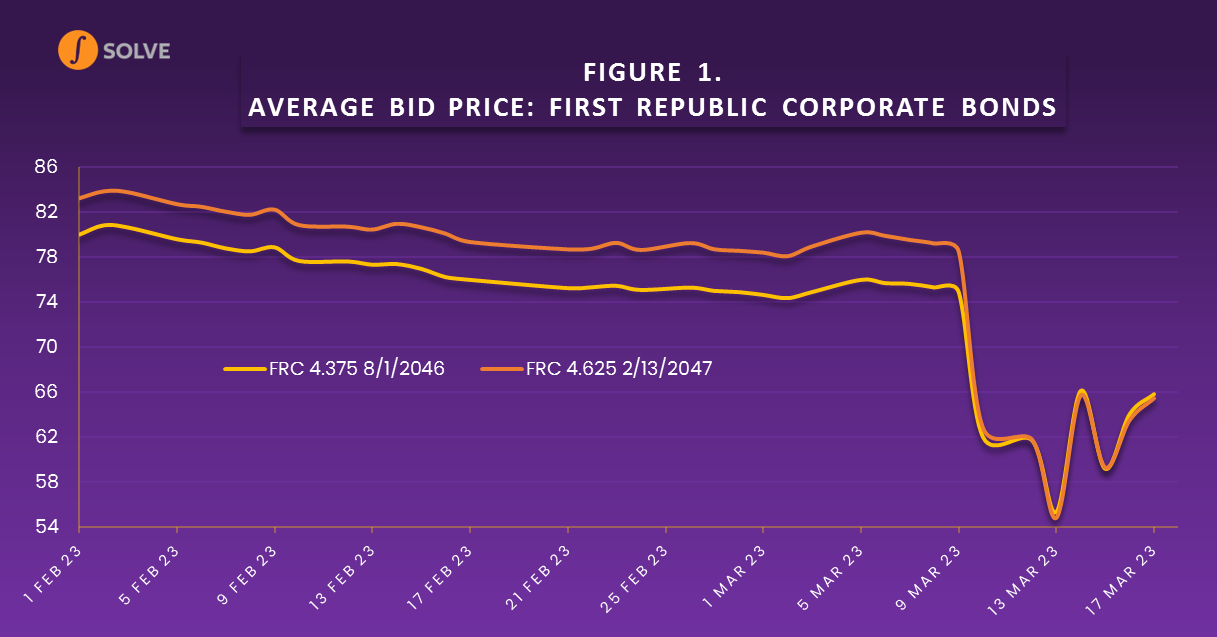

The effects of the recent turmoil can be illustrated by the price of First Republic Bank’s 4.375% notes due 2046. The collapse of Silicon Valley Bank saw bond prices plummet just over a week ago and the recent influx of cash has created a bounce back of about 10% (Figure 1).

Stay up-to-date on the latest from Solve