Insights,NEWSROOM

Historic Dow Suggests a Dip in Inflation, the Possibility of a Fed Rate Cut

The Dow’s recent surge past 40,000 points was influenced by April’s Consumer Price Index (CPI) report. This index measures the average change in prices for a basket of goods and services. Here’s the breakdown:

In April, the CPI rose by 3.4% YoY (Year-over-Year), slightly lower than March’s 3.5% YoY increase. Additionally, the CPI increased by 0.3% MoM (Month-over-Month) in April, compared to a 0.4% MoM rise in March.

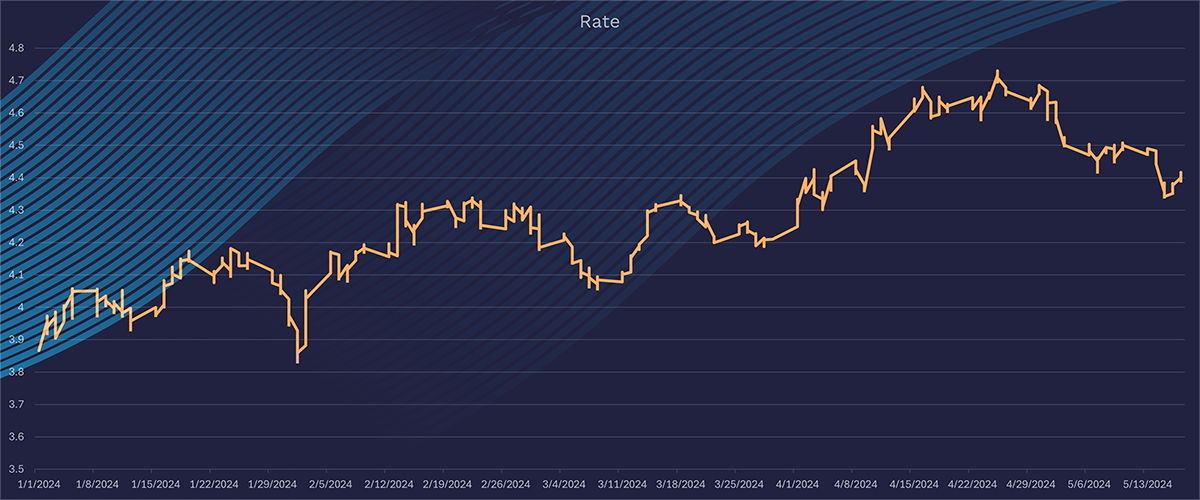

Following the CPI report, the yield on the 10 yr Treasury dropped by 8 bps. Fixed income has been generally pretty calm with 10 yr Treasury yields hovering near 4.5%, down from the highs in April of 4.7%, but still elevated from the 4.3% witnessed in February.

The market has been waiting for inflation to slow, and we saw a small sign on Wednesday that it may be beginning to trend downward. The market has been desperately waiting and expecting the Fed to reduce rates, but until inflation gets under 3.0%, it’s unlikely.

Overall, the positive reaction to the CPI report suggests hope that the Federal Reserve could still cut interest rates later this year. Fed rate expectations have consistently been reevaluated over the past six month. Expectations of seven rate cuts in 2024 have dropped to five, then four, then three, then two. While some in the industry predict no rate cuts in the “higher for longer” mantra, consensus now predicts one rate cut in December, with two more expected in 2025.

Stay up-to-date on the latest from Solve

BDCs

BDCs  SOLVE Insights

SOLVE Insights  SOLVE Newsroom

SOLVE Newsroom