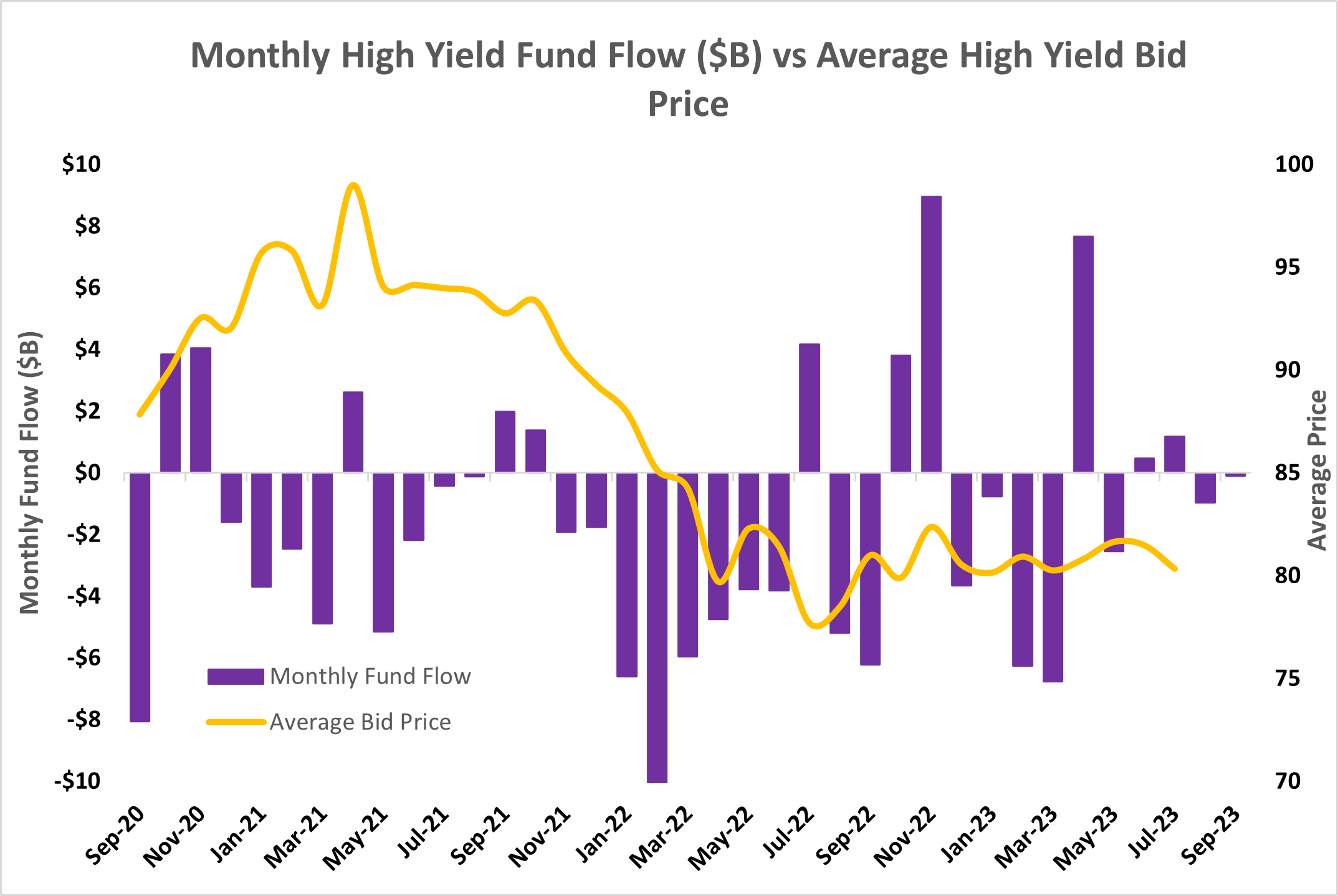

High Yield Debt: Outflows Continue in September

Amid an up and down 2023 in terms of US high yield fund flow, investors withdrew for the second straight month in September. This comes as no surprise given the volatile interest rate environment and the persistent downward price pressure on junk bonds. The chart below illustrates the US high yield fund flow as it relates to average bid price over the last 3 years. The down year of 2022 saw massive outflows within HY and declining average price for the better part of the year. Prices have stabilized in the low 80s in 2023 but high yield debt remains a volatile environment for investors.

Here

Source: lipperusfundflows.com; SOLVE Fixed Income, Copyright © 2023. Redistribution Strictly Prohibited. Data cannot be used in any way to populate a database nor shared with unauthorized users. See SOLVE Terms. All rights reserved. +1 (646) 699-5041.

Stay up-to-date on the latest from Solve