Credit Default Swaps

GET OUR CDS MARKET SUMMARIES STRAIGHT TO YOUR INBOX. LEARN MORE

High Yield CDS Market Summary:

september 2024

Our newsletter presents key trends derived from observable Credit Default Swaps pricing data over a monthly period.

![]()

Top 10 Outperformers

Showcases the top 10 HY CDS “outperformers” based on the largest mid spread decreases between 9/1/24 – 9/30/24

| RANK | BOND NAME | ISSUER | % CHANGE | BPS CHANGE | SPRD | SPRD-1 MONTH | DEALERS |

| 1 | RMK 5Y | ARAMARK CORP | -17.0% | -17 | 81 | 97 | 4 |

| 2 | DAL 5Y | DELTA AIR LINES INC | -13.7% | -18 | 115 | 133 | 5 |

| 3 | VISTRAENE 5Y | VISTRA ENERGY CORP | -9.2% | -11 | 104 | 115 | 3 |

| 4 | SDFGR 5Y | MORTON INTL INC IND | -8.6% | -14 | 150 | 165 | 3 |

| 5 | AES 5Y | AES TRUST I | -7.1% | -7 | 99 | 106 | 5 |

| 6 | STGATE 5Y | STONEGATE PUB CO FINANCING PLC | -4.1% | -8 | 182 | 190 | 2 |

| 7 | NVFVES 5Y | NOVAFIVES SAS | -3.2% | -4 | 119 | 123 | 3 |

| 8 | HPLGR 5Y | HAPAG-LLOYD A G | -2.3% | -4 | 180 | 184 | 4 |

| 9 | AKS 5Y | AK STL CORP | -2.1% | -3 | 142 | 145 | 2 |

| 10 | FTI 5Y | TECHNIPFMC PLC | -1.8% | -3 | 176 | 179 | 4 |

Top 10 Underperformers

Showcases the top 10 HY CDS “underperformers” based on the largest mid spread increases between 9/1/24 – 9/30/24

| RANK | BOND NAME | ISSUER | % CHANGE | BPS CHANGE | SPREAD | SPREAD-1 MONTH | DEALERS |

| 1 | LB 5Y | LIMITED BRANDS | 61.2% | 82 | 215 | 133 | 2 |

| 2 | MUR 5Y | MURPHY OIL CORP | 54.6% | 59 | 167 | 108 | 4 |

| 3 | MBIA_AA 5Y | MBIA INC | 50.6% | 100 | 298 | 198 | 3 |

| 4 | ZFFNGR 5Y | ZF NA CAPITAL | 48.4% | 116 | 356 | 240 | 3 |

| 5 | EOFP 5Y | FAURECIA | 41.0% | 99 | 342 | 243 | 5 |

| 6 | CHRYSLER 5Y | FIAT CHRYSLER AUTOMOBILES NV | 39.8% | 45 | 159 | 114 | 7 |

| 7 | TATAMTR 5Y | JAGUAR LD ROVER PLC | 38.8% | 60 | 217 | 156 | 4 |

| 8 | FRFP 5Y | VALEO SA | 32.3% | 62 | 254 | 192 | 6 |

| 9 | VOVCAB 5Y | VOLVO | 28.0% | 49 | 224 | 175 | 6 |

| 10 | ADRBID 5Y | UNITED GROUP BV | 26.0% | 68 | 330 | 262 | 4 |

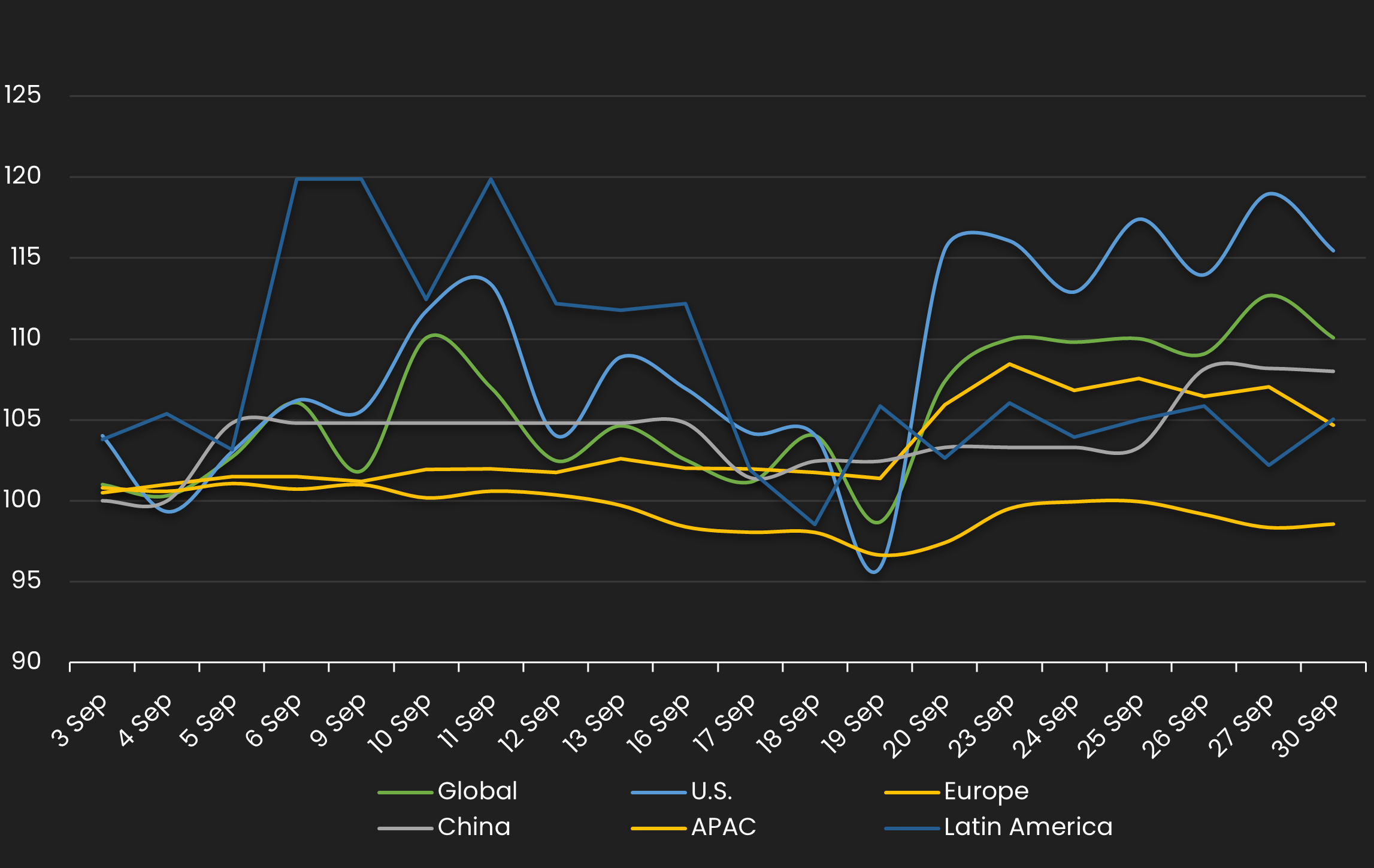

Normalized HY Spread by Region

Displays the HY CDS spread by region between 9/1/24 – 9/30/24

Results are based on 5 select regions, however, we offer data across 12 regions

HY Spread by Region – Monthly Comparison

Exhibits the HY mid spread by region for the month ending 8/31/24 vs. the month ending 9/30/24

| REGION | PREVIOUS SPREAD | CURRENT SPREAD | BPS CHANGE | MONTHLY PERFORMANCE | CDS COUNT |

| Global | 132 | 145 | 13 | Wider | 187 |

| U.S. | 123 | 142 | 19 | Wider | 99 |

| U.K. | 88 | 90 | 1 | Wider | 19 |

| Canada | 75 | 132 | 57 | Wider | 2 |

| China | 74 | 80 | 6 | Wider | 1 |

| APAC | 99 | 98 | -1 | Tighter | 1 |

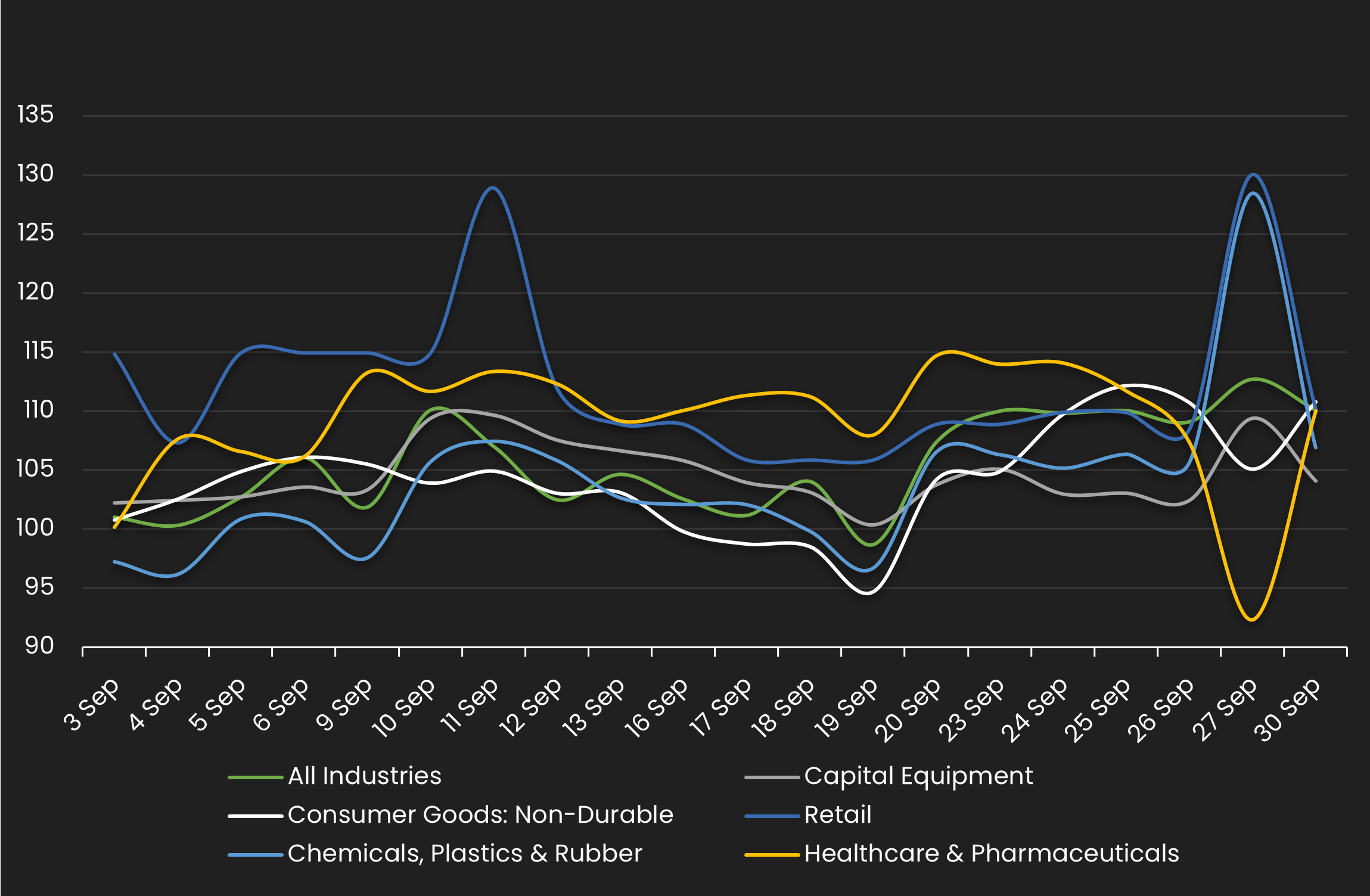

Normalized HY Spread by Industry

Displays the HY CDS spread by industry between 9/1/24 – 9/30/24

Results are based on 5 select industry sectors, however, we offer data across 36 sectors

HY Spread by Industries – Monthly Comparison

Exhibits the HY spread by industry for the month ending 8/31/24 vs. the month ending 9/30/24

| INDUSTRIES | PREVIOUS SPREAD | CURRENT SPREAD | BPS CHANGE | MONTHLY PERFORMANCE | CDS COUNT |

| All Industries | 132 | 145 | 13 | Wider | 187.00 |

| Capital Equipment | 185 | 193 | 8 | Wider | 5.00 |

| Consumer Goods: Non-Durable | 116 | 129 | 13 | Wider | 5.00 |

| Retail | 165 | 182 | 17 | Wider | 15.00 |

| Chemicals, Plastics & Rubber | 93 | 100 | 6 | Wider | 9.00 |

| Healthcare & Pharmaceuticals | 87 | 95 | 9 | Wider | 7.00 |

Stay up-to-date with monthly summaries.

BDCs

BDCs  SOLVE Insights

SOLVE Insights  SOLVE Newsroom

SOLVE Newsroom