Syndicated Bank Loans

GET OUR BANK LOAN MARKET SUMMARIES STRAIGHT TO YOUR INBOX. LEARN MORE

Syndicated Bank Loan Market Summary:

Week Ending 6/28/24

Our newsletter presents key trends derived from observable Syndicated Bank Loan pricing data over a weekly period.

![]()

New Issues

Loans issued during the week ending 6/28/24

| ISSUER | AMOUNT (MM) | LOAN TYPE | MATURITY | RATE |

| Mermaid Bidco Inc. | Term Loan | 340 | 6/21/2031 | E+375 |

| Solarwinds Inc. | Term Loan | 1236 | 2/1/2030 | S+275 |

| Carroll County Energy LLC | Term Loan | 425 | 6/11/2031 | S+400 |

forward calendar

Forward calendar during the week ending 6/28/24

| Issuer | Deal Information | Banks | Expected Issue Date |

| Atlas Air | $992M TLB | GS | Q3 2024 |

| Datasite | $665M TLB | GS,BofA | Q3 2024 |

| Ensemble | $814M TL (B2/B) | GS | Q3 2024 |

Largest Loans

Highlights the weekly price movements and quote depth for the 20 largest bank loans between 6/21/24 – 6/28/24

| RANK | SIZE (MM) | NAME | CHANGE | PRC | PRC-1W | DEALERS |

| 1 | 6,143 | MEDLINE TL B | 0.04% | 100.16 | 100.12 | 16 |

| 2 | 5,385 | ULTIMATE SOFTWARE TL B | 0.11% | 100.35 | 100.24 | 15 |

| 3 | 5,160 | MCAFEE CORP TL | -0.02% | 99.78 | 99.80 | 11 |

| 4 | 4,860 | HUB INTL LTD TL B | 0.17% | 100.23 | 100.07 | 17 |

| 5 | 4,750 | ZAYO TL | 0.31% | 86.82 | 86.55 | 15 |

| 6 | 4,741 | INTERNET BRANDS TL B | 0.08% | 99.88 | 99.80 | 14 |

| 7 | 4,525 | TRANSDIGM INC. TL I | 0.19% | 100.16 | 99.97 | 17 |

| 8 | 4,237 | INSPIRE BRANDS TL | 0.06% | 99.89 | 99.83 | 13 |

| 9 | 3,935 | SS&C TECH TL B8 | 0.03% | 100.11 | 100.08 | 16 |

| 10 | 3,900 | DIRECTV TL | -0.03% | 99.95 | 99.98 | 17 |

| 11 | 3,640 | TRANSDIGM INC. TL J | 0.30% | 100.22 | 99.92 | 13 |

| 12 | 3,573 | CDK GLOBAL TL B | -0.18% | 98.47 | 98.65 | 16 |

| 13 | 3,564 | MKS INSTRUMENTS TL B | 0.02% | 99.97 | 99.95 | 10 |

| 14 | 3,500 | SEDGWICK TL B | -0.25% | 99.95 | 100.20 | 12 |

| 15 | 3,500 | AMERICAN AIRLINES TL B | -0.12% | 103.17 | 103.29 | 13 |

| 16 | 3,500 | WESTINGHOUSE TL B | 0.07% | 100.03 | 99.96 | 15 |

| 17 | 3,420 | RCN GRANDE TL | 0.50% | 80.61 | 80.21 | 12 |

| 18 | 3,380 | SOLERA TL B | 0.12% | 99.93 | 99.82 | 15 |

| 19 | 3,350 | THE NIELSEN COMPANY B.V. TL B | -0.70% | 94.44 | 95.11 | 10 |

| 20 | 3,340 | PROOFPOINT TL B | 0.10% | 100.06 | 99.95 | 12 |

| AVERAGE | 4,120 | 0.04% | 98.21 | 98.17 | 14.0 |

Top 10 Performers

Showcases the top 10 loan performers based on the largest bid price increases between 6/21/24-6/28/24

| RANK | NAME | CHANGE | PRC | PRC-1W | DEALERS |

| 1 | MULTIPLAN TL B | 5.76% | 83.04 | 78.52 | 12 |

| 2 | RESEARCH NOW TL | 3.44% | 74.88 | 72.39 | 11 |

| 3 | UPSTREAM REHABILITATION TL | 2.31% | 90.33 | 88.29 | 10 |

| 4 | VERIFONE TL B | 1.88% | 81.83 | 80.32 | 18 |

| 5 | HERTZ EXIT TL C | 1.87% | 90.09 | 88.44 | 4 |

| 6 | AMC ENTERTAINMENT TL B1 | 1.68% | 94.62 | 93.06 | 15 |

| 7 | COX ENTERPRISES, INC. TL B | 1.30% | 79.34 | 78.31 | 13 |

| 8 | ADVANTAGE SALES TL B | 1.03% | 97.23 | 96.23 | 10 |

| 9 | WASTEQUIP TL B | 0.73% | 97.36 | 96.66 | 7 |

| 10 | RESTORATION HARDWARE TL B | 0.65% | 96.15 | 95.53 | 7 |

Bottom 10 Perfromers

Showcases the bottom 10 loan performers based on the largest bid price decreases between 6/21/24-6/28/24

| RANK | NAME | CHANGE | PRC | PRC-1W | DEALERS |

| 1 | PACKERS HOLDINGS TL | -7.23% | 53.29 | 57.44 | 7 |

| 2 | CORRECT CARE TL B | -5.24% | 62.82 | 66.29 | 9 |

| 3 | LANDESK TL B | -3.75% | 78.45 | 81.51 | 12 |

| 4 | CARESTREAM HEALTH TL B | -3.74% | 88.02 | 91.44 | 6 |

| 5 | VERACODE TL B | -3.65% | 92.49 | 96.00 | 8 |

| 6 | NUMERICABLE TL B12 | -3.34% | 78.53 | 81.25 | 5 |

| 7 | MAGENTA BUYER LLC TL | -3.05% | 57.29 | 59.09 | 8 |

| 8 | LIFESCAN TL B | -3.01% | 45.69 | 47.11 | 6 |

| 9 | MEDICAL SOLUTIONS TL | -2.27% | 74.61 | 76.34 | 10 |

| 10 | CABLEVISION TL B5 | -2.05% | 82.93 | 84.67 | 13 |

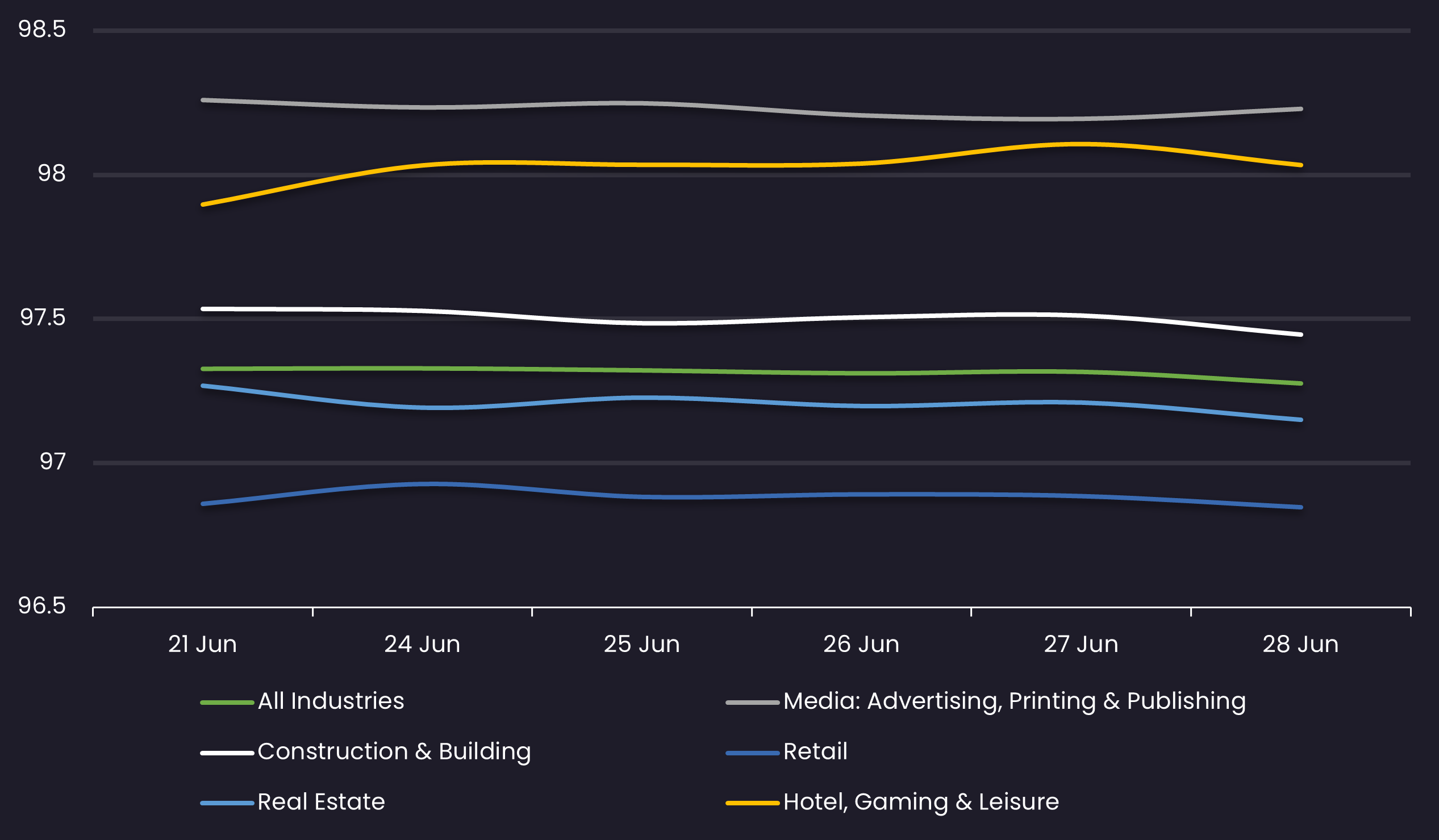

Avg Bid PX by Sector

Displays the average loan bid price by sector between 6/21/24-6/28/24

Results are based on 5 select industry sectors, however, we offer data across 36 sectors

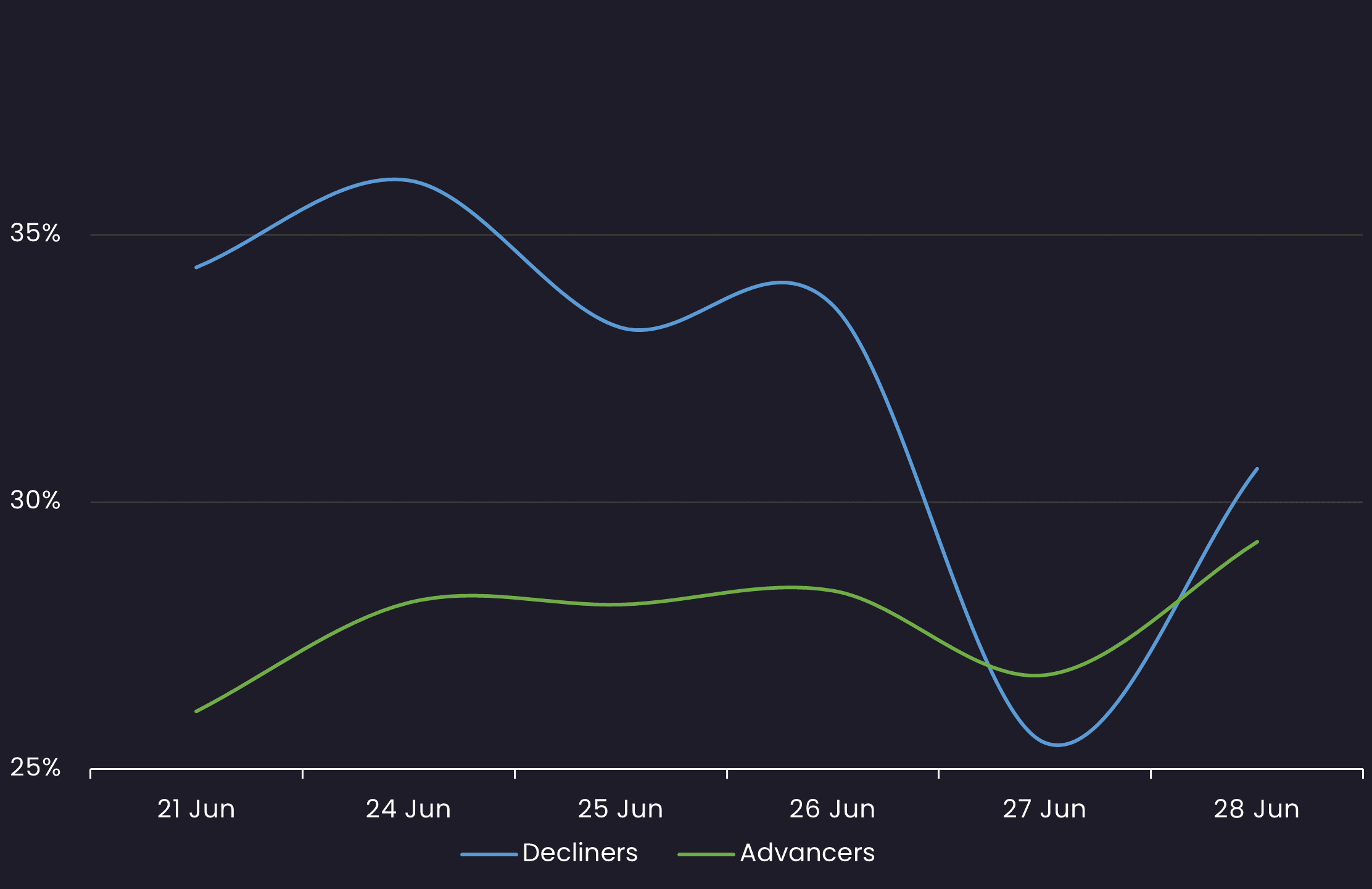

Sentiment

Reveals the percent of loans increasing in price (advancers) vs. loans decreasing in price (decliners) between 6/21/24-6/28/24

Top Quote Volume Movers: This Week vs Last Week

Exhibits the loans with the largest increase in quote volume for the week ending 6/21/24 vs. the week ending 6/28/24

| RANK | TRANCHE | PRIOR WEEK | THIS WEEK | INCREASE | % INCREASE |

| 1 | ENTEGRIS TL B | 34 | 86 | 52 | 153% |

| 2 | TRANSDIGM INC. TL K | 90 | 138 | 48 | 53% |

| 3 | TELENET TL | 48 | 90 | 42 | 88% |

| 4 | BERLIN PACKAGING TL B7 | 68 | 106 | 38 | 56% |

| 5 | TRANSDIGM INC. TL I | 94 | 130 | 36 | 38% |

| 6 | DAVITA TL B | 72 | 105 | 33 | 46% |

| 7 | ZELIS / REDCARD TL B | 67 | 100 | 33 | 49% |

| 8 | BUCKEYE TL B3 | 55 | 88 | 33 | 60% |

| 9 | IRIDIUM SATELLITE TL B | 29 | 62 | 33 | 114% |

| 10 | UPC HOLDING BV TL | 45 | 78 | 33 | 73% |

Most Quoted Loans

Ranks the loans that were quoted by the highest number of dealers between 6/21/24-6/28/24

| RANK | TRANCHE | DEALERS |

| 1 | VERIFONE TL B | 18 |

| 2 | TRANSDIGM INC. TL K | 18 |

| 3 | TENNECO TL B | 18 |

| 4 | BMC SOFTWARE TL B | 17 |

| 5 | HUB INTL LTD TL B | 17 |

| 6 | TRANSDIGM INC. TL I | 17 |

| 7 | HILEX POLY TL B | 17 |

| 8 | BERRY PLASTICS TL | 17 |

| 9 | DAVITA TL B | 17 |

| 10 | FRONERI TL B | 17 |

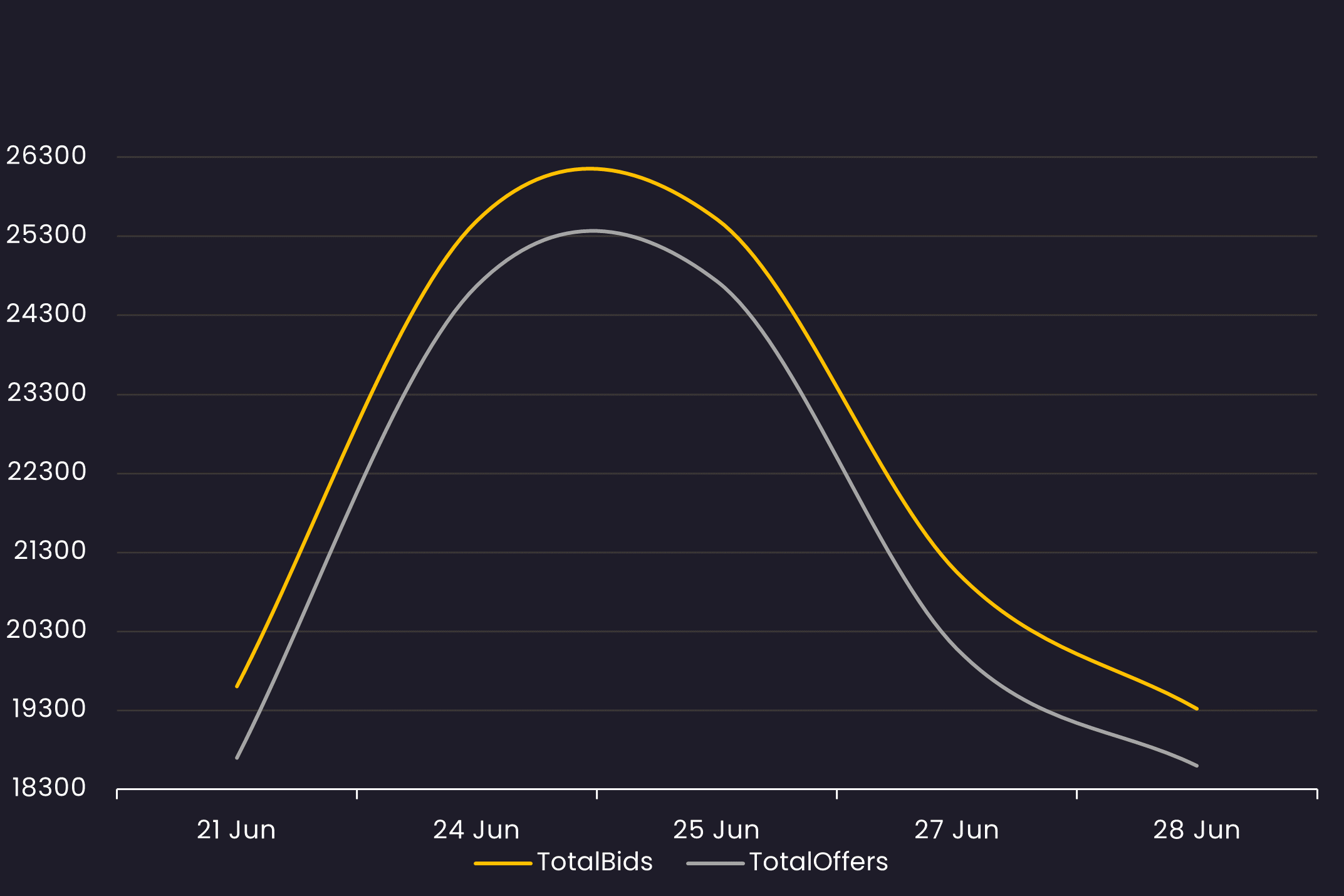

Bid and Offer Volume

Reveals the total number of quotes by bid and offer between 6/21/24-6/28/24

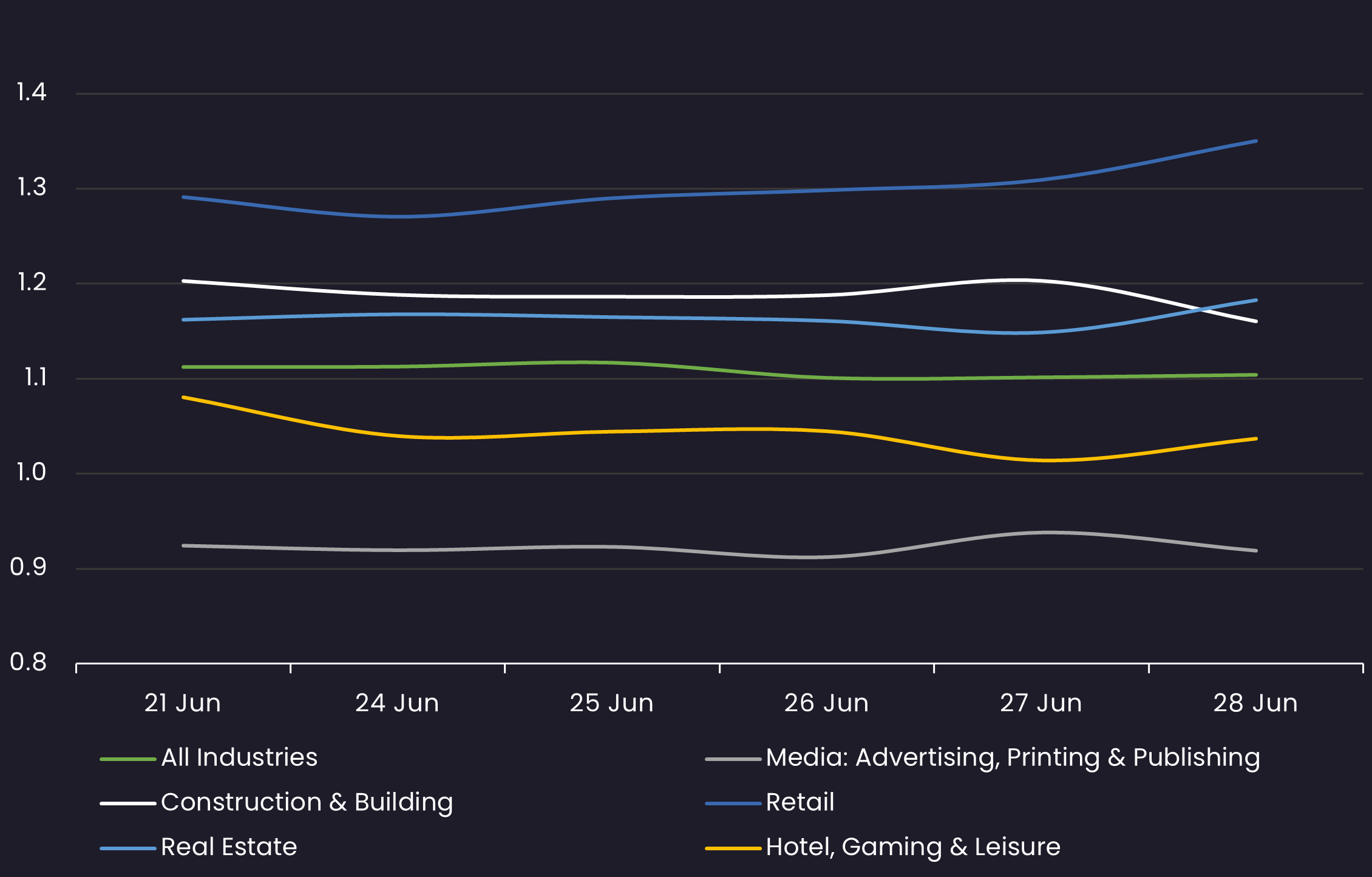

Sector Bid-Offer Spread

Results are based on 5 select industry sectors, however, we offer data across 36 sectors

Stay up-to-date with weekly summaries.

BDCs

BDCs  SOLVE Insights

SOLVE Insights  SOLVE Newsroom

SOLVE Newsroom