Corporates

GET OUR CORPORATE MARKET SUMMARIES STRAIGHT TO YOUR INBOX. LEARN MORE

High Yield Corporate Bond Market Summary:

Week Ending 4/26/24

Our newsletter presents key trends derived from observable Corporate Bond pricing data over a weekly period.

![]()

Forward Calendar

The following are lists of upcoming high-yield corporate bond offerings in the United States

| ISSUER | ISSUE INFORMATION | BROKER DEALER | EXPECTED ISSUE DATE |

| Brightspeed | $1.865 billion senior secured notes | 1st Quarter 2024 |

Top 10 Performers

Showcases the top 10 HY Corp performers based on the largest bid price increases between 4/19/24 – 4/26/24

| RANK | BOND NAME | COUPON | MATURITY | CHANGE | PRC | PRC-1W | DEALERS |

| 1 | LECTA 0 9/1/2028 144A | 0.00% | 09/01/28 | 26.78% | 42.34 | 33.40 | 3 |

| 2 | INTRUM FLT 9/12/2025 | 8.62% | 09/12/25 | 13.85% | 77.88 | 68.41 | 3 |

| 3 | ALTICE 4.75 1/15/2028 REGS | 4.75% | 01/15/28 | 12.90% | 66.23 | 58.67 | 23 |

| 4 | FUTLAN 4.45 7/13/2025 | 4.45% | 07/13/25 | 9.52% | 47.98 | 43.81 | 13 |

| 5 | ARNDTN 4.75 PERP | 4.75% | NULL | 8.19% | 68.81 | 63.60 | 15 |

| 6 | ARDFIN 6.5 6/30/2027 144A | 6.50% | 06/30/27 | 8.18% | 28.97 | 26.78 | 8 |

| 7 | WOMCHI 6.875 11/26/2024 REGS | 6.88% | 11/26/24 | 7.67% | 37.62 | 34.94 | 19 |

| 8 | UNIT 6.5 2/15/2029 144A | 6.50% | 02/15/29 | 7.08% | 78.95 | 73.73 | 19 |

| 9 | VTRFIN 6.375 7/15/2028 REGS | 6.38% | 07/15/28 | 6.95% | 70.57 | 65.99 | 20 |

| 10 | WW 4.5 4/15/2029 144A | 4.50% | 04/15/29 | 6.90% | 38.75 | 36.25 | 20 |

Bottom 10 Performers

Showcases the bottom 10 HY Corp performers based on the largest bid price decreases between 4/19/24 – 4/26/24

| RANK | BOND NAME | COUPON | MATURITY | CHANGE | PRC | PRC-1W | DEALERS |

| 1 | LOUBID FLT 2/15/2027 | #VALUE! | 02/15/27 | -26.46% | 60.90 | 82.82 | 13 |

| 2 | GFMEGA 8.25 2/11/2025 REGS | 8.25% | 02/11/25 | -23.35% | 29.90 | 39.01 | 6 |

| 3 | SPRIND 6.5 10/1/2029 144A | 6.50% | 10/01/29 | -11.08% | 58.96 | 66.30 | 17 |

| 4 | UKRAIN 7.75 9/1/2026 REGS | 7.75% | 09/01/26 | -8.97% | 29.70 | 32.63 | 18 |

| 5 | WHLPRO 6.5 5/15/2029 144A | 6.50% | 05/15/29 | -8.05% | 27.27 | 29.65 | 10 |

| 6 | KPERST 4.25 3/1/2026 REGS | 4.25% | 03/01/26 | -7.87% | 77.00 | 83.58 | 21 |

| 7 | BHCCN 6.25 2/15/2029 144A | 6.25% | 02/15/29 | -7.68% | 43.48 | 47.10 | 18 |

| 8 | LMRTSP 7.5 2/9/2026 | 7.50% | 02/09/26 | -7.00% | 75.94 | 81.65 | 20 |

| 9 | KEMONE 5.625 11/15/2028 REGS | 5.63% | 11/15/28 | -7.00% | 80.01 | 86.03 | 22 |

| 10 | LVLT 3.625 1/15/2029 144A | 3.63% | 01/15/29 | -6.33% | 32.95 | 35.17 | 15 |

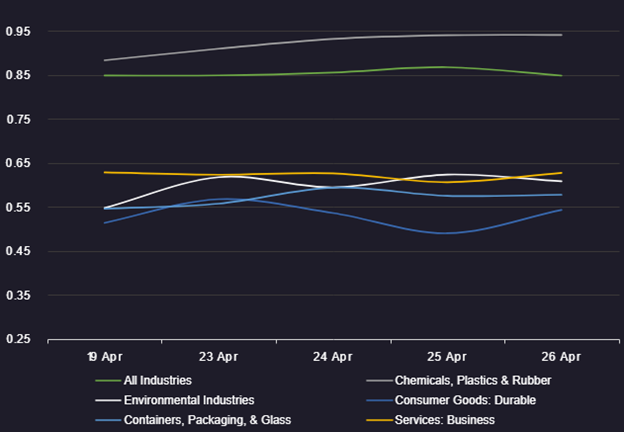

Avg Industry Price

Displays the HY Corp average industry price by sector between 4/19/24 – 4/26/24

Results are based on 5 select industry sectors, however, we offer data across 36 sectors

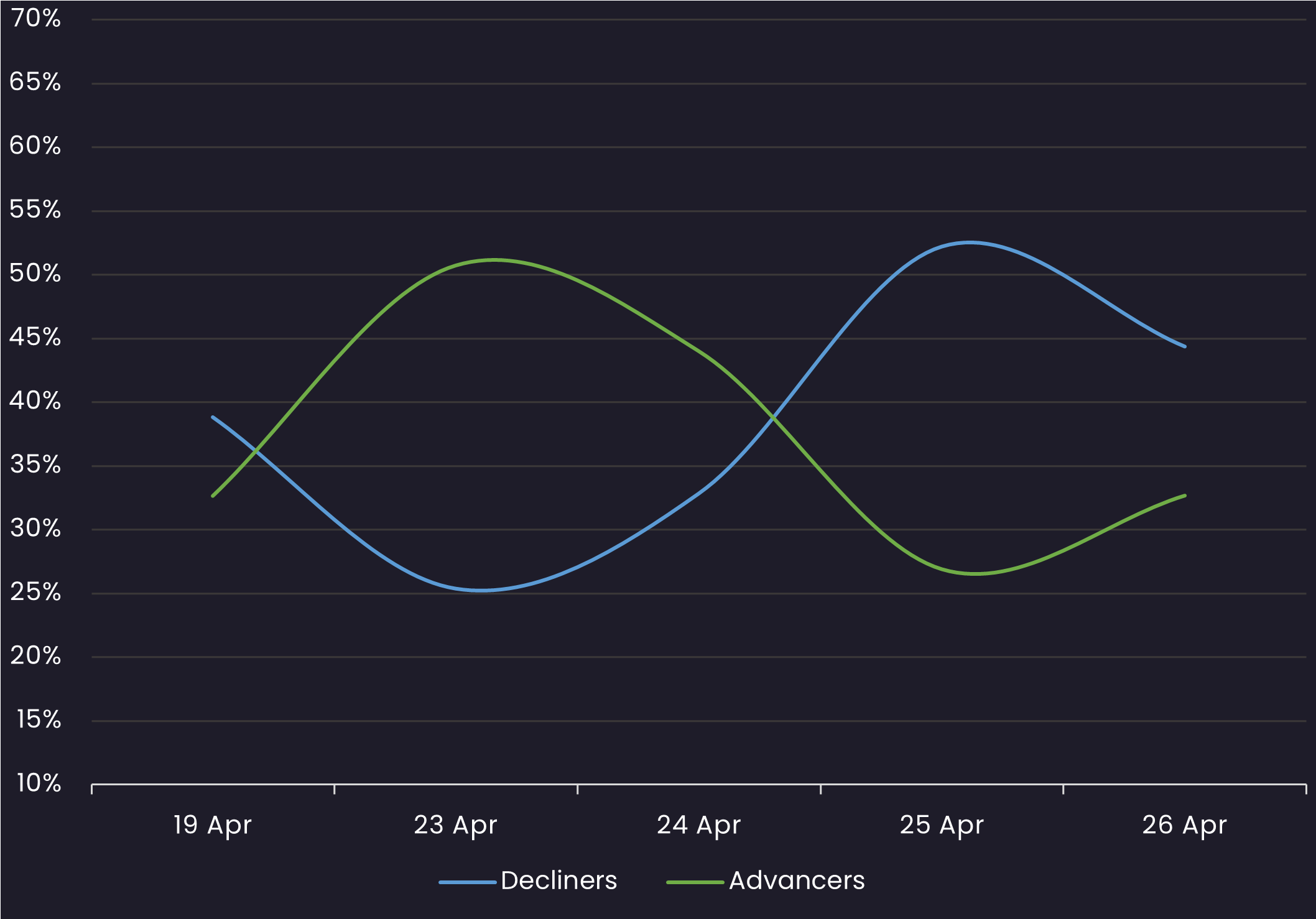

Sentiment

Reveals the percent of HY Corps increasing in price (advancers) vs. HY Corps decreasing in price (decliners) between 4/19/24 – 4/26/24

Top Quote Volume Movers: This Week vs Last Week

Exhibits the HY Corps with the largest increase in quote volume for the week ending 4/19/24 vs. the week ending 4/26/24

| RANK | TRANCHE | COUPON | MATURITY | PRIOR WEEK | THIS WEEK | INCREASE | % INCREASE |

| 1 | PDVSA 9 11/17/2021 REGS | 9.00% | 11/17/21 | 107 | 205 | 98 | 92% |

| 2 | CSLAU 5.417 4/3/2054 144A | 5.42% | 04/03/54 | 173 | 238 | 65 | 38% |

| 3 | FCFS 6.875 3/1/2032 144A | 6.88% | 03/01/32 | 56 | 120 | 64 | 114% |

| 4 | PBBGR 8.474 PERP | 8.47% | NULL | 121 | 183 | 62 | 51% |

| 5 | HLT 4.875 1/15/2030 | 4.88% | 01/15/30 | 212 | 273 | 61 | 29% |

| 6 | AGGHOL 9.625 11/9/2025 | 9.63% | 11/09/25 | 15 | 75 | 60 | 400% |

| 7 | ISPIM 7.75 PERP | 7.75% | NULL | 208 | 264 | 56 | 27% |

| 8 | RBIAV 4.5 PERP | 4.50% | NULL | 200 | 254 | 54 | 27% |

| 9 | KIJAIJ 7.5 12/15/2027 REGS | 7.50% | 12/15/27 | 60 | 111 | 51 | 85% |

| 10 | CSLAU 5.106 4/3/2034 144A | 5.11% | 04/03/34 | 185 | 233 | 48 | 26% |

Most Quoted HY Corps

Ranks the HY Corps that were quoted by the highest number of dealers between 4/19/24 – 4/26/24

| RANK | TRANCHE | COUPON | MATURITY | DEALERS |

| 1 | BACR 8 PERP | 8.00% | 12/15/99 | 39 |

| 2 | LLOYDS 7.5 PERP | 7.50% | NULL | 36 |

| 3 | BACR 4.375 PERP | 4.38% | NULL | 36 |

| 4 | INTNED 6.5 PERP | 6.50% | NULL | 36 |

| 5 | MTDR 5.875 9/15/2026 | 5.88% | 09/15/26 | 36 |

| 6 | F 4.95 5/28/2027 | 4.95% | 05/28/27 | 35 |

| 7 | BACR 9.625 PERP | 9.63% | 12/15/99 | 35 |

| 8 | DB 7.5 PERP | 7.50% | NULL | 35 |

| 9 | BACR 6.125 PERP | 6.13% | NULL | 35 |

| 10 | UBS 6.875 PERP | 6.88% | 12/29/49 | 35 |

Bid-Offer Spread by Industry

Results are based on 5 select industry sectors, however, we offer data across 36 sectors

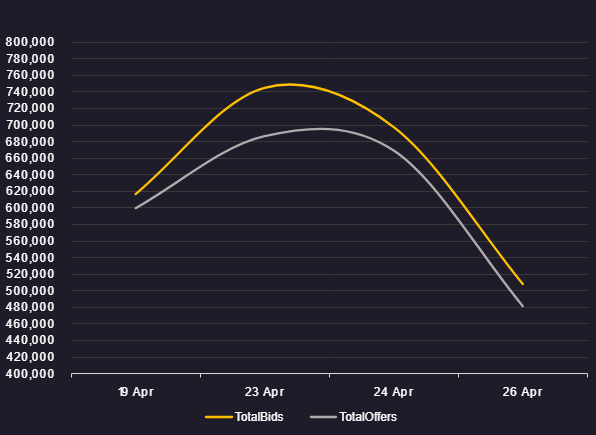

Bid and Offer Volume

Reveals the total number of quotes by bid and offer between 4/19/24 – 4/26/24

Stay up-to-date with weekly summaries.

BDCs

BDCs  SOLVE Insights

SOLVE Insights  SOLVE Newsroom

SOLVE Newsroom