Syndicated Bank Loans

GET OUR BANK LOAN MARKET SUMMARIES STRAIGHT TO YOUR INBOX. LEARN MORE

Syndicated Bank Loan Market Summary:

Week Ending 1/12/24

Our newsletter presents key trends derived from observable Syndicated Bank Loan pricing data over a weekly period.

![]()

New Issues

Loans issued during the week ending 1/12/24

| ISSUER | AMOUNT (MM) | LOAN TYPE | MATURITY | RATE |

| Solarwinds Inc. | 1186 | Term Loan | 2/1/2027 | S+325 |

| KBR Inc. | 800 | Term Loan | 1/10/2031 | S+250 |

| BRP INC | 1000 | Term Loan | 1/1/2031 | S+275 |

forward calendar

Forward calendar during the week ending 1/12/24

| Issuer | Deal Information | Banks | Expected Issue Date |

| Kohler Energy | $1.625B TLB | BofA, GS, BMO, DB, HSBC, MIZ | Q1 2024 |

| Vistage Worldwide | $125MM TL | GLB | Q1 2024 |

Largest Loans

Highlights the weekly price movements and quote depth for the 20 largest bank loans between 1/5/24 – 1/12/24

| RANK | SIZE (MM) | NAME | CHANGE | PRC | PRC-1W | DEALERS |

| 1 | 8,572 | GEO GROUP TL1 | 0.79% | 102.04 | 101.23 | 10 |

| 2 | 7,270 | MEDLINE TL B | -0.15% | 100.18 | 100.33 | 13 |

| 3 | 7,270 | MEDLINE TL B | -0.15% | 100.18 | 100.33 | 13 |

| 4 | 5,000 | UNITED CONTINENTAL TL B | -0.06% | 100.11 | 100.17 | 13 |

| 5 | 4,750 | HUB INTL LTD TL B5 | -0.09% | 100.24 | 100.33 | 15 |

| 6 | 4,750 | ZAYO TL | 0.56% | 84.42 | 83.95 | 15 |

| 7 | 4,559 | TRANSDIGM INC. TL I | -0.02% | 100.34 | 100.36 | 18 |

| 8 | 4,463 | ULTIMATE SOFTWARE TL B | -0.11% | 100.03 | 100.14 | 13 |

| 9 | 4,463 | ULTIMATE SOFTWARE TL B | -0.11% | 100.03 | 100.14 | 13 |

| 10 | 4,415 | ICON PLC TL B | -0.09% | 100.21 | 100.30 | 10 |

| 11 | 4,050 | CITRIX TL B | 0.14% | 97.63 | 97.49 | 13 |

| 12 | 3,900 | DIRECTV TL | -0.05% | 99.79 | 99.85 | 15 |

| 13 | 3,900 | DIRECTV TL | -0.05% | 99.79 | 99.85 | 15 |

| 14 | 3,580 | CDK GLOBAL TL B | -0.04% | 100.34 | 100.38 | 14 |

| 15 | 3,550 | CITADEL TL B | -0.31% | 99.93 | 100.23 | 13 |

| 16 | 3,500 | AMERICAN AIRLINES TL B | 0.13% | 102.69 | 102.55 | 14 |

| 17 | 3,500 | AMERICAN AIRLINES TL B | 0.13% | 102.69 | 102.55 | 14 |

| 18 | 3,500 | PILOT TRAVEL TL B | -0.04% | 100.17 | 100.22 | 12 |

| 19 | 3,450 | GOLDEN NUGGET INC TL B | -0.07% | 99.84 | 99.91 | 14 |

| 20 | 3,420 | RCN GRANDE TL | 0.08% | 78.72 | 78.66 | 15 |

| AVERAGE | 4,593 | 0.02% | 98.47 | 98.45 | 13.6 |

Top 10 Performers

Showcases the top 10 loan performers based on the largest bid price increases between 1/5/24-1/12/24

| RANK | NAME | CHANGE | PRC | PRC-1W | DEALERS |

| 1 | ALLOHEIM EUR TL B | 12.50% | 92.54 | 82.26 | 12 |

| 2 | KLOECKNER EUR TL B | 3.32% | 92.49 | 89.52 | 14 |

| 3 | WESSANEN EUR TL | 3.08% | 92.52 | 89.76 | 11 |

| 4 | LANDESK 2ND LIEN TL | 3.01% | 79.59 | 77.26 | 7 |

| 5 | AT&T COLOCATION TL | 2.83% | 97.30 | 94.62 | 7 |

| 6 | ASCEND LEARNING 2ND LIEN TL | 2.82% | 88.85 | 86.41 | 8 |

| 7 | ADB SAFEGATE EUR TL B | 2.68% | 90.91 | 88.54 | 9 |

| 8 | WEBER-STEPHEN TL B | 2.68% | 89.77 | 87.43 | 10 |

| 9 | COMPREHENSIVE EYECARE PARTNERS TL | 2.45% | 50.70 | 49.49 | 12 |

| 10 | XELLA INTERNATIONAL GMBH EUR TL B | 2.12% | 90.80 | 88.92 | 14 |

Bottom 10 Perfromers

Showcases the bottom 10 loan performers based on the largest bid price decreases between 1/5/24-1/12/24

| RANK | NAME | CHANGE | PRC | PRC-1W | DEALERS |

| 1 | CITY BREWING TL B | -2.58% | 75.98 | 78.00 | 8 |

| 2 | GRIFOLS WORLDWIDE EUR TL B | -2.38% | 96.93 | 99.29 | 16 |

| 3 | HEARTHSIDE FOODS TL B | -1.97% | 78.46 | 80.03 | 17 |

| 4 | CORRECT CARE TL B | -1.69% | 82.58 | 84.00 | 9 |

| 5 | RESEARCH NOW TL | -1.52% | 72.98 | 74.11 | 7 |

| 6 | PATHWAY PARTNERS VET MANAGEMENT TL | -1.44% | 86.93 | 88.20 | 11 |

| 7 | BBB INDUSTRIES TL B | -1.21% | 94.25 | 95.40 | 6 |

| 8 | ACCELL GROUP EUR TL B | -1.05% | 74.08 | 74.87 | 12 |

| 9 | TROPICANA TL | -0.80% | 96.17 | 96.94 | 12 |

| 10 | AMERICAN BATH TL | -0.76% | 97.22 | 97.97 | 13 |

Avg Bid PX by Sector

Displays the average loan bid price by sector between 1/5/24-1/12/24

Results are based on 5 select industry sectors, however, we offer data across 36 sectors

Sentiment

Reveals the percent of loans increasing in price (advancers) vs. loans decreasing in price (decliners) between 1/5/24-1/12/24

Top Quote Volume Movers: This Week vs Last Week

Exhibits the loans with the largest increase in quote volume for the week ending 1/5/24 vs. the week ending 1/12/24

| RANK | TRANCHE | PRIOR WEEK | THIS WEEK | INCREASE | % INCREASE |

| 1 | SIGMA BIDCO GBP TL B | 22 | 56 | 34 | 155% |

| 2 | SIGMA BIDCO EUR TL B | 40 | 74 | 34 | 85% |

| 3 | AMMERAAL BELTECH EUR TL B | 24 | 56 | 32 | 133% |

| 4 | CLUB CORP TL B | 74 | 106 | 32 | 43% |

| 5 | BLACKSTONE CQP TL B | 64 | 96 | 32 | 50% |

| 6 | APEX TOOLS 2ND LIEN TL | 26 | 58 | 32 | 123% |

| 7 | INTERTAPE POLYMER US INC TL | 54 | 86 | 32 | 59% |

| 8 | INEOS FIN EUR TL B | 18 | 50 | 32 | 178% |

| 9 | ALKEGEN TL B | 84 | 116 | 32 | 38% |

| 10 | KLOECKNER EUR TL B | 28 | 60 | 32 | 114% |

Most Quoted Loans

Ranks the loans that were quoted by the highest number of dealers between 1/5/24-1/12/24

| RANK | TRANCHE | DEALERS |

| 1 | TRANSDIGM INC. TL I | 18 |

| 2 | ZIGGO EUR TL H | 18 |

| 3 | HILEX POLY TL B | 18 |

| 4 | HEARTHSIDE FOODS TL B | 17 |

| 5 | ALKEGEN TL B | 17 |

| 6 | TELENET EUR TL | 17 |

| 7 | WESTINGHOUSE TL B | 17 |

| 8 | CALPINE CONSTRUCTION FINANCE TL B | 16 |

| 9 | MASMOVIL IBERCOM SA EUR TL B2 | 16 |

| 10 | TRICORBRAUN TL B | 16 |

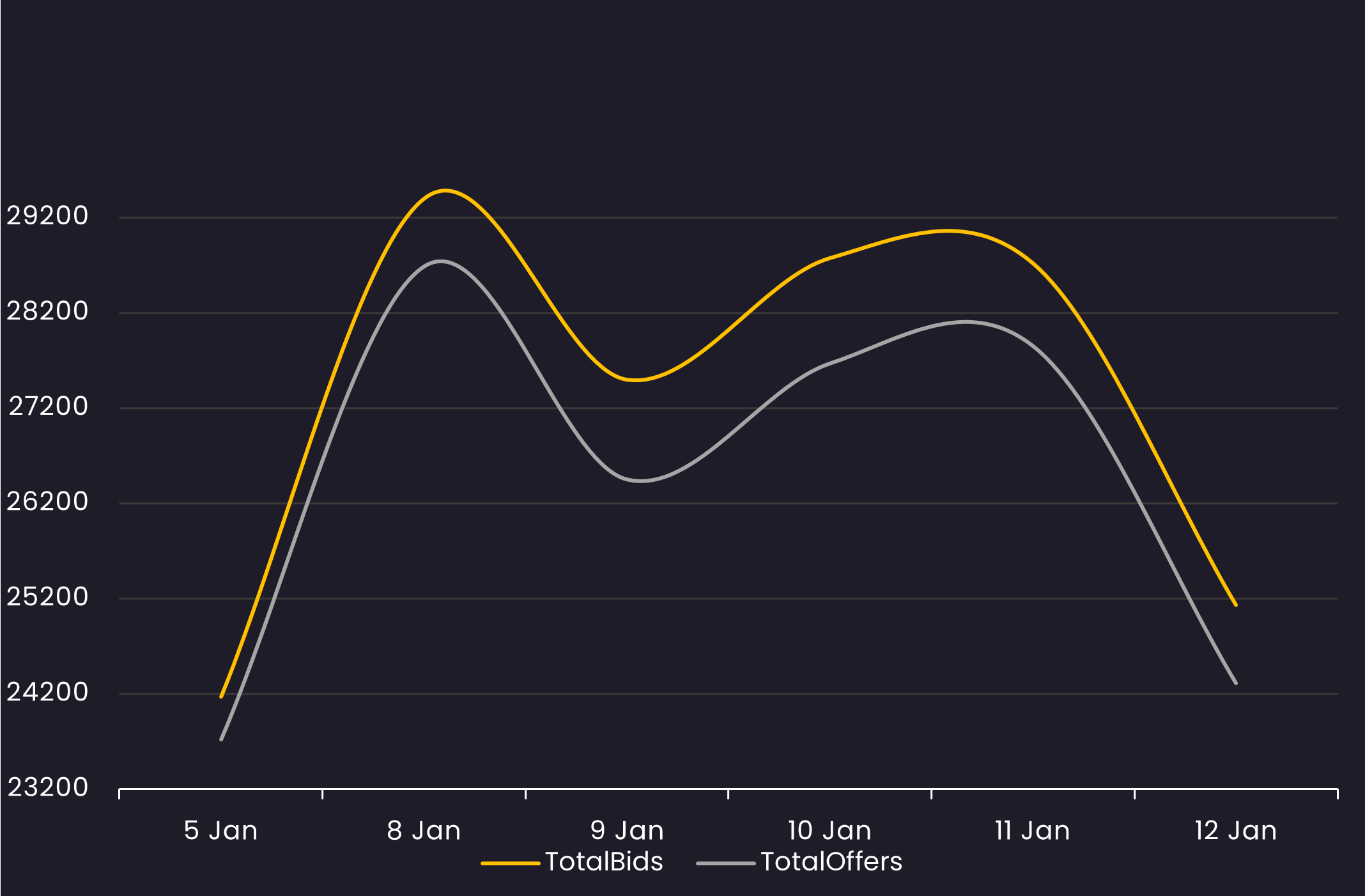

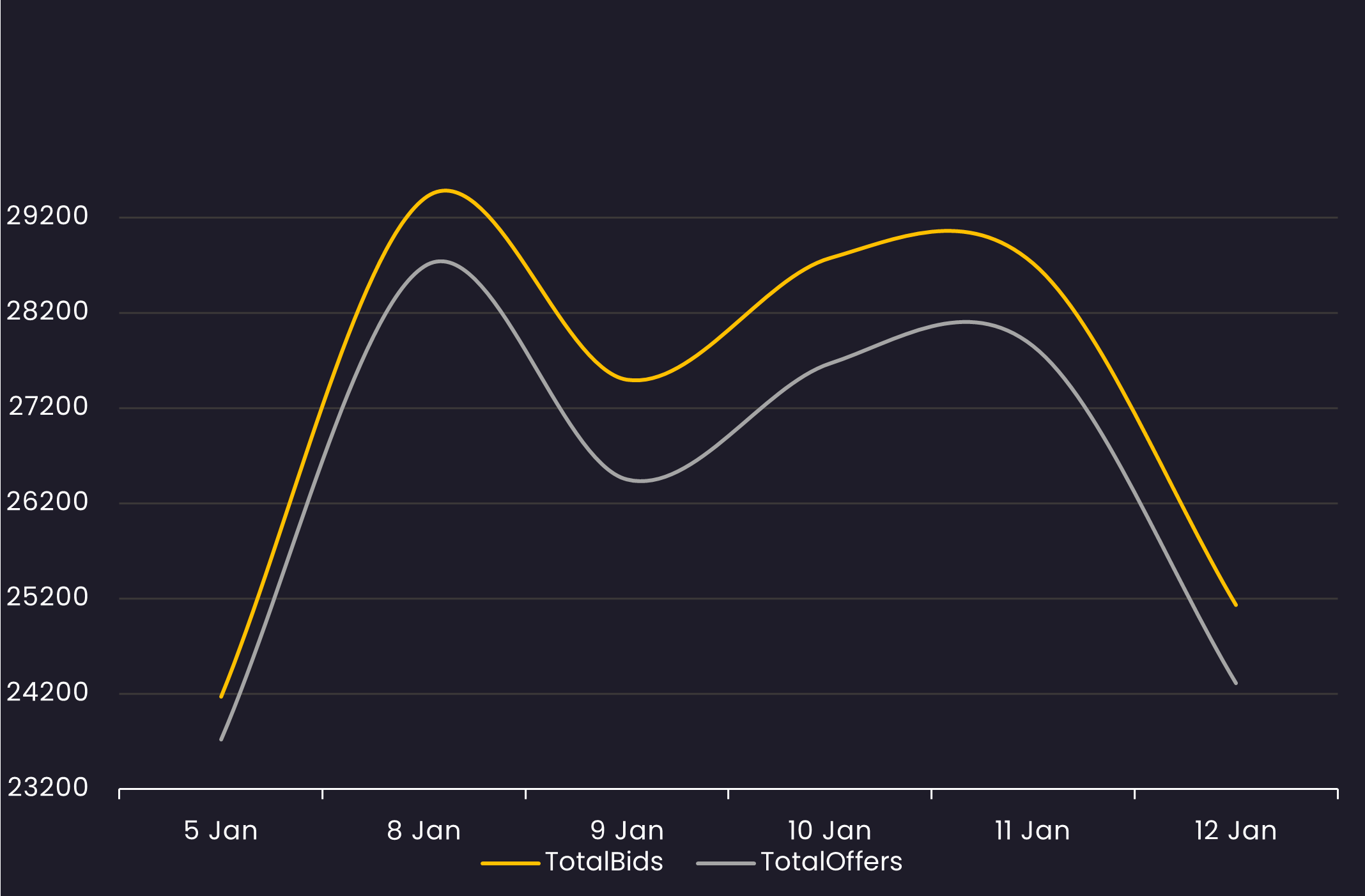

Bid and Offer Volume

Reveals the total number of quotes by bid and offer between 1/5/24-1/12/24

Sector Bid-Offer Spread

Results are based on 5 select industry sectors, however, we offer data across 36 sectors

Stay up-to-date with weekly summaries.