Syndicated Bank Loans

GET OUR BANK LOAN MARKET SUMMARIES STRAIGHT TO YOUR INBOX. LEARN MORE

Syndicated Bank Loan Market Summary:

Week Ending 12/29/23

Our newsletter presents key trends derived from observable Syndicated Bank Loan pricing data over a weekly period.

![]()

New Issues

Loans issued during the week ending 12/29/23

| ISSUER | AMOUNT (MM) | LOAN TYPE | MATURITY | RATE |

| — | — | — | — | — |

| — | — | — | — | — |

forward calendar

Forward calendar during the week ending 12/29/23

| Issuer | Deal Information | Banks | Expected Issue Date |

| Avolon | $2.334B TLB-5 | BofA,DB,BNPQY,FITN,MS,TFC | Q4 2022 |

| Culligan International Co. | $1.15B TLB | BofA,MS,GS | Q4 2022 |

Largest Loans

Highlights the weekly price movements and quote depth for the 20 largest bank loans between 12/22/23 – 12/29/23

| RANK | SIZE (MM) | NAME | CHANGE | PRC | PRC-1W | DEALERS |

| 1 | 8,572 | GEO GROUP TL1 | 0.07% | 101.86 | 101.80 | 10 |

| 2 | 7,270 | MEDLINE TL B | 0.18% | 100.47 | 100.29 | 13 |

| 3 | 5,000 | UNITED CONTINENTAL TL B | 0.03% | 100.34 | 100.31 | 16 |

| 4 | 4,750 | HUB INTL LTD TL B5 | 0.04% | 100.40 | 100.36 | 14 |

| 5 | 4,750 | ZAYO TL | 0.32% | 85.37 | 85.11 | 13 |

| 6 | 4,741 | INTERNET BRANDS TL B | 0.37% | 98.22 | 97.86 | 13 |

| 7 | 4,559 | TRANSDIGM INC. TL I | 0.03% | 100.38 | 100.35 | 19 |

| 8 | 4,463 | ULTIMATE SOFTWARE TL B | 0.01% | 100.25 | 100.23 | 14 |

| 9 | 4,415 | ICON PLC TL B | 0.20% | 100.43 | 100.23 | 10 |

| 10 | 4,050 | CITRIX TL B | -0.07% | 97.34 | 97.40 | 13 |

| 11 | 3,900 | DIRECTV TL | 0.05% | 99.93 | 99.88 | 16 |

| 12 | 3,580 | CDK GLOBAL TL B | 0.06% | 100.37 | 100.31 | 14 |

| 13 | 3,550 | CITADEL TL B | 0.00% | 100.13 | 100.12 | 11 |

| 14 | 3,500 | PILOT TRAVEL TL B | 0.08% | 100.21 | 100.14 | 12 |

| 15 | 3,500 | AMERICAN AIRLINES TL B | 0.17% | 102.80 | 102.62 | 14 |

| 16 | 3,450 | GOLDEN NUGGET INC TL B | 0.15% | 100.04 | 99.89 | 13 |

| 17 | 3,420 | RCN GRANDE TL | -0.20% | 79.81 | 79.97 | 13 |

| 18 | 3,380 | SOLERA TL B | 0.61% | 98.57 | 97.97 | 15 |

| 19 | 3,300 | NTL CABLE PLC TL N | 0.22% | 99.56 | 99.35 | 12 |

| 20 | 3,175 | MAGENTA BUYER LLC TL | 3.53% | 70.26 | 67.87 | 11 |

| AVERAGE | 4,366 | 0.29% | 96.84 | 96.60 | 13.3 |

Top 10 Performers

Showcases the top 10 loan performers based on the largest bid price increases between 12/22/23-12/29/23

| RANK | NAME | CHANGE | PRC | PRC-1W | DEALERS |

| 1 | ARVOS TL B | 10.29% | 37.31 | 33.83 | 6 |

| 2 | CBS RADIO INC TL B | 6.82% | 47.87 | 44.82 | 8 |

| 3 | MAGENTA BUYER LLC TL | 3.53% | 70.26 | 67.87 | 12 |

| 4 | NTHRIVE 2ND LIEN TL | 3.46% | 59.00 | 57.03 | 6 |

| 5 | RACKSPACE HOSTING TL B | 2.06% | 43.01 | 42.14 | 12 |

| 6 | TRINSEO TL B | 2.03% | 77.90 | 76.35 | 10 |

| 7 | AMERICAN TIRE TL B | 1.84% | 83.29 | 81.79 | 10 |

| 8 | QUORUM BUSINESS TL B | 1.53% | 95.38 | 93.94 | 7 |

| 9 | WEIGHT WATCHERS TL B | 1.32% | 70.72 | 69.80 | 10 |

| 10 | POLYCONCEPT TL B | 1.24% | 99.06 | 97.85 | 6 |

Bottom 10 Perfromers

Showcases the bottom 10 loan performers based on the largest bid price decreases between 12/22/23-12/29/23

| RANK | NAME | CHANGE | PRC | PRC-1W | DEALERS |

| 1 | 0 | 0.00% | 0.00 | 0.00 | 0 |

| 2 | 0 | 0.00% | 0.00 | 0.00 | 0 |

| 3 | 0 | 0.00% | 0.00 | 0.00 | 0 |

| 4 | 0 | 0.00% | 0.00 | 0.00 | 0 |

| 5 | 0 | 0.00% | 0.00 | 0.00 | 0 |

| 6 | 0 | 0.00% | 0.00 | 0.00 | 0 |

| 7 | 0 | 0.00% | 0.00 | 0.00 | 0 |

| 8 | 0 | 0.00% | 0.00 | 0.00 | 0 |

| 9 | 0 | 0.00% | 0.00 | 0.00 | 0 |

| 10 | 0 | 0.00% | 0.00 | 0.00 | 0 |

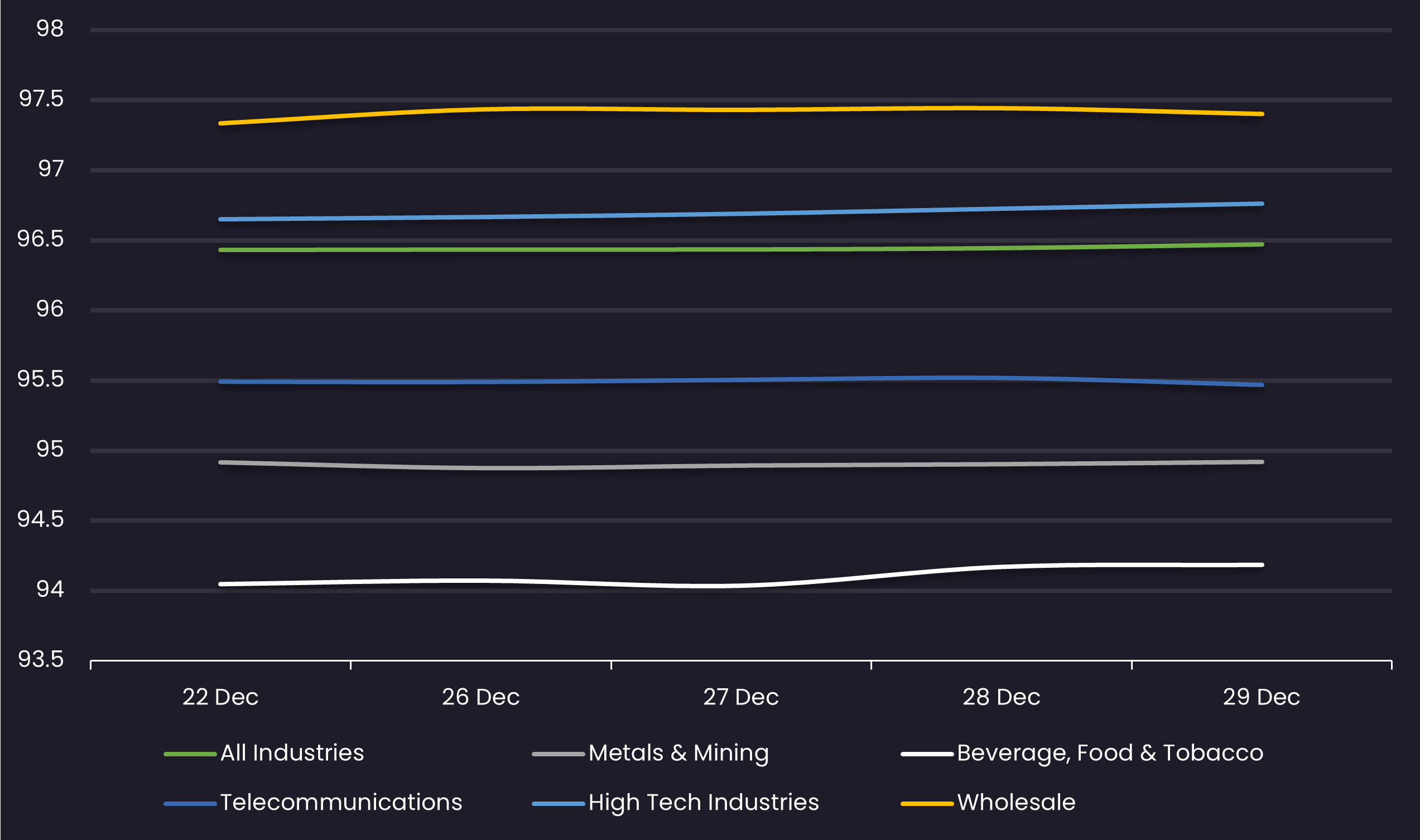

Avg Bid PX by Sector

Displays the average loan bid price by sector between 12/22/23-12/29/23

Results are based on 5 select industry sectors, however, we offer data across 36 sectors

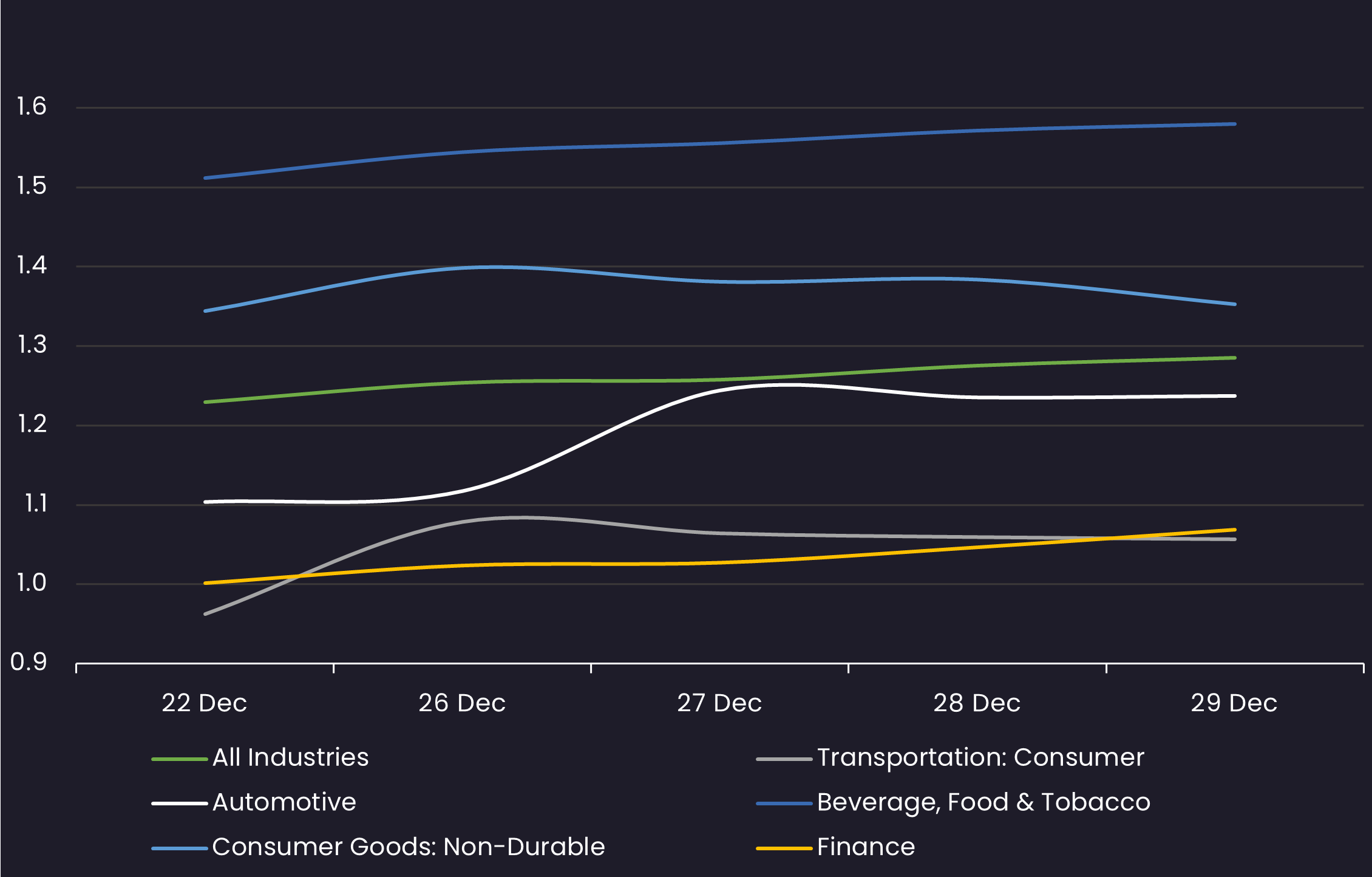

Sentiment

Reveals the percent of loans increasing in price (advancers) vs. loans decreasing in price (decliners) between 12/22/23-12/29/23

Top Quote Volume Movers: This Week vs Last Week

Exhibits the loans with the largest increase in quote volume for the week ending 12/22/23 vs. the week ending 12/29/23

| RANK | TRANCHE | PRIOR WEEK | THIS WEEK | INCREASE | % INCREASE |

| 1 | SKILLSOFT TL B | 0 | 22 | 22 | NA |

| 2 | SS&C TECH TL B | 0 | 19 | 19 | NA |

| 3 | USI HOLDINGS TL B | 14 | 28 | 14 | 100% |

| 4 | CULLIGAN TL B | 2 | 16 | 14 | 700% |

| 5 | ATLANTIC AVIATION TL B | 22 | 34 | 12 | 55% |

| 6 | TACALA TL | 9 | 20 | 11 | 122% |

| 7 | XPO LOGISTICS TL B | 6 | 16 | 10 | 167% |

| 8 | AVIS BUDGET TL C | 18 | 26 | 8 | 44% |

| 9 | ICP GROUP 2ND LIEN TL | 0 | 8 | 8 | NA |

| 10 | FEECO TL B | 4 | 12 | 8 | 200% |

Most Quoted Loans

Ranks the loans that were quoted by the highest number of dealers between 12/22/23-12/29/23

| RANK | TRANCHE | DEALERS |

| 1 | TRANSDIGM INC. TL I | 19 |

| 2 | HILEX POLY TL B | 18 |

| 3 | ALKEGEN TL B | 17 |

| 4 | ZIGGO EUR TL H | 17 |

| 5 | BMC SOFTWARE TL B | 17 |

| 6 | TRANSDIGM INC. TL H | 17 |

| 7 | REYNOLDS GROUP HOLDINGS LIMITED TL B3 | 16 |

| 8 | HEARTHSIDE FOODS TL B | 16 |

| 9 | TELENET EUR TL | 16 |

| 10 | NTL CABLE PLC EUR TL R | 16 |

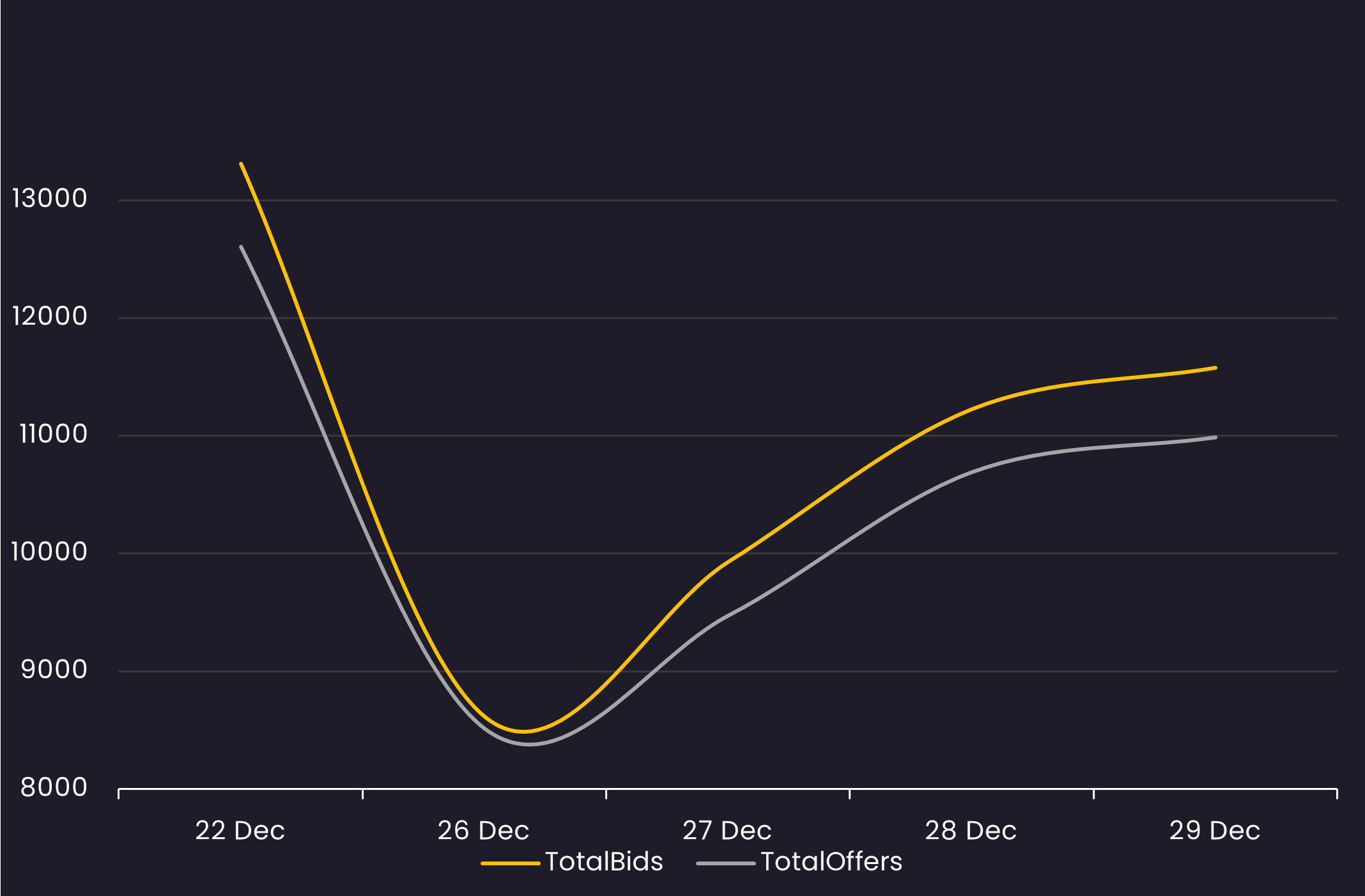

Bid and Offer Volume

Reveals the total number of quotes by bid and offer between 12/22/23-12/29/23

Sector Bid-Offer Spread

Results are based on 5 select industry sectors, however, we offer data across 36 sectors

Stay up-to-date with weekly summaries.