Municipals

GET OUR MUNICIPAL BOND MARKET SUMMARIES STRAIGHT TO YOUR INBOX. LEARN MORE

Municipal Bond Market Summary:

Week Ending 12/15/23

Our newsletter presents key trends derived from observable Municipal Bond pricing data over a weekly period.

![]()

Top 10 Performers

Showcases the top 10 Muni Bond performers based on price movements between 12/8/23-12/15/23

| RANK | BOND NAME | COUPON | MATURITY | CHANGE | PX | PX-1W | DEALERS |

| 1 | LONG BEACH CMNTY CLG | 3.000% | 08/01/37 | 7.88% | 96.94 | 89.86 | 2 |

| 2 | SAN JOSE ETC-B | 3.000% | 09/01/37 | 7.68% | 96.92 | 90.01 | 2 |

| 3 | UNIV OF PITTSBURGH PA | 3.555% | 09/15/19 | 7.58% | 71.71 | 66.65 | 6 |

| 4 | MA ST-A | 2.000% | 03/01/41 | 7.58% | 69.99 | 65.07 | 2 |

| 5 | PR SALES TAX FING-A1 | 0.000% | 07/01/51 | 7.54% | 23.68 | 22.02 | 11 |

| 6 | WAYZATA ISD #284-A | 3.125% | 02/01/37 | 7.53% | 95.73 | 89.02 | 2 |

| 7 | MILPITAS UNIF SD-B | 3.000% | 08/01/37 | 7.45% | 96.97 | 90.24 | 3 |

| 8 | SANTA CLARITA CA | 3.000% | 08/01/44 | 7.44% | 86.05 | 80.09 | 2 |

| 9 | MISSOURI ST HLTH & ED | 3.229% | 05/15/50 | 7.42% | 77.02 | 71.70 | 7 |

| 10 | LOS ANGELES DEPT ARPT | 4.000% | 05/15/49 | 7.27% | 98.41 | 91.74 | 5 |

Bottom 10 Performers

Showcases the bottom 10 Muni Bond performers based on price movements between 12/8/23-12/15/23

| RANK | BOND NAME | COUPON | MATURITY | CHANGE | PX | PX-1W | DEALERS |

| 1 | FL FLSHSG 3.30 07/01/2049 | 3.300% | 07/01/49 | -4.56% | 85.82 | 89.93 | 3 |

| 2 | CT NWW 2.00 03/15/2034 | 2.000% | 03/15/34 | -4.48% | 85.07 | 89.05 | 2 |

| 3 | NY NHRSCD 2.00 06/15/2029 | 2.000% | 06/15/29 | -4.45% | 91.06 | 95.30 | 8 |

| 4 | CA IRGFAC 4.00 09/01/2058 | 4.000% | 09/01/58 | -4.00% | 94.71 | 98.66 | 5 |

| 5 | HI HISGEN 4.00 03/01/2037 | 4.000% | 03/01/37 | -3.90% | 67.22 | 69.94 | 2 |

| 6 | VA CHEUTL 3.00 07/01/2033 | 3.000% | 07/01/33 | -3.35% | 94.67 | 97.96 | 3 |

| 7 | CO COSHSG 1.75 11/01/2033 | 1.750% | 11/01/33 | -3.32% | 80.11 | 82.87 | 2 |

| 8 | IL CHIEDU 5.00 12/01/2046 | 5.000% | 12/01/46 | -2.95% | 96.72 | 99.66 | 2 |

| 9 | CA ANDSCD 3.38 08/01/2039 | 3.375% | 08/01/39 | -2.80% | 87.38 | 89.90 | 2 |

| 10 | TX FORTRN 3.00 03/01/2039 | 3.000% | 03/01/39 | -2.75% | 85.86 | 88.29 | 4 |

Top 10 State Performers

Showcases the top 10 Muni State performers based on yield movements between 12/8/23-12/15/23

| RANK | STATE | CHANGE | YLD | YLD-1W |

| 1 | HI | -66 bps | 3.76% | 4.42% |

| 2 | KY | -65 bps | 3.27% | 3.92% |

| 3 | MS | -51 bps | 3.71% | 4.22% |

| 4 | RI | -48 bps | 3.10% | 3.58% |

| 5 | OK | -46 bps | 3.27% | 3.73% |

| 6 | MD | -41 bps | 3.35% | 3.76% |

| 7 | NE | -37 bps | 3.45% | 3.82% |

| 8 | VT | -34 bps | 3.03% | 3.37% |

| 9 | MN | -32 bps | 3.46% | 3.78% |

| 10 | NV | -30 bps | 3.57% | 3.88% |

Bottom 10 State Performers

Showcases the bottom 10 Muni State performers based on yield movements between 12/8/23-12/15/23

| RANK | STATE | CHANGE | YLD | YLD-1W |

| 1 | GA | 11 bps | 3.43% | 3.32% |

| 2 | DC | 1 bps | 3.92% | 3.91% |

| 3 | WV | -2 bps | 3.66% | 3.69% |

| 4 | VA | -3 bps | 3.56% | 3.59% |

| 5 | NH | -3 bps | 3.49% | 3.52% |

| 6 | NY | -10 bps | 3.55% | 3.65% |

| 7 | KS | -11 bps | 3.62% | 3.74% |

| 8 | NM | -12 bps | 3.36% | 3.48% |

| 9 | ME | -12 bps | 12.47% | 12.60% |

| 10 | OR | -13 bps | 3.76% | 3.88% |

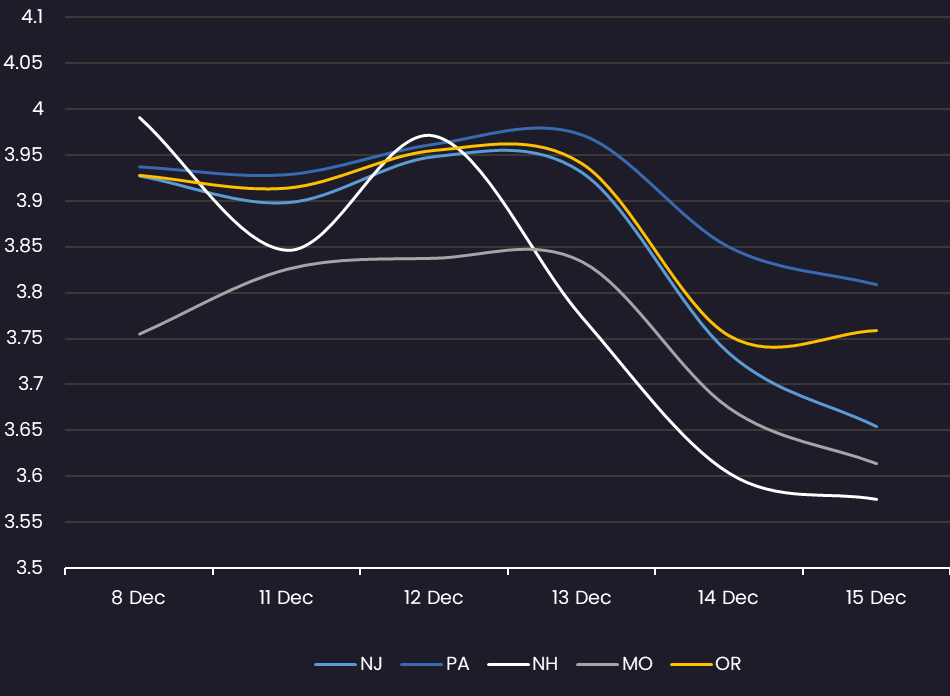

10 Year Yield by State – All

Displays the average Muni 10 year yield by state between 12/8/23-12/15/23 (General Obligation and Revenue Bonds)

Results are based on 5 select states, however, we offer data across all 50 states and U.S. territories

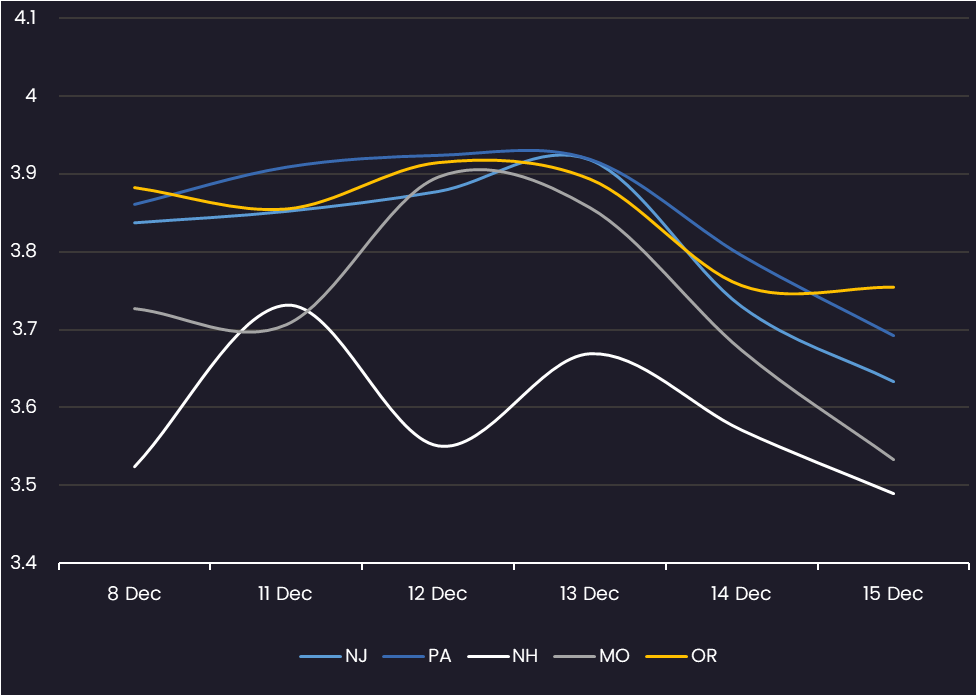

10 Year Yield by State – GO Only

Displays the average Muni 10 year yield by state between 12/8/23-12/15/23 (General Obligation Bonds only)

Results are based on 5 select states, however, we offer data across all 50 states and U.S. territories

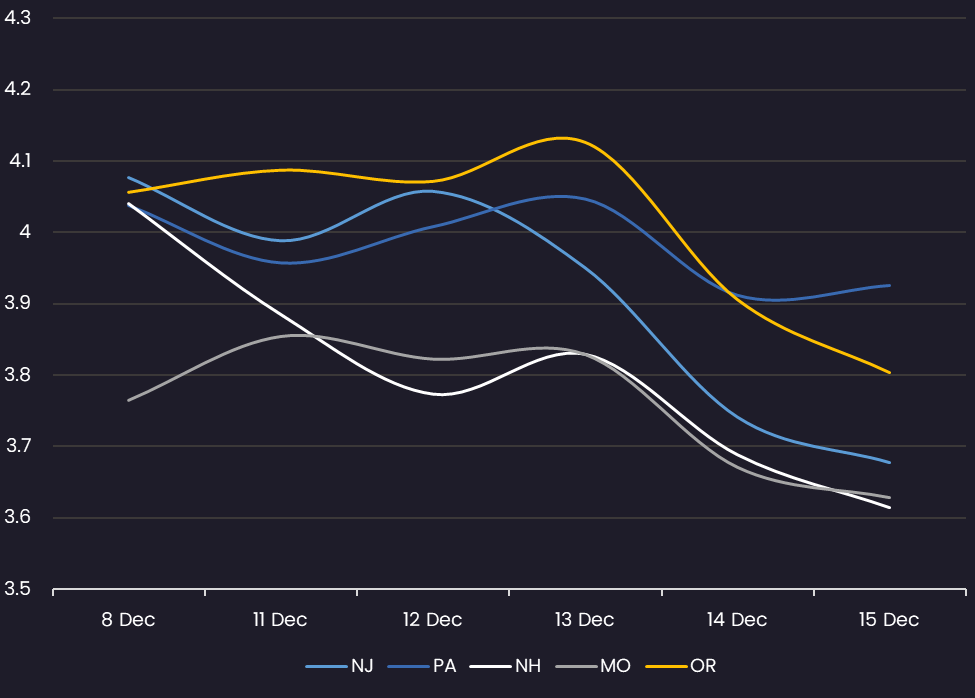

10 Year Yield by State – Rev Only

Displays the average Muni 10 year yield by state between 12/8/23-12/15/23 (Revenue Bonds only)

Results are based on 5 select states, however, we offer data across all 50 states and U.S. territories

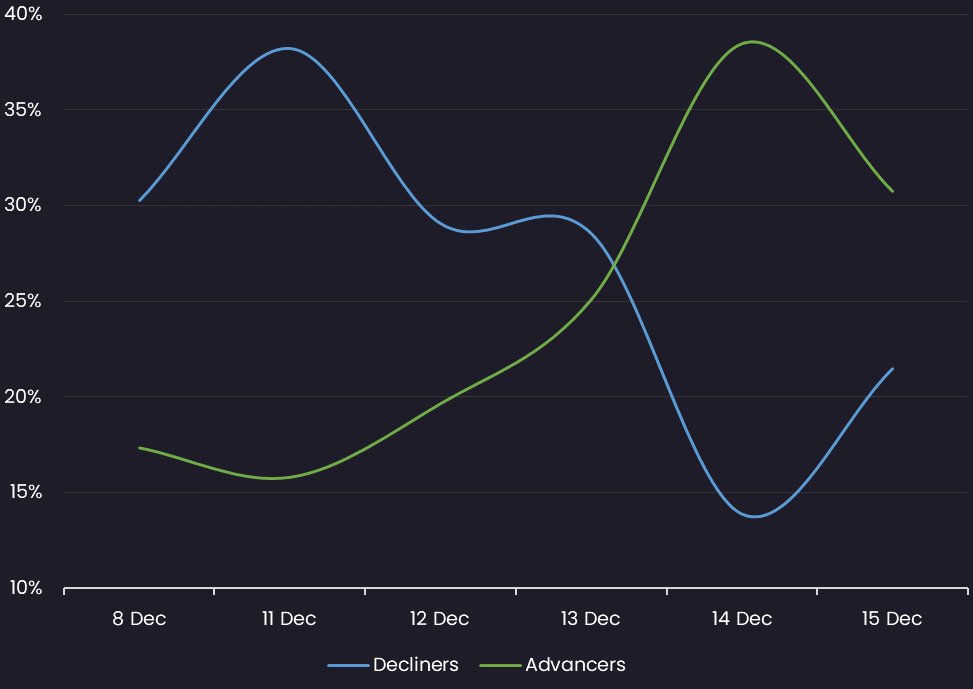

Sentiment

Reveals the percent of Muni bonds increasing in price (advancers) vs. decreasing in price (decliners) between 12/8/23-12/15/23

Top Quote Volume Movers: This Week vs Last Week

Exhibits the Munis with the largest increase in quote volume for the week ending 12/8/23 vs. the week ending 12/15/23

| RANK | TRANCHE | COUPON | MATURITY | PRIOR WEEK | THIS WEEK | INCREASE | % INCREASE |

| 1 | IN FIN AUTH-REF-2 | 5.000% | 10/01/25 | 8 | 84 | 76 | 950% |

| 2 | OHIO ST | 5.000% | 06/15/25 | 8 | 74 | 66 | 825% |

| 3 | N FORT BEND WTR AUTH | 5.000% | 12/15/25 | 15 | 78 | 63 | 420% |

| 4 | NEW JERSEY ST ECON DE | 4.000% | 06/15/25 | 19 | 81 | 62 | 326% |

| 5 | CALIFORNIA ST-GREEN | 3.750% | 10/01/37 | 58 | 118 | 60 | 103% |

| 6 | NE PUB PWR DT-C-REF | 5.000% | 01/01/26 | 5 | 64 | 59 | 1180% |

| 7 | MEMPHIS TN SANTN SWR | 5.000% | 10/01/25 | 5 | 64 | 59 | 1180% |

| 8 | UTAH TRANSIT AUTH-REF | 5.000% | 06/15/28 | 10 | 68 | 58 | 580% |

| 9 | BURLINGTON CO-REV | 4.000% | 04/01/25 | 6 | 64 | 58 | 967% |

| 10 | MAGNOLIA-CTFS OBLIG | 4.000% | 11/01/42 | 11 | 68 | 57 | 518% |

Most Quoted Munis

Ranks the Munis that were quoted by the highest number of dealers between 12/8/23 – 12/15/23

| RANK | TRANCHE | COUPON | MATURITY | DEALERS |

| 1 | MASSACHUSETTS CMNWL-D | 5.000% | 10/01/53 | 49 |

| 2 | DT OF COLUMBIA-A-REV | 5.500% | 07/01/47 | 38 |

| 3 | NYC MUNI WTR FIN-CC-1 | 5.000% | 06/15/52 | 38 |

| 4 | CALIFORNIA ST-BID -B | 5.000% | 09/01/33 | 38 |

| 5 | TRIBOROUGH BRIDGE & T | 4.000% | 11/15/54 | 38 |

| 6 | DETROIT | 5.500% | 04/01/50 | 36 |

| 7 | NYC TRANSITIONAL FIN | 4.000% | 05/01/45 | 35 |

| 8 | MASSACHUSETTS CMNWLTH | 5.000% | 06/01/50 | 34 |

| 9 | CALIFORNIA ST-BID -B | 5.000% | 09/01/32 | 33 |

| 10 | TX WTR DEV BRD-A -REV | 5.000% | 10/15/58 | 32 |

Stay up-to-date with weekly summaries.