Municipals

GET OUR MUNICIPAL BOND MARKET SUMMARIES STRAIGHT TO YOUR INBOX. LEARN MORE

Municipal Bond Market Summary:

Week Ending 11/10/23

Our newsletter presents key trends derived from observable Municipal Bond pricing data over a weekly period.

![]()

Top 10 Performers

Showcases the top 10 Muni Bond performers based on price movements between 11/3/23-11/10/23

| RANK | BOND NAME | COUPON | MATURITY | CHANGE | PX | PX-1W | DEALERS |

| 1 | GRTR TX CULTURAL FACS | 4.000% | 03/01/46 | 11.02% | 89.38 | 80.51 | 15 |

| 2 | CALIFORNIA ST UNIV-C | 4.000% | 11/01/51 | 10.75% | 94.39 | 85.23 | 12 |

| 3 | GRAND RAPIDS MI SANTN | 4.000% | 01/01/50 | 9.60% | 87.75 | 80.06 | 5 |

| 4 | NEW JERSEY ST HLTH CA | 4.000% | 07/01/44 | 9.41% | 86.84 | 79.37 | 2 |

| 5 | JACKSON REORG SD#4-A | 4.000% | 03/01/40 | 9.22% | 97.09 | 88.89 | 13 |

| 6 | PORT AUTH OF NEW YORK | 4.000% | 11/01/41 | 8.51% | 93.30 | 85.98 | 12 |

| 7 | NEW YORK-D-1 | 4.000% | 03/01/50 | 8.31% | 90.68 | 83.72 | 10 |

| 8 | OK WTR RESOURCES BRD | 4.000% | 04/01/41 | 7.94% | 95.98 | 88.91 | 12 |

| 9 | TEXAS ISD | 4.000% | 08/15/53 | 7.31% | 90.78 | 84.59 | 9 |

| 10 | PORT AUTH NY & NJ | 4.000% | 12/15/37 | 6.90% | 96.75 | 90.50 | 12 |

Bottom 10 Performers

Showcases the bottom 10 Muni Bond performers based on price movements between 11/3/23-11/10/23

| RANK | BOND NAME | COUPON | MATURITY | CHANGE | PX | PX-1W | DEALERS |

| 1 | OK UNIHSG 4.00 07/01/2047 | 4.000% | 07/01/47 | -6.11% | 87.73 | 93.45 | 2 |

| 2 | NY NYSHSG 2.75 11/01/2034 | 2.750% | 11/01/34 | -5.59% | 80.77 | 85.55 | 3 |

| 3 | OH OHSEDU 5.00 12/01/2032 | 5.000% | 12/01/32 | -4.72% | 103.82 | 108.96 | 2 |

| 4 | NJ NJSDEV 4.00 07/01/2034 | 4.000% | 07/01/34 | -4.31% | 89.00 | 93.01 | 3 |

| 5 | CA CASFIN 4.00 02/01/2051 | 4.000% | 02/01/51 | -4.08% | 80.43 | 83.86 | 9 |

| 6 | MD MDSEDU 4.00 06/01/2037 | 4.000% | 06/01/37 | -3.04% | 96.11 | 99.12 | 6 |

| 7 | OH OHSHSG 4.00 03/01/2049 | 4.000% | 03/01/49 | -2.58% | 92.96 | 95.42 | 3 |

| 8 | TX CLIEDU 4.00 08/15/2039 | 4.000% | 08/15/39 | -2.25% | 86.08 | 88.07 | 5 |

| 9 | MN MIN 2.00 12/01/2026 | 2.000% | 12/01/26 | -2.13% | 92.97 | 94.99 | 2 |

| 10 | TX TXSSFH 4.35 09/01/2038 | 4.350% | 09/01/38 | -2.09% | 97.07 | 99.14 | 2 |

Top 10 State Performers

Showcases the top 10 Muni State performers based on yield movements between 11/3/23-11/10/23

| RANK | STATE | CHANGE | YLD | YLD-1W |

| 1 | NM | -39 bps | 3.54% | 3.93% |

| 2 | ME | -34 bps | 3.96% | 4.30% |

| 3 | UT | -27 bps | 4.14% | 4.41% |

| 4 | CT | -23 bps | 4.20% | 4.43% |

| 5 | RI | -22 bps | 3.87% | 4.08% |

| 6 | MO | -21 bps | 4.12% | 4.33% |

| 7 | NY | -21 bps | 4.16% | 4.37% |

| 8 | LA | -19 bps | 4.10% | 4.30% |

| 9 | MD | -17 bps | 3.88% | 4.05% |

| 10 | SC | -13 bps | 4.26% | 4.39% |

Bottom 10 State Performers

Showcases the bottom 10 Muni State performers based on yield movements between 11/3/23-11/10/23

| RANK | STATE | CHANGE | YLD | YLD-1W |

| 1 | KS | 10 bps | 4.06% | 3.96% |

| 2 | AL | 9 bps | 4.23% | 4.14% |

| 3 | NJ | 6 bps | 4.53% | 4.47% |

| 4 | NE | 5 bps | 4.10% | 4.04% |

| 5 | OK | 4 bps | 4.19% | 4.16% |

| 6 | HI | 2 bps | 4.42% | 4.40% |

| 7 | PA | 0 bps | 4.36% | 4.37% |

| 8 | WA | -1 bps | 4.14% | 4.15% |

| 9 | AK | -2 bps | 4.08% | 4.10% |

| 10 | IA | -3 bps | 4.56% | 4.59% |

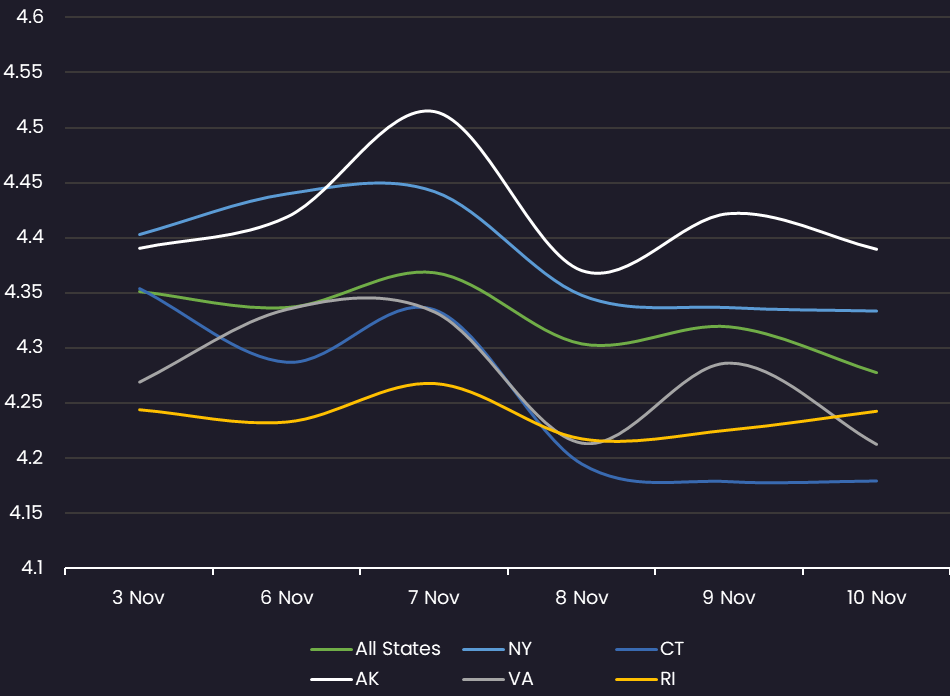

10 Year Yield by State – All

Displays the average Muni 10 year yield by state between 11/3/23-11/10/23 (General Obligation and Revenue Bonds)

Results are based on 5 select states, however, we offer data across all 50 states and U.S. territories

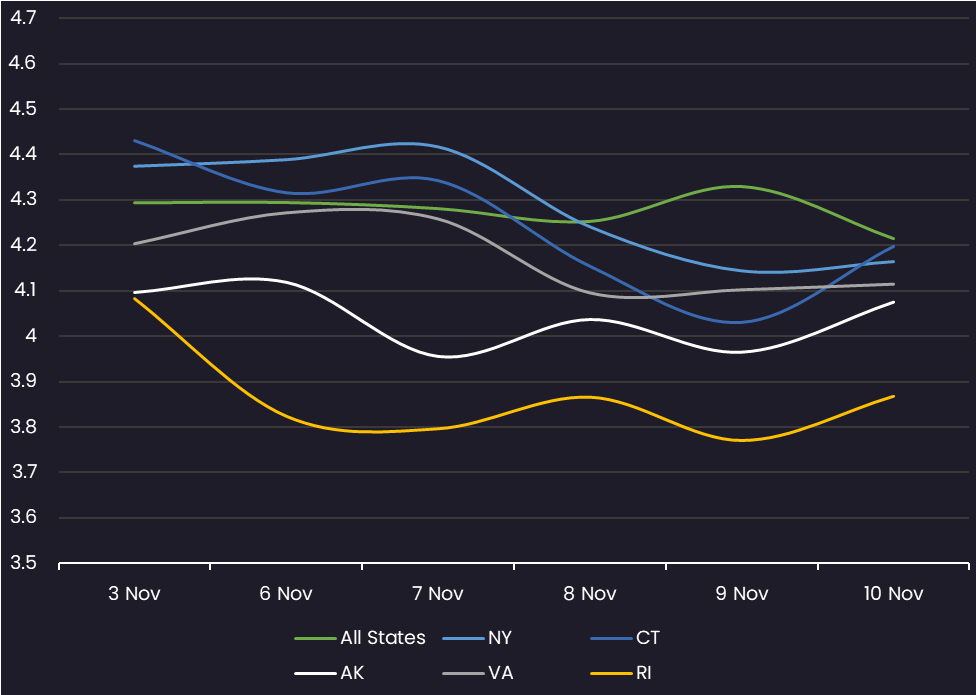

10 Year Yield by State – GO Only

Displays the average Muni 10 year yield by state between 11/3/23-11/10/23 (General Obligation Bonds only)

Results are based on 5 select states, however, we offer data across all 50 states and U.S. territories

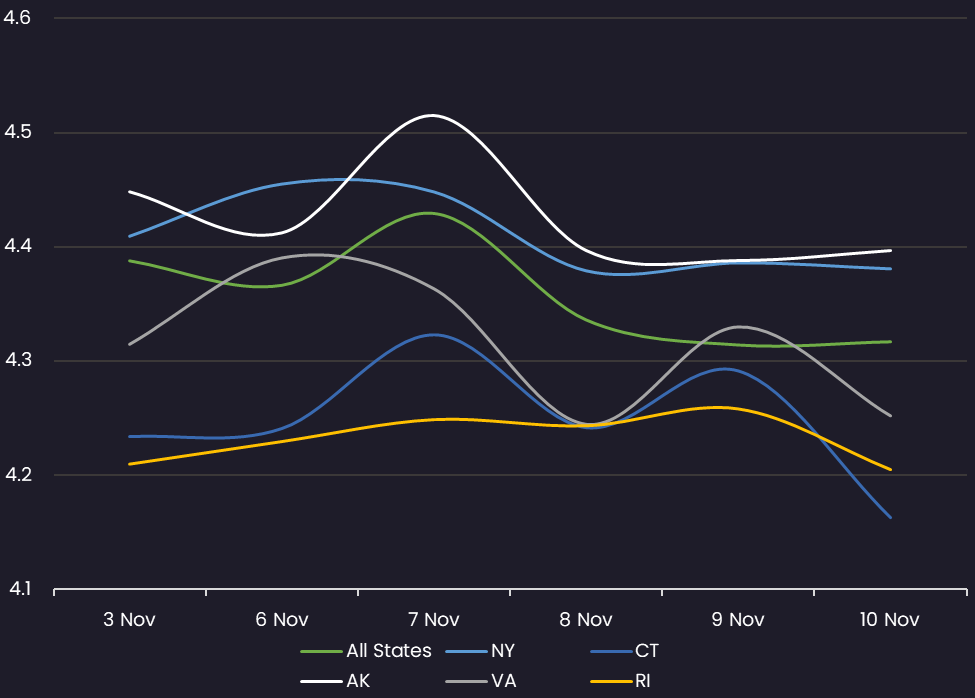

10 Year Yield by State – Rev Only

Displays the average Muni 10 year yield by state between 11/3/23-11/10/23 (Revenue Bonds only)

Results are based on 5 select states, however, we offer data across all 50 states and U.S. territories

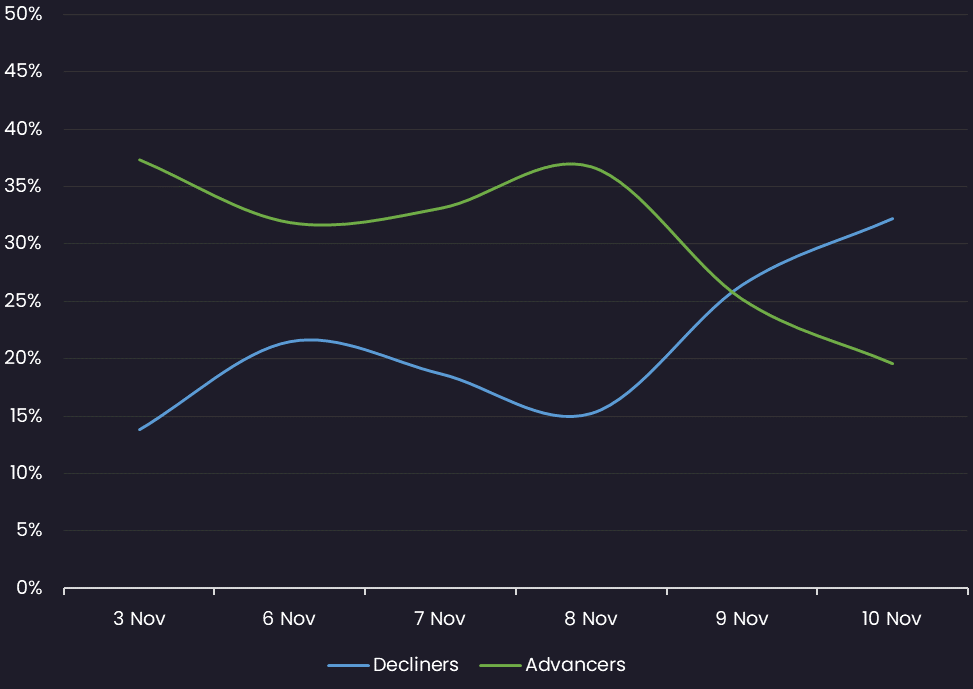

Sentiment

Reveals the percent of Muni bonds increasing in price (advancers) vs. decreasing in price (decliners) between 11/3/23-11/10/23

Top Quote Volume Movers: This Week vs Last Week

Exhibits the Munis with the largest increase in quote volume for the week ending 11/3/23 vs. the week ending 11/10/23

| RANK | TRANCHE | COUPON | MATURITY | PRIOR WEEK | THIS WEEK | INCREASE | % INCREASE |

| 1 | PENNSYLVANIA ST ECON | 5.250% | 06/30/36 | 13 | 90 | 77 | 592% |

| 2 | MASSACHUSETTS | 5.000% | 07/01/33 | 15 | 88 | 73 | 487% |

| 3 | N TEXAS TOLLWY AUTH-B | 4.000% | 01/01/37 | 7 | 76 | 69 | 986% |

| 4 | DT OF COLUMBIA-A-REV | 5.500% | 07/01/47 | 22 | 91 | 69 | 314% |

| 5 | TRAVIS CNTY TX-A | 5.000% | 03/01/28 | 20 | 86 | 66 | 330% |

| 6 | SWARTHMORE BORO AUTH | 5.000% | 09/15/39 | 18 | 82 | 64 | 356% |

| 7 | MASSACHUSETTS ST DEV | 4.000% | 07/01/32 | 5 | 68 | 63 | 1260% |

| 8 | GA MUNI ELEC AUTH -A | 5.000% | 01/01/49 | 7 | 69 | 62 | 886% |

| 9 | NEW YORK-A-A-1 | 5.000% | 08/01/41 | 15 | 76 | 61 | 407% |

| 10 | NEW YORK CITY TRANS | 5.000% | 05/01/41 | 17 | 77 | 60 | 353% |

Most Quoted Munis

Ranks the Munis that were quoted by the highest number of dealers between 11/3/23 – 11/10/23

| RANK | TRANCHE | COUPON | MATURITY | DEALERS |

| 1 | NEW YORK ST DORM AUTH | 5.000% | 07/01/39 | 44 |

| 2 | MASSACHUSETTS CMNWLTH | 5.000% | 06/01/50 | 42 |

| 3 | NYC MUNI WTR FIN-CC-1 | 5.000% | 06/15/52 | 38 |

| 4 | NYC TRAN FIN AUTH-B1 | 4.000% | 08/01/35 | 38 |

| 5 | TX WTR DEV BRD-A -REV | 5.000% | 10/15/58 | 38 |

| 6 | SALT RIVER | 5.000% | 01/01/47 | 37 |

| 7 | NY DORM AUTH-1-REF | 4.000% | 07/01/35 | 36 |

| 8 | CALIFORNIA ST | 5.000% | 10/01/42 | 35 |

| 9 | NY DORM AUTH-1-REF | 4.000% | 07/01/34 | 33 |

| 10 | SAN DIEGO ARPT-SER B | 5.000% | 07/01/48 | 33 |

Stay up-to-date with weekly summaries.

BDCs

BDCs  SOLVE Insights

SOLVE Insights  SOLVE Newsroom

SOLVE Newsroom