-

SOLVE Expands Corporate Bond Predictive Pricing with Launch of Confidence Score for SOLVE Px™

Read MoreNew AI-powered metric quantifies pricing uncertainty to help fixed income professionals interpret predictive prices with greater clarity.

-

SOLVE Acquires MBS Source to Expand Structured Products Coverage

Read MoreAcquisition adds specialized mortgage- and asset-backed securities data and analytics to SOLVE’s multi-asset fixed income platform, enhancing capabilities for buy- and sell-side clients

-

Unlocking Efficiency In Municipal Trading: Predictive Pricing, Automation, And Client Perspectives

Register For The WebinarIn this discussion, senior executives from Northern Trust, Investortools, and SOLVE will share real-world experiences on how the Municipal market is evolving.

-

SOLVE and Investortools

Read MoreSOLVE and Investortools announce integration of predictive pricing data to streamline and enhance fixed income trading workflows

-

The Science Of AI Predictive Pricing: Evidence From SOLVE Px In Corporate Bonds

Access The WhitepaperSOLVE Px for the Corporate Bond Market empowers traders, portfolio managers, and analysts to identify value, manage risk, and benchmark performance with confidence.

-

SOLVE Quotes: 24+ Million Daily Quotes for Accurate Fixed Income Decisions

Learn More About SOLVE QuotesGain the edge with real-time data across all key asset classes. Trade and value securities confidently with 10x more data than the competition.

-

From Cool To Core: AI’s Evolution In The Capital Markets

Watch the Entire InterviewIn a recent TabbForum interview, SOLVE CEO Eugene Grinberg discussed how firms’ understanding and adoption of AI have matured, moving from confusion to confidence.

SOLVE’s Market Coverage

CORPORATE BONDS

-

250,000+

Coverage

-

50,000

Daily Securities

-

24M+

Daily Quotes

-

250,000+

AI Predictive Trade Prices

SYNDICATED LOANS

-

6,500+

Coverage

-

3,000+

Daily Securities

-

60,000+

Daily Quotes

STRUCTURED PRODUCTS

-

150,000+

Coverage

-

20,000+

Daily Securities

-

120,000+

Daily Quotes

MUNICIPAL BONDS

-

1.1M+

Coverage

-

57,000+

Daily Securities

-

490,000+

Daily Quotes

-

900,000+

AI Predictive Trade Prices

BDCs & PRIVATE CREDIT

-

46,000

Holdings

-

10,000

Portfolio Companies

CREDIT DEFAULT SWAPS

-

6,000+

Coverage

-

4,500+

Daily Securities

-

200,000+

Daily Quotes

CONVERTIBLE BONDS

-

2,500+

Coverage

-

1,100+

Daily Securities

-

44,000+

Daily Quotes

INDICES

-

3,400+

Coverage

-

200+

Daily Securities

-

5,000+

Daily Quotes

SOLVE Solutions

-

SOLVE PRIMARY MARKET DATA & ANALYTICS

Price, structure, and benchmark new issues with tools for debt analysis, scales, and comps:

-

Debt Analysis – Analyze issuer debt profiles and peer comps to inform structure, pricing, and refunding strategy.

-

New Issue Pricing – Build defensible new-issue pricing using comparable transactions, trade prints, and market context.

-

Scale Viewer – Explore historical and live municipal scales to benchmark proposed structures quickly.

-

Scale Writer – Create, edit, and export municipal scales (coupons, calls, maturities) for bids and presentations.

-

Workstation | Banking Data – A banker’s workspace to track comps, monitor secondary performance, and accelerate pitch prep.

-

-

SECONDARY MARKET DATA & ANALYTICS

Access 24M+ daily quotes, AI predictive trade pricing, and relative value analytics across fixed income:

-

SOLVE Quotes – Aggregates and parses 24M+ daily quotes from street messages into structured, searchable market data.

-

SOLVE Px™ | Corporate Bonds – Predictive trade pricing with confidence scoring for 250,000+ corporate bonds to support trading and valuations.

-

SOLVE Px | Municipal Bonds – Predictive trade pricing for municipal bonds, with confidence scores and broad daily coverage for 900,000+ securities.

-

SOLVE Relative Value Analysis – Identify when bonds or sectors are trading rich or cheap versus peers by benchmarking yields, spreads, and liquidity across issuers and asset classes.

-

Secondary Market Pricing – Market-based municipal data for pricing validation and best execution support.

-

Ticker – Live and historical municipal trade prints for real-time transparency.

-

-

PRIVATE CREDIT DATA & ANALYTICS

Benchmark BDC portfolios and private credit exposures with standardized holdings and peer comparisons:

- Workstation | BDC Data – Portfolio-level transparency for BDCs and direct lenders, with holdings, valuations, and peer benchmarking.

-

REGULATORY & COMPLIANCE SOLUTIONS

Automate 15c2-12 and G-47 disclosures with traceable, audit-ready data:

-

15c2-12 Analysis – Automated diligence and monitoring of municipal issuer disclosures to support regulatory reviews.

-

Time of Trade Disclosure – Tools and data to document G-47 disclosures with auditable, evidence-backed pricing at the time of trade.

-

SOLVE Market Summaries

Data-Driven Highlights of Key Trends in the Fixed Income Market.

-

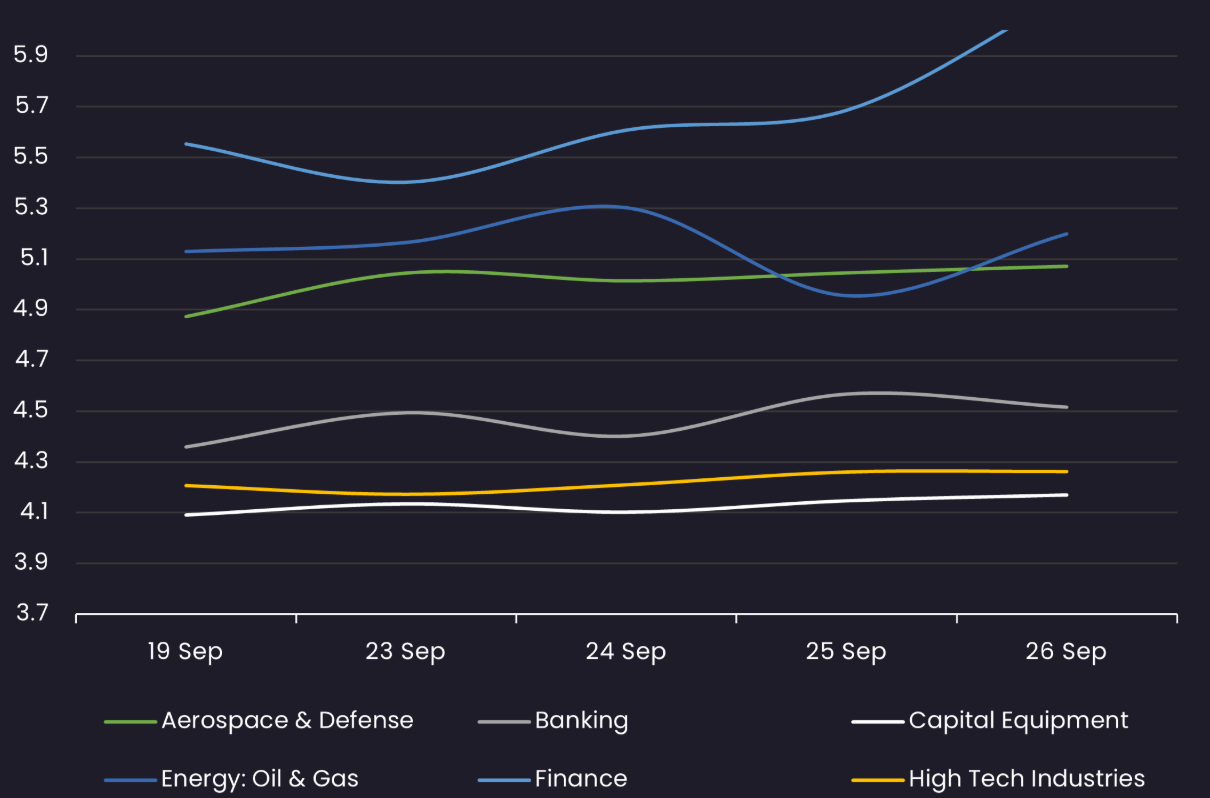

IG CORP 5 Year Yield by Industry

Displays the average IG Corp 5 year yield by industry between 9/19/25 – 9/26/25

Results are based on 6 select industry sectors, however, we offer data across 36 sectors.

-

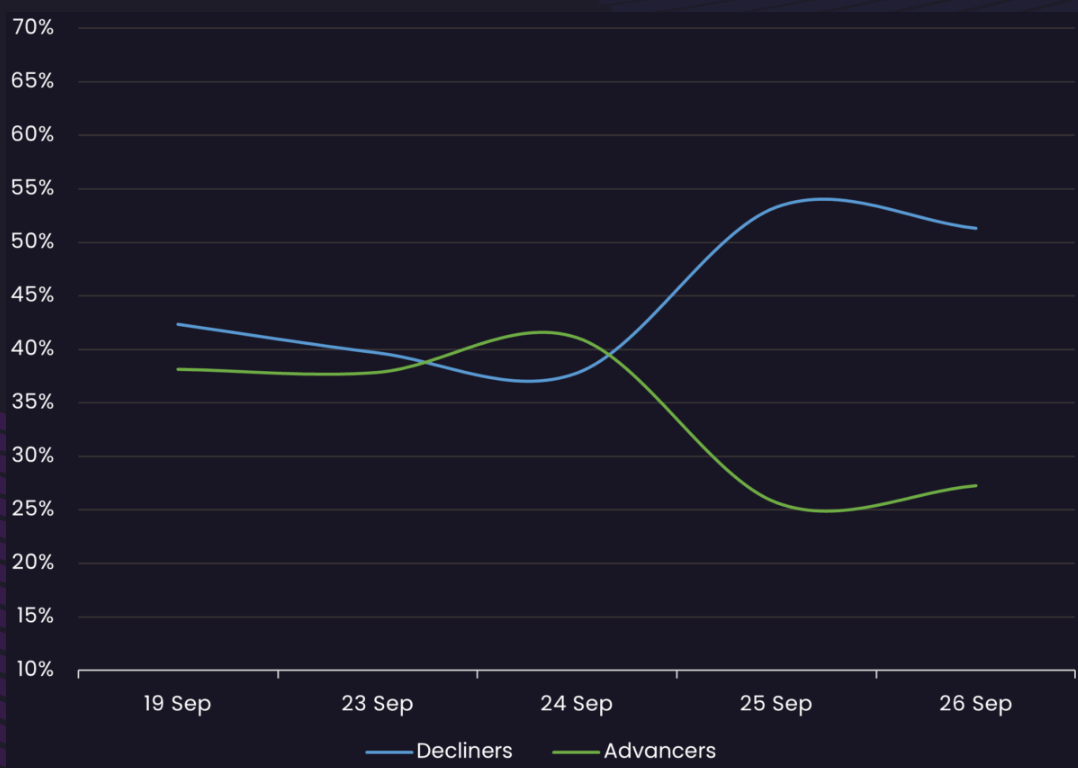

HY Corps Sentiment

Reveals the percent of HY Corps increasing in price (advancers) vs. HY Corps decreasing in price (decliners) between 9/19/25 – 9/26/25 -

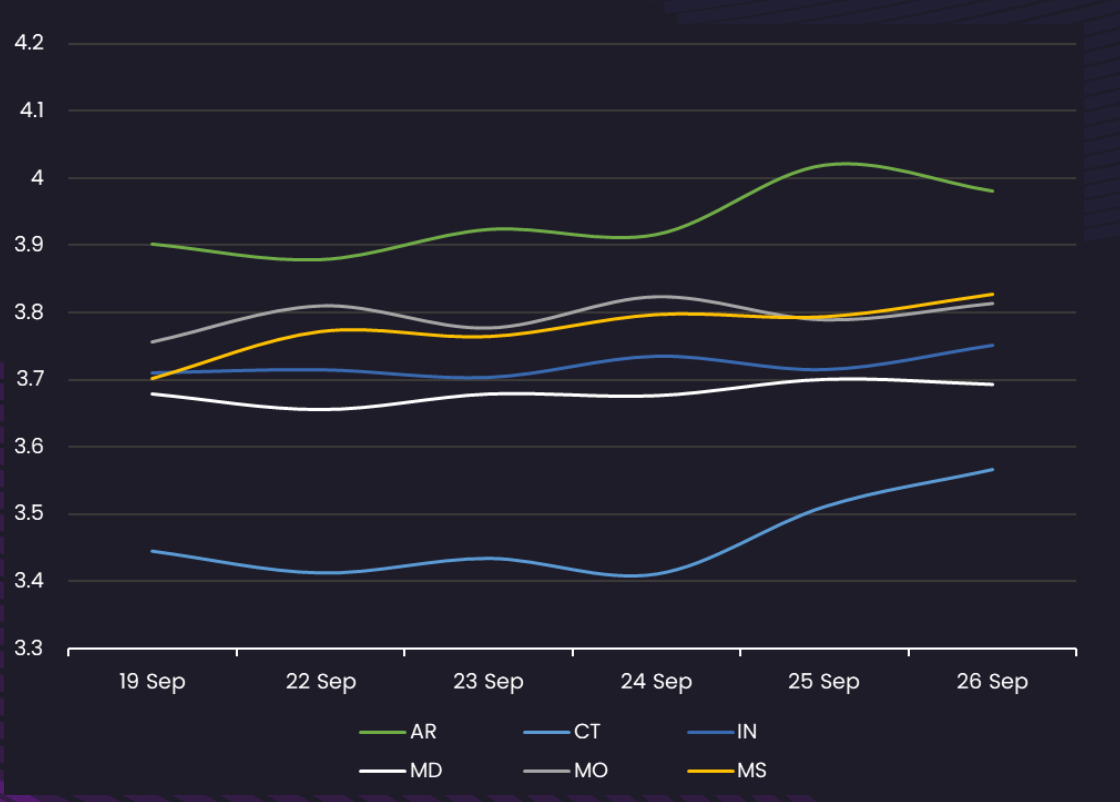

10 Year Yield by State – GO Only

Displays the average Muni 10 year yield by state between 9/19/25-9/26/25 (General Obligation Bonds only)

Results are based on 6 select states, however, we offer data across all 50 states and U.S. territories.

-

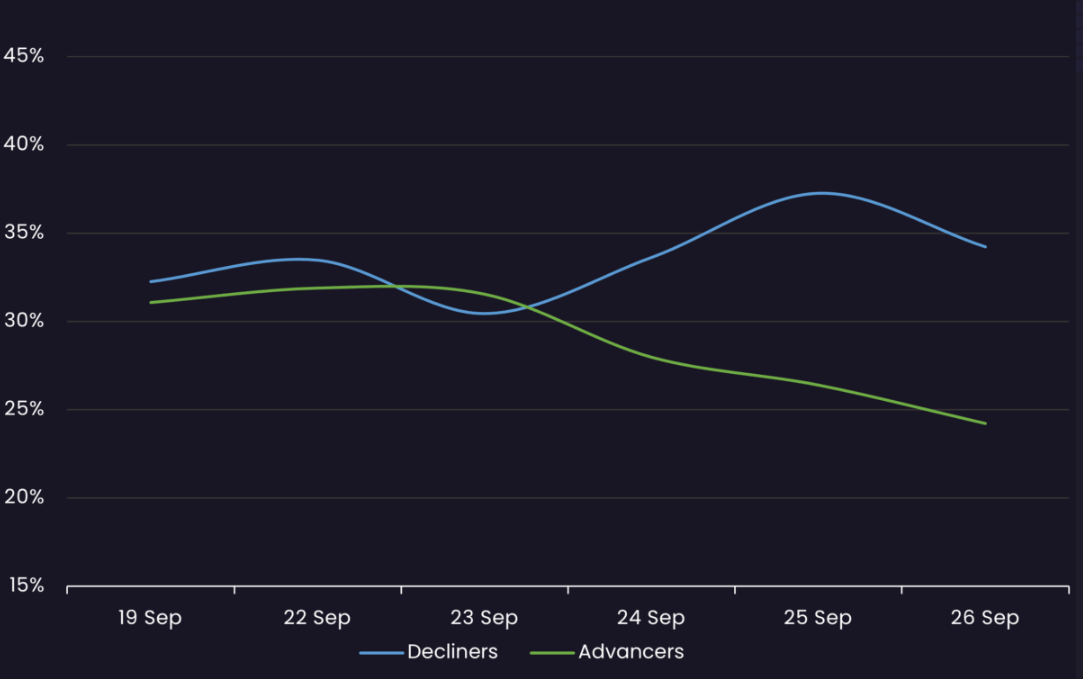

Syndicated Bank Loans Sentiment

Reveals the percent of loans increasing in price (advancers) vs. loans decreasing in price (decliners) between 9/19/25-9/26/25.

Explore all our Market Summaries in SOLVE's Resources > -

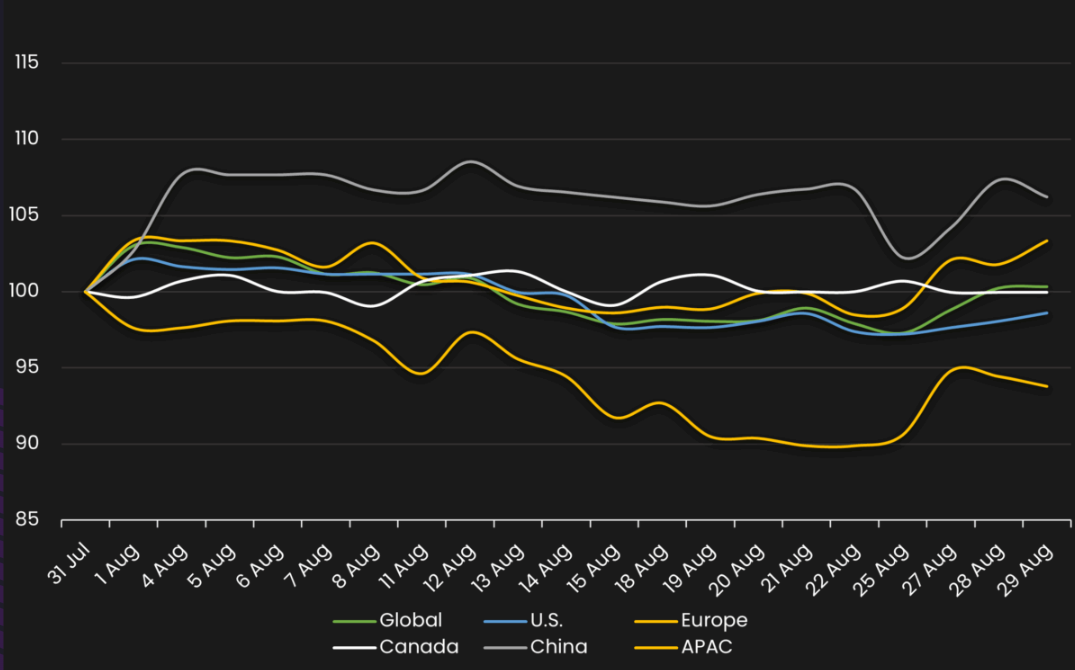

Normalized IG Spread by Region

Displays the IG CDS spread by region between 8/1/25 – 8/31/25

Results are based on 5 select regions, however, we offer data across 12 regions.

-

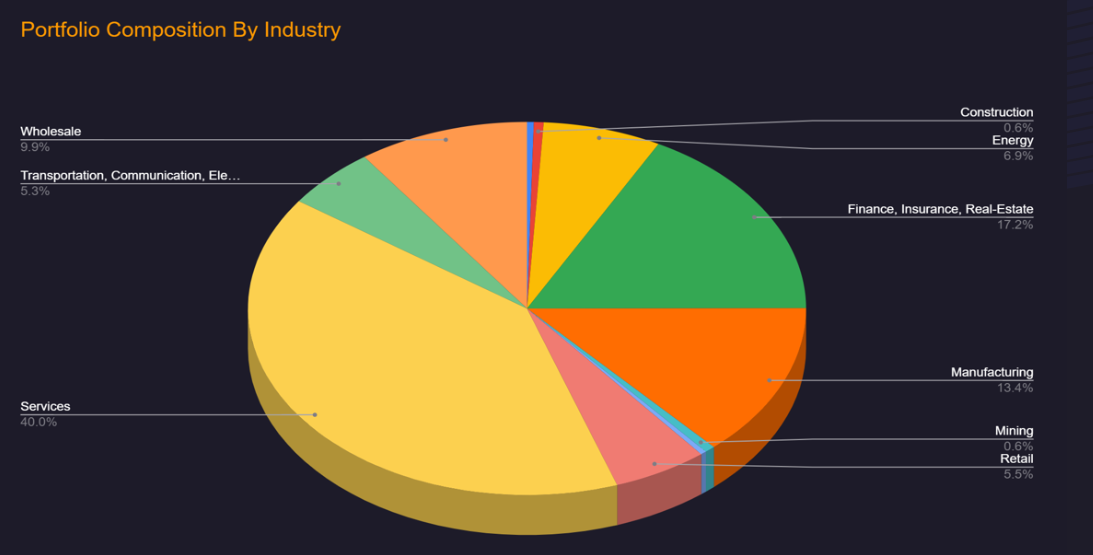

BDC Filings - Portfolio Composition By Indust

The chart below is a bird’s-eye view of the BDCs aggregate Industry Diversification.

Subscribe

SOLVE in the News

What Our Customers Say

“With SOLVE, I have greater confidence our organization is buying fixed income securities at the best price available against comparables and can validate that with our back office and audit teams.”

—Global Head of Fixed Income Trading, Investment Bank