Syndicated Bank Loan Market Summary – Week Ending 7/19/24

GET OUR BANK LOAN MARKET SUMMARIES STRAIGHT TO YOUR INBOX. LEARN MORE

Syndicated Bank Loan Market Summary: Week Ending 7/19/24

Our newsletter presents key trends derived from observable Syndicated Bank Loan pricing data over a weekly period.

New Issues

Loans issued during the week ending 7/19/24

| ISSUER | AMOUNT (MM) | LOAN TYPE | MATURITY | RATE |

|---|---|---|---|---|

| Thor Industries Inc. | Term Loan | 350 | 11/8/2030 | S+225 |

| Paragon Films Inc. | Term Loan | 306 | 12/16/2028 | S+425 |

| Greystar Real Estate Partners LLC | Term Loan | 491 | 7/17/2030 | S+275 |

forward calendar

Forward calendar during the week ending 7/19/24

| Issuer | Deal Information | Banks | Expected Issue Date |

|---|---|---|---|

| Acuren | $725M TL | JEFF,UBS,CITI | Q3 2024 |

| Garda World Security Corp. | $2.322B TLB | JPM | Q3 2024 |

| Wilsonart LLC | $1.06B TLB (B2/B+) | DB,GS | Q3 2024 |

Largest Loans

Highlights the weekly price movements and quote depth for the 20 largest bank loans between 7/12/24 – 7/19/24

| RANK | SIZE (MM) | NAME | CHANGE | PRC | PRC-1W | DEALERS |

|---|---|---|---|---|---|---|

| 1 | 6,143 | MEDLINE TL B | -0.02% | 100.19 | 100.21 | 15 |

| 2 | 5,385 | ULTIMATE SOFTWARE TL B | -0.01% | 100.47 | 100.48 | 16 |

| 3 | 4,860 | HUB INTL LTD TL B | -0.03% | 100.28 | 100.31 | 16 |

| 4 | 4,750 | ZAYO TL | -0.28% | 86.27 | 86.51 | 16 |

| 5 | 4,741 | INTERNET BRANDS TL B | 0.01% | 99.83 | 99.82 | 15 |

| 6 | 4,525 | TRANSDIGM INC. TL I | -0.03% | 100.29 | 100.32 | 16 |

| 7 | 4,237 | INSPIRE BRANDS TL | 0.02% | 100.11 | 100.09 | 12 |

| 8 | 3,935 | SS&C TECH TL B8 | 0.10% | 100.25 | 100.14 | 16 |

| 9 | 3,900 | DIRECTV TL | -0.15% | 100.05 | 100.20 | 15 |

| 10 | 3,640 | TRANSDIGM INC. TL J | -0.02% | 100.26 | 100.28 | 13 |

| 11 | 3,573 | CDK GLOBAL TL B | -0.27% | 98.89 | 99.15 | 15 |

| 12 | 3,566 | AIR MEDICAL PIK TL B | -0.04% | 97.40 | 97.44 | 10 |

| 13 | 3,500 | SEDGWICK TL B | 0.02% | 100.13 | 100.11 | 12 |

| 14 | 3,500 | AMERICAN AIRLINES TL B | 0.06% | 103.31 | 103.25 | 14 |

| 15 | 3,500 | WESTINGHOUSE TL B | 0.08% | 100.19 | 100.11 | 15 |

| 16 | 3,420 | RCN GRANDE TL | -0.42% | 82.28 | 82.63 | 14 |

| 17 | 3,380 | SOLERA TL B | 0.03% | 100.14 | 100.11 | 16 |

| 18 | 3,350 | THE NIELSEN COMPANY B.V. TL B | 0.20% | 94.10 | 93.92 | 10 |

| 19 | 3,340 | PROOFPOINT TL B | 0.04% | 100.39 | 100.35 | 12 |

| 20 | 3,300 | NTL CABLE PLC TL N | 0.64% | 97.18 | 96.57 | 11 |

| AVERAGE | 4,027 | 0.00% | 98.10 | 98.10 | 14.0 |

Top 10 Performers

Showcases the top 10 loan performers based on the largest bid price increases between 7/12/24-7/19/24

| RANK | NAME | CHANGE | PRC | PRC-1W | DEALERS |

|---|---|---|---|---|---|

| 1 | CORRECT CARE TL B | 3.24% | 63.78 | 61.78 | 9 |

| 2 | EW SCRIPPS EXT TL B3 | 2.60% | 88.28 | 86.04 | 10 |

| 3 | LANDESK TL B | 2.06% | 81.13 | 79.50 | 13 |

| 4 | NEW FORTRESS ENERGY TL B | 1.77% | 98.27 | 96.56 | 11 |

| 5 | IHEART TL B | 1.68% | 82.69 | 81.32 | 10 |

| 6 | COX ENTERPRISES, INC. TL B | 1.65% | 81.49 | 80.17 | 13 |

| 7 | PETCO TL B | 1.13% | 92.65 | 91.62 | 14 |

| 8 | AMC ENTERTAINMENT TL B1 | 1.01% | 95.42 | 94.46 | 15 |

| 9 | THOUGHTWORKS TL | 0.95% | 98.96 | 98.02 | 9 |

| 10 | STAPLES TL B | 0.91% | 92.50 | 91.66 | 10 |

Bottom 10 Perfromers

Showcases the bottom 10 loan performers based on the largest bid price decreases between 7/12/24-7/19/24

| RANK | NAME | CHANGE | PRC | PRC-1W | DEALERS |

|---|---|---|---|---|---|

| 1 | SITEL LLC / SITEL FIN CORP TL B | -5.57% | 69.42 | 73.51 | 11 |

| 2 | LESLIE’S POOLMART TL B | -4.84% | 92.70 | 97.41 | 16 |

| 3 | VERACODE TL B | -2.30% | 88.92 | 91.02 | 8 |

| 4 | EIG INVESTORS TL B | -2.29% | 89.12 | 91.21 | 8 |

| 5 | KOFAX TL | -2.29% | 90.18 | 92.29 | 7 |

| 6 | CONAIR HOLDINGS TL | -1.48% | 97.63 | 99.10 | 6 |

| 7 | RV RETAILER TL B | -1.24% | 90.77 | 91.92 | 8 |

| 8 | GRIFOLS WORLDWIDE EUR TL B | -1.20% | 96.29 | 97.46 | 14 |

| 9 | INTERTAPE POLYMER US INC TL | -1.19% | 92.23 | 93.34 | 13 |

| 10 | HARBOR FREIGHT TL B | -1.13% | 98.32 | 99.45 | 14 |

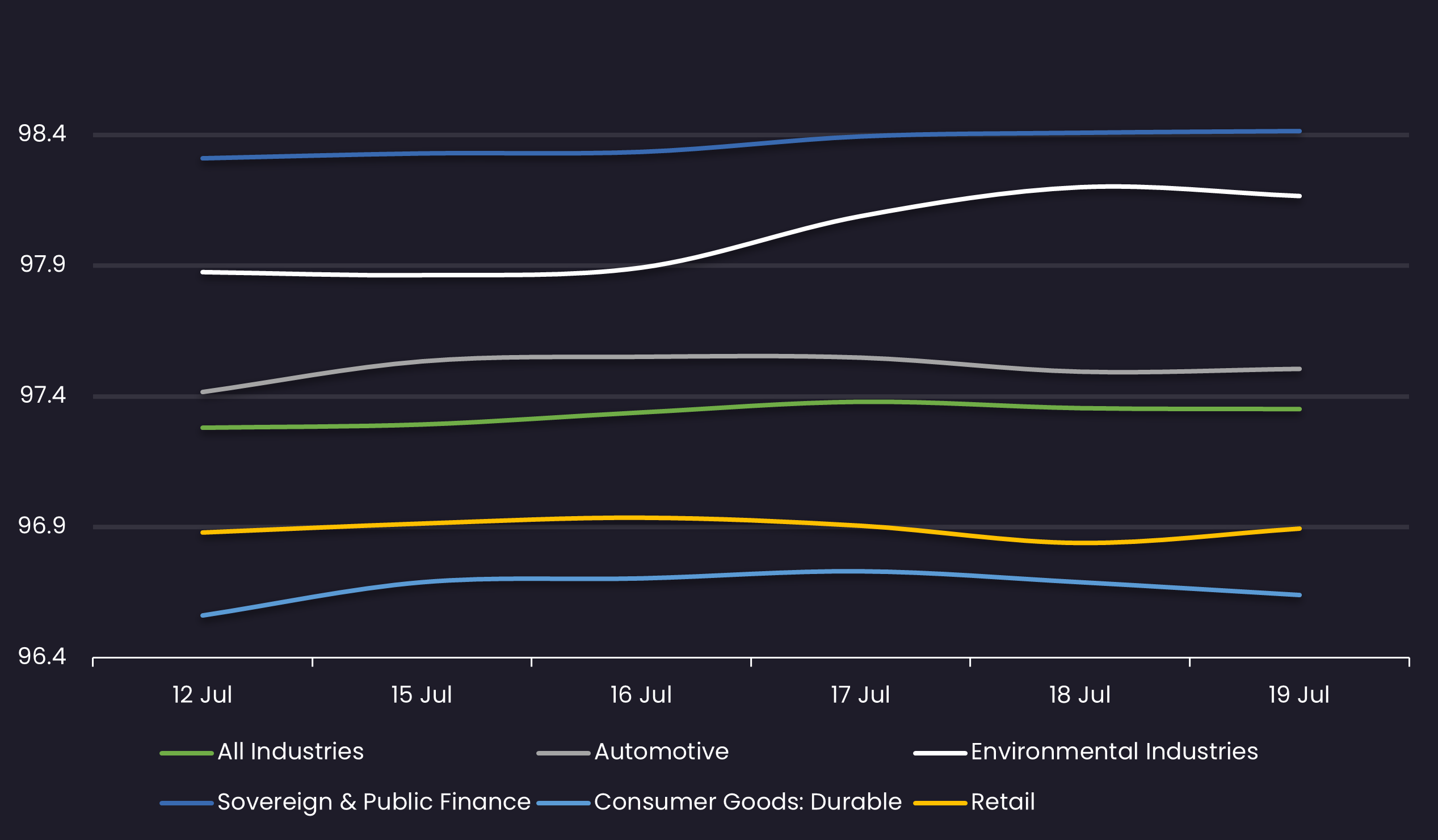

Avg Bid PX by Sector

Displays the average loan bid price by sector between 7/12/24-7/19/24 Results are based on 5 select industry sectors, however, we offer data across 36 sectors

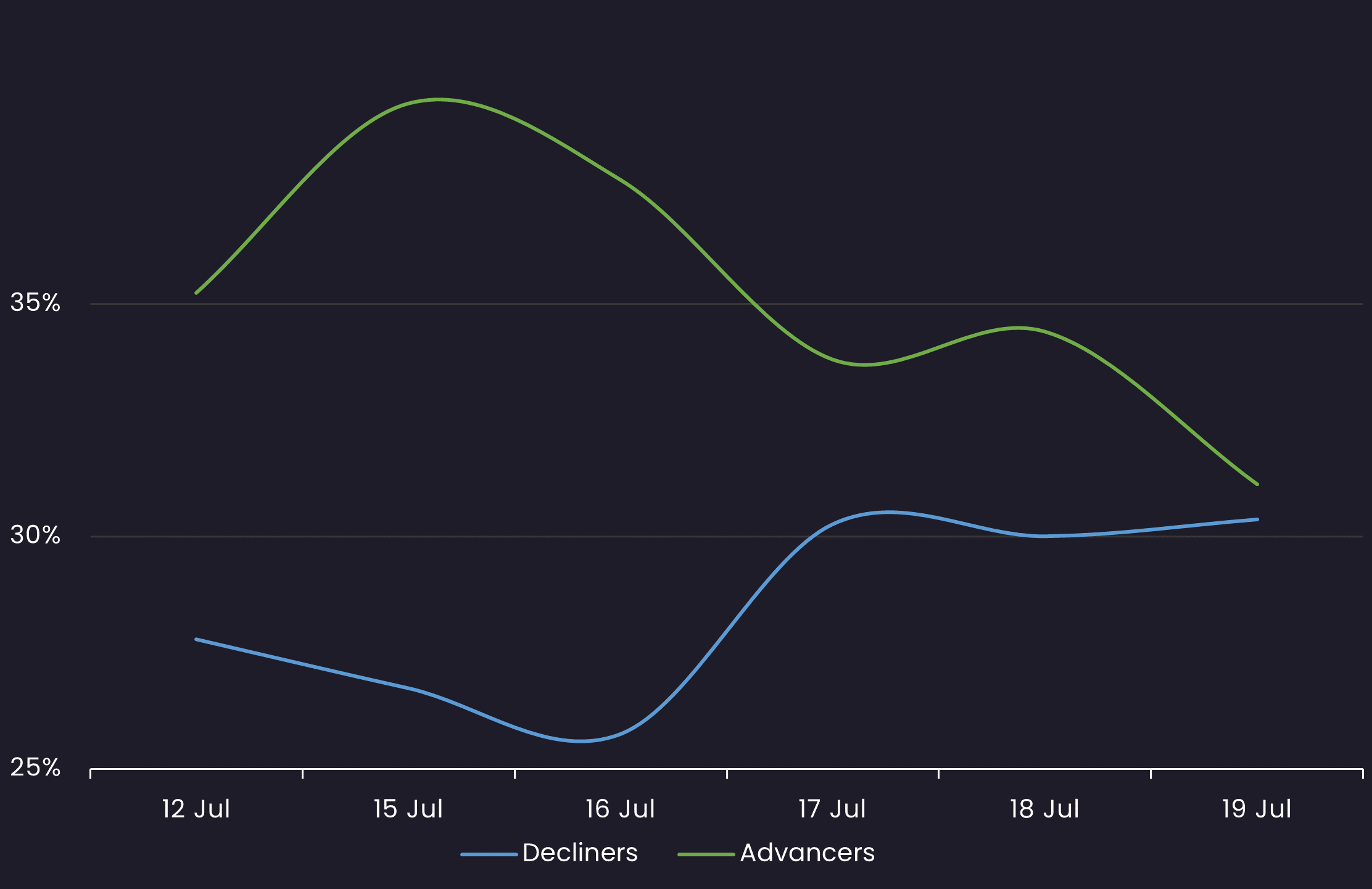

Sentiment

Reveals the percent of loans increasing in price (advancers) vs. loans decreasing in price (decliners) between 7/12/24-7/19/24

Top Quote Volume Movers: This Week vs Last Week

Exhibits the loans with the largest increase in quote volume for the week ending 7/12/24 vs. the week ending 7/19/24

| RANK | TRANCHE | PRIOR WEEK | THIS WEEK | INCREASE | % INCREASE |

|---|---|---|---|---|---|

| 1 | OPEN TEXT CORP TL B | 24 | 70 | 46 | 192% |

| 2 | MOTOR FUEL EUR TL B | 2 | 38 | 36 | 1800% |

| 3 | MOTOR FUEL GBP TL B5 | 6 | 42 | 36 | 600% |

| 4 | AUTODATA TL B | 50 | 82 | 32 | 64% |

| 5 | KIK CUSTOM TL B | 30 | 58 | 28 | 93% |

| 6 | TALEN ENERGY SUPPLY LLC TL B | 30 | 58 | 28 | 93% |

| 7 | STADA ARZNEIMITTEL EUR TL B3 | 28 | 52 | 24 | 86% |

| 8 | THERAMEX EUR TL B | 48 | 71 | 23 | 48% |

| 9 | ZAYO EUR TL | 18 | 40 | 22 | 122% |

| 10 | HELIX GENERATION TL B | 54 | 74 | 20 | 37% |

Most Quoted Loans

Ranks the loans that were quoted by the highest number of dealers between 7/12/24-7/19/24

| RANK | TRANCHE | DEALERS |

|---|---|---|

| 1 | AMWINS TL B | 18 |

| 2 | TENNECO TL B | 18 |

| 3 | ALLIANT HLDGS I INC TL B6 | 17 |

| 4 | HILEX POLY TL B | 17 |

| 5 | BMC SOFTWARE TL B | 17 |

| 6 | TRANSDIGM INC. TL K | 17 |

| 7 | DAVITA TL B | 17 |

| 8 | CHEPLAPHARM ARZNEIMITTEL EUR TL B | 17 |

| 9 | HUB INTL LTD TL B | 16 |

| 10 | ULTIMATE SOFTWARE TL B | 16 |

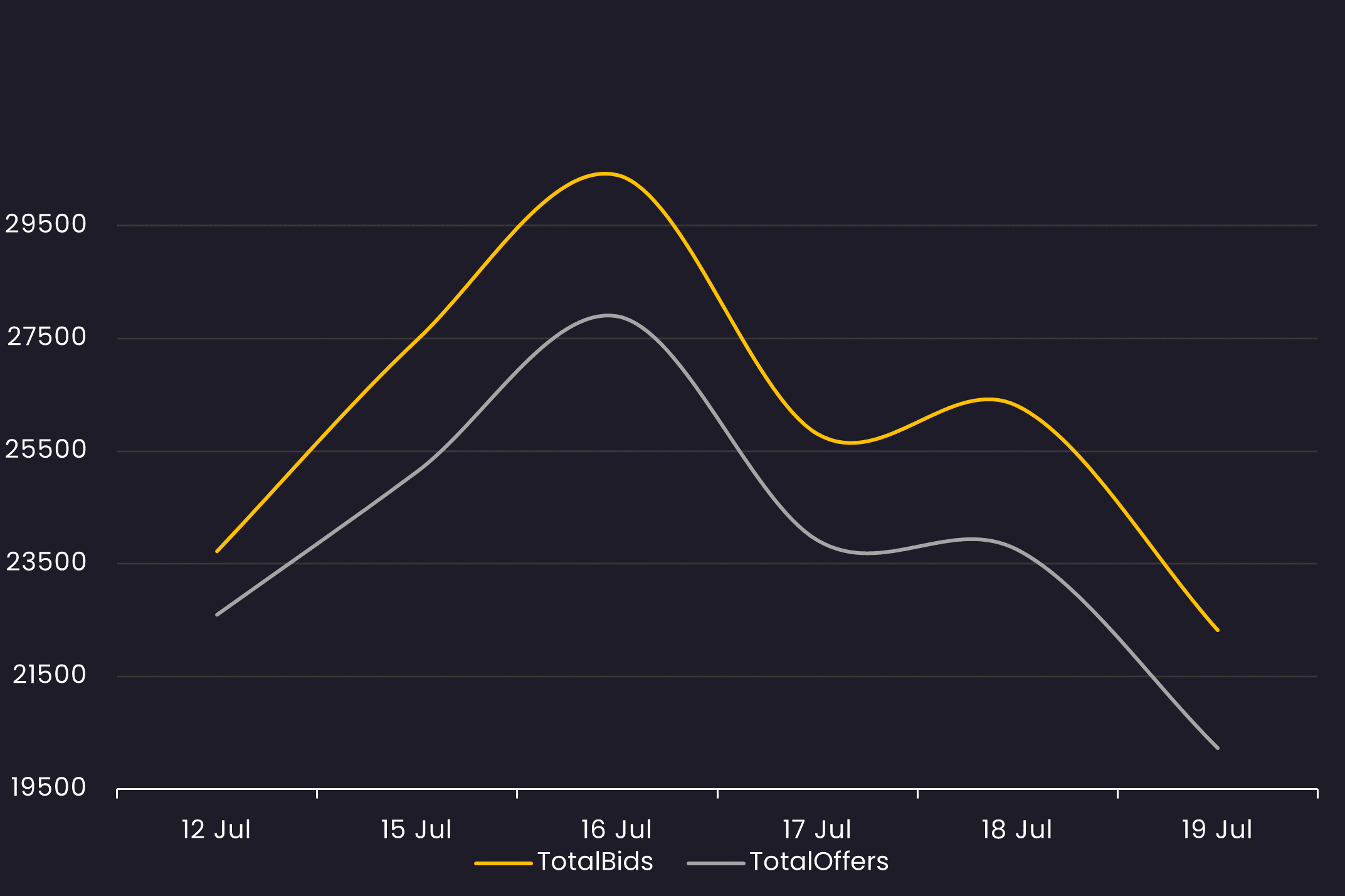

Bid and Offer Volume

Reveals the total number of quotes by bid and offer between 7/12/24-7/19/24

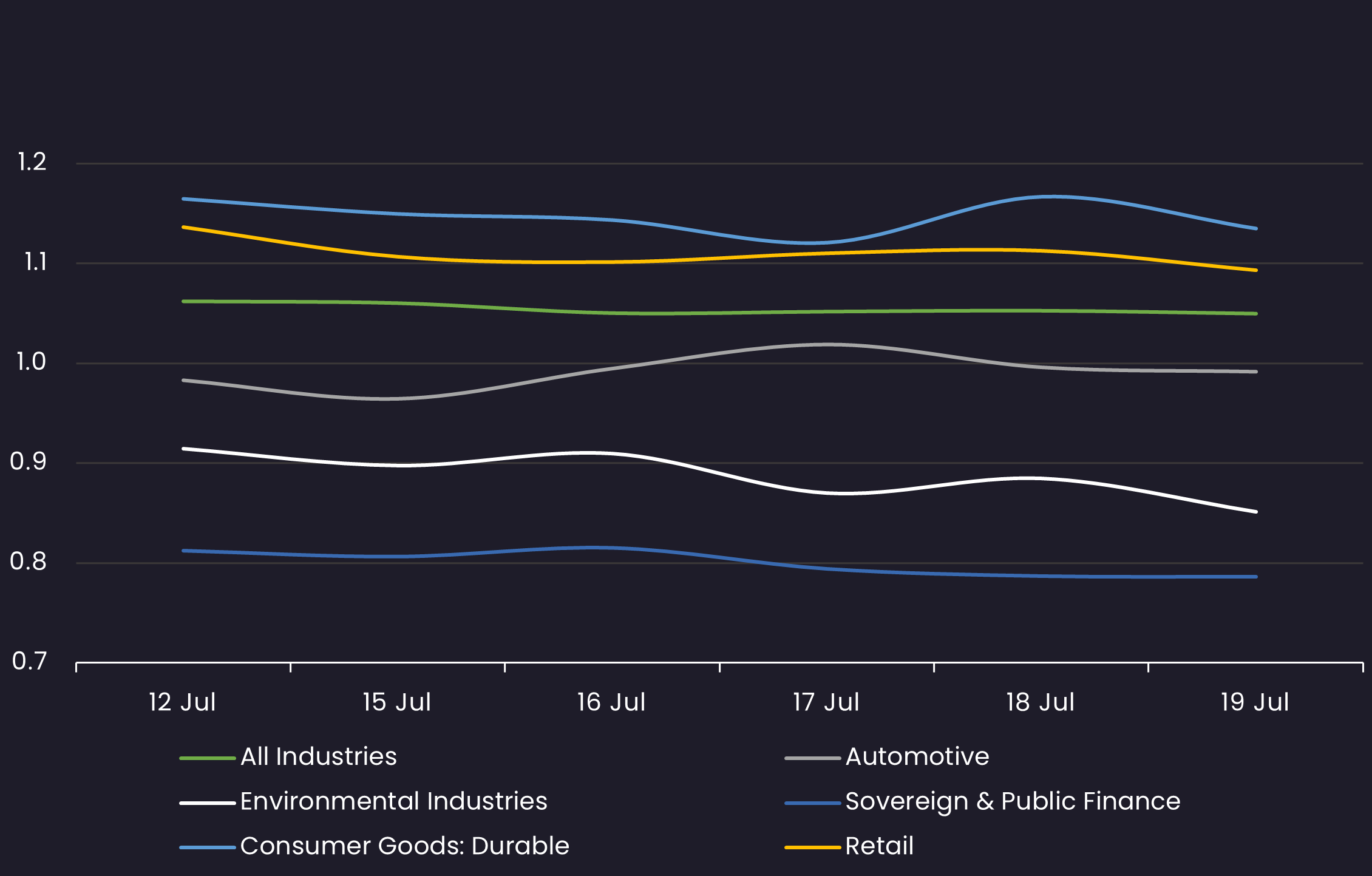

Sector Bid-Offer Spread

Results are based on 5 select industry sectors, however, we offer data across 36 sectors

Stay up-to-date with weekly summaries.

Related Resources

About SOLVE

SOLVE is the leading market data platform provider for fixed-income securities, trusted by sophisticated buy-side and sell-side firms worldwide. Founded in 2011, SOLVE leverages its AI-driven technology and deep industry expertise to offer unparalleled transparency into markets, reduce risk, and save hundreds of hours across front-office workflows. With the largest real-time datasets for Securitized Products, Municipal Bonds, Corporate Bonds, Syndicated Bank Loans, Convertible Bonds, CDS, and Private Credit, SOLVE empowers clients to transform the way they bring new securities to market, trade on secondary markets, and value highly illiquid securities. Headquartered in Connecticut, with offices across the globe, SOLVE is the definitive source for market pricing in fixed-income markets.