Investment Grade CDS Market Summary – June 2024

GET OUR CDS MARKET SUMMARIES STRAIGHT TO YOUR INBOX. LEARN MORE

Investment Grade CDS Market june 2024

Our newsletter presents key trends derived from observable Credit Default Swaps pricing data over a monthly period.

Top 10 Outperformers

Showcases the top 10 IG CDS “outperformers” based on the largest mid spread decreases between 6/1/24 – 6/30/24

| RANK | BOND NAME | ISSUER | % CHANGE | BPS CHANGE | SPRD | SPRD-1 MONTH | DEALERS |

|---|---|---|---|---|---|---|---|

| 1 | WHR 5Y | MAYTAG CORP | -33.3% | -49 | 97 | 146 | 5 |

| 2 | EXPE 5Y | EXPEDIA INC | -14.6% | -13 | 76 | 89 | 3 |

| 3 | LUV 5Y | AIRTRAN HLDGS INC | -11.4% | -13 | 99 | 112 | 4 |

| 4 | HMSOLN 5Y | HAMMERSON PLC | -11.2% | -12 | 98 | 111 | 3 |

| 5 | UHS 5Y | UNIVERSAL HEALTH SERVICES INC | -10.0% | -6 | 56 | 62 | 3 |

| 6 | FITB 5Y | FIFTH THIRD BANCORP | -9.0% | -7 | 69 | 76 | 2 |

| 7 | MRO 5Y | MARATHON GLOBAL FDG CORP | -5.9% | -3 | 55 | 58 | 3 |

| 8 | HYUELE 5Y | HYNIX SEMICONDUCTOR INC | -5.9% | -4 | 70 | 74 | 2 |

| 9 | SUMICH 5Y | SUMITOMO CHEMICAL CO LTD | -4.4% | -4 | 78 | 82 | 3 |

| 10 | FISV 5Y | FISERV INC | -4.3% | -3 | 62 | 65 | 3 |

Top 10 Underperformers

Showcases the top 10 IG CDS “underperformers” based on the largest mid spread increases between 6/1/24 – 6/30/24

| RANK | BOND NAME | ISSUER | % CHANGE | BPS CHANGE | SPRD | SPRD-1 MONTH | DEALERS |

|---|---|---|---|---|---|---|---|

| 1 | VINCI 5Y | VINCI | 54.6% | 17 | 47 | 31 | 5 |

| 2 | MMBFP 5Y | LAGARDERE SCA | 52.4% | 28 | 81 | 53 | 3 |

| 3 | CARLB 5Y | CARLSBERG AS | 49.2% | 13 | 39 | 26 | 4 |

| 4 | ENFP 5Y | BOUYGUES SA | 41.1% | 13 | 43 | 31 | 5 |

| 5 | HANRUE 5Y | HANNOVER RUECK | 36.8% | 10 | 39 | 28 | 4 |

| 6 | CAFP 5Y | CARREFOUR SA | 36.3% | 18 | 66 | 48 | 5 |

| 7 | MUNRE 5Y | MUENCHENER RUECKVERSICHERUNGS | 36.0% | 10 | 39 | 29 | 4 |

| 8 | ALVGR 5Y | ALLIANZ SE | 35.5% | 10 | 37 | 27 | 4 |

| 9 | AXASA 5Y | AXA SA | 34.7% | 13 | 52 | 39 | 4 |

| 10 | ORAFP 5Y | ORANGE SA | 34.4% | 10.3 | 40 | 30 | 4 |

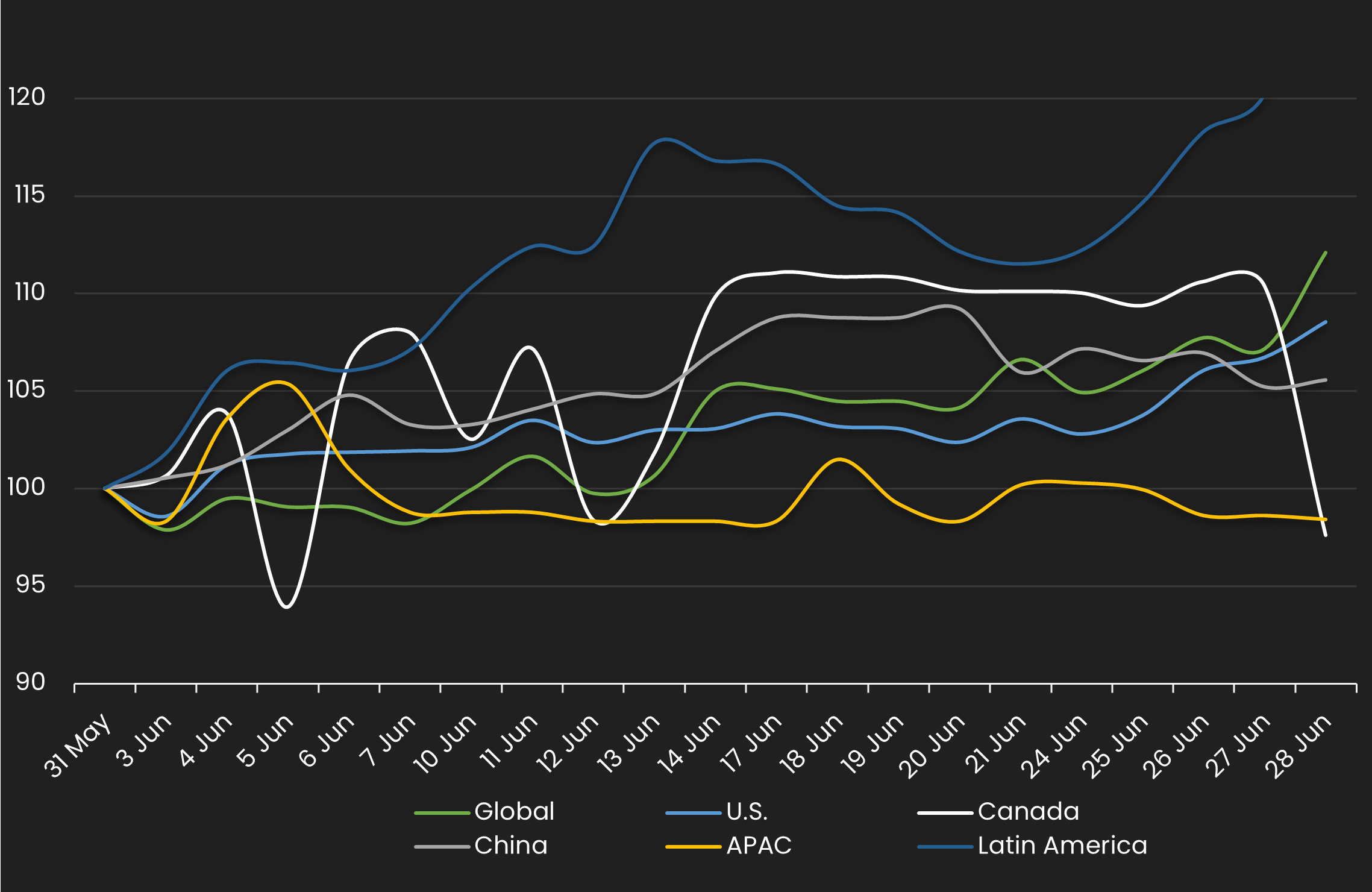

Normalized IG Spread by Region

Displays the IG CDS spread by region between 6/1/24 – 6/30/24 Results are based on 5 select regions, however, we offer data across 12 regions

IG Spread by Region – Monthly Comparison

Exhibits the IG mid spread by region for the month ending 5/31/23 vs. the month ending 6/30/24

| REGION | PREVIOUS SPREAD | CURRENT SPREAD | BPS CHANGE | MONTHLY PERFORMANCE | CDS COUNT |

|---|---|---|---|---|---|

| Global | 49 | 55 | 6 | Wider | 753 |

| U.S. | 49 | 53 | 4 | Wider | 296 |

| Canada | 49 | 48 | -1 | Tighter | 17 |

| China | 66 | 69 | 4 | Wider | 12 |

| APAC | 46 | 46 | -1 | Tighter | 55 |

| Latin America | 94 | 122 | 28 | Wider | 11 |

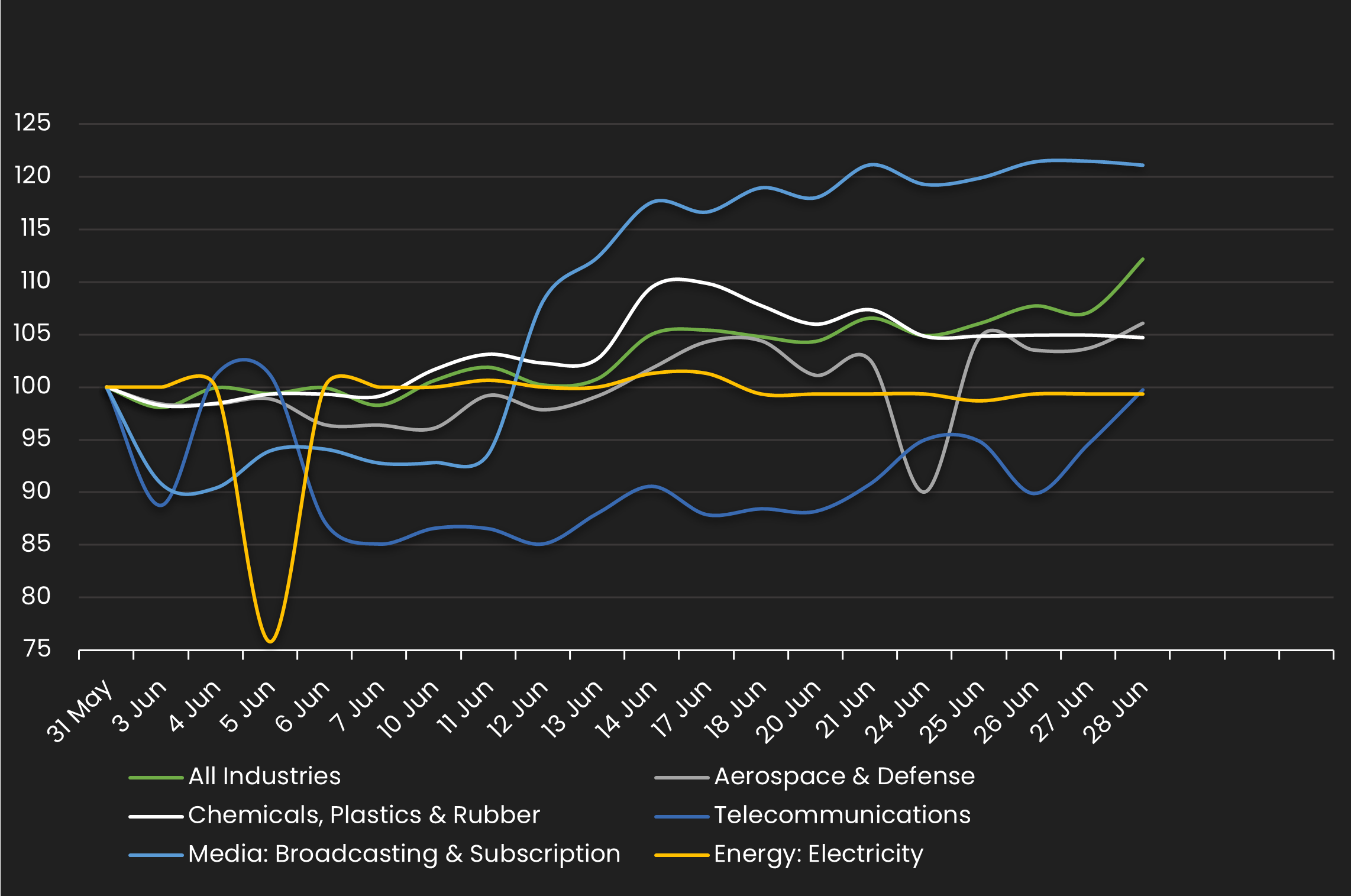

Normalized IG Spread by Industry

Displays the IG CDS spread by industry between 6/1/24 – 6/30/24 Results are based on 5 select industry sectors, however, we offer data across 36 sectors

IG Spread by Industries – Monthly Comparison

Exhibits the IG spread by industry for the month ending 5/31/23 vs. the month ending 6/30/24

| INDUSTRIES | PREVIOUS SPREAD | CURRENT SPREAD | BPS CHANGE | MONTHLY PERFORMANCE | CDS COUNT |

|---|---|---|---|---|---|

| All Industries | 49 | 55 | 6 | Wider | 755.00 |

| Aerospace & Defense | 39 | 41 | 2 | Wider | 12.00 |

| Chemicals, Plastics & Rubber | 72 | 76 | 3 | Wider | 15.00 |

| Telecommunications | 51 | 51 | 0 | Tighter | 45.00 |

| Media: Broadcasting & Subscription | 122 | 148 | 26 | Wider | 2.00 |

| Energy: Electricity | 77 | 76 | -1 | Tighter | 2.00 |

Stay up-to-date with monthly summaries.

Related Resources

About SOLVE

SOLVE is the leading market data platform provider for fixed-income securities, trusted by sophisticated buy-side and sell-side firms worldwide. Founded in 2011, SOLVE leverages its AI-driven technology and deep industry expertise to offer unparalleled transparency into markets, reduce risk, and save hundreds of hours across front-office workflows. With the largest real-time datasets for Securitized Products, Municipal Bonds, Corporate Bonds, Syndicated Bank Loans, Convertible Bonds, CDS, and Private Credit, SOLVE empowers clients to transform the way they bring new securities to market, trade on secondary markets, and value highly illiquid securities. Headquartered in Connecticut, with offices across the globe, SOLVE is the definitive source for market pricing in fixed-income markets.