Municipal Bond Market Summary – Week Ending 12/6/24

GET OUR MUNICIPAL BOND MARKET SUMMARIES STRAIGHT TO YOUR INBOX. LEARN MORE

Municipal Bond Market Summary: Week Ending 12/6/24

Our newsletter presents key trends derived from observable Municipal Bond pricing data over a weekly period.

Top 10 Performers

Showcases the top 10 Muni Bond performers based on price movements between 11/29/24-12/6/24

| RANK | BOND NAME | COUPON | MATURITY | CHANGE | PRC | PRC-1W | DEALERS |

|---|---|---|---|---|---|---|---|

| 1 | CHAFFEY JT UN-H-CABS | 0.000% | 08/01/48 | 5.57% | 36.65 | 34.71 | 3 |

| 2 | PENNSYLVANIA ST ECON | 3.143% | 06/15/42 | 4.96% | 81.40 | 77.55 | 3 |

| 3 | NY CONVENTN CTR-B | 0.000% | 11/15/56 | 4.42% | 22.39 | 21.44 | 4 |

| 4 | IA ST BRD OF RGTS-B S | 3.000% | 09/01/52 | 4.35% | 83.76 | 80.28 | 2 |

| 5 | FALLS CHURCH | 3.000% | 07/15/42 | 4.24% | 92.59 | 88.82 | 3 |

| 6 | MICHIGAN ST UNIV-TXBL | 4.165% | 08/15/22 | 4.24% | 79.97 | 76.72 | 6 |

| 7 | CA MUNI FIN AUTH-A | 3.000% | 02/01/46 | 4.21% | 80.01 | 76.79 | 2 |

| 8 | CA HLTH FACS-A2 | 5.000% | 11/01/47 | 4.17% | 125.31 | 120.30 | 11 |

| 9 | MET PIER & EXPO-A | 0.000% | 12/15/52 | 4.14% | 29.42 | 28.25 | 11 |

| 10 | CHARLESTON CO -A | 2.000% | 11/01/39 | 3.83% | 80.16 | 77.20 | 5 |

Bottom 10 Performers

Showcases the bottom 10 Muni Bond performers based on price movements between 11/29/24-12/6/24

| RANK | BOND NAME | COUPON | MATURITY | CHANGE | PRC | PRC-1W | DEALERS |

|---|---|---|---|---|---|---|---|

| 1 | MA MAS 5.00 01/01/2035 | 5.000% | 01/01/35 | -2.27% | 108.48 | 111.00 | 3 |

| 2 | NY NYCGEN 4.00 05/01/2053 | 4.000% | 05/01/53 | -2.27% | 99.43 | 101.74 | 2 |

| 3 | CA CASMED 5.00 08/15/2035 | 5.000% | 08/15/35 | -1.92% | 103.18 | 105.21 | 5 |

| 4 | MA MASEDU 5.00 08/15/2034 | 5.000% | 08/15/34 | -1.84% | 111.60 | 113.69 | 2 |

| 5 | NJ RUTHGR 3.25 05/01/2039 | 3.250% | 05/01/39 | -1.56% | 91.21 | 92.66 | 2 |

| 6 | MO MOSMED 3.75 10/01/2039 | 3.750% | 10/01/39 | -1.49% | 98.72 | 100.22 | 2 |

| 7 | IN WTCUTL 2.00 07/01/2035 | 2.000% | 07/01/35 | -1.47% | 82.32 | 83.55 | 2 |

| 8 | AL CHEEDU 3.00 12/01/2031 | 3.000% | 12/01/31 | -1.42% | 95.53 | 96.91 | 2 |

| 9 | MN APPGEN 4.38 01/01/2047 | 4.375% | 01/01/47 | -1.34% | 81.92 | 83.04 | 4 |

| 10 | CA UNVHGR 4.00 05/15/2053 | 4.000% | 05/15/53 | -1.30% | 100.19 | 101.51 | 3 |

Top 10 State Performers

Showcases the top 10 Muni State performers based on yield movements between 11/29/24-12/6/24

| RANK | STATE | CHANGE | YLD | YLD-1W |

|---|---|---|---|---|

| 1 | AL | -15 bps | 3.68% | 3.83% |

| 2 | HI | -13 bps | 3.71% | 3.84% |

| 3 | IN | -12 bps | 3.60% | 3.71% |

| 4 | KY | -11 bps | 3.39% | 3.50% |

| 5 | CT | -10 bps | 3.53% | 3.63% |

| 6 | FL | -10 bps | 3.66% | 3.76% |

| 7 | NV | -10 bps | 3.39% | 3.49% |

| 8 | NJ | -10 bps | 3.68% | 3.77% |

| 9 | AR | -9 bps | 3.98% | 4.07% |

| 10 | TX | -9 bps | 3.62% | 3.71% |

Bottom 10 State Performers

Showcases the bottom 10 Muni State performers based on yield movements between 11/29/24-12/6/24

| RANK | STATE | CHANGE | YLD | YLD-1W |

|---|---|---|---|---|

| 1 | DC | 25 bps | 3.69% | 3.44% |

| 2 | ME | 19 bps | 3.87% | 3.68% |

| 3 | KS | 8 bps | 3.58% | 3.51% |

| 4 | SC | 5 bps | 3.55% | 3.50% |

| 5 | NM | 3 bps | 3.34% | 3.30% |

| 6 | GA | 2 bps | 3.57% | 3.54% |

| 7 | WA | 2 bps | 3.75% | 3.73% |

| 8 | OH | 2 bps | 3.69% | 3.67% |

| 9 | UT | 1 bps | 3.40% | 3.39% |

| 10 | VA | 0 bps | 3.48% | 3.48% |

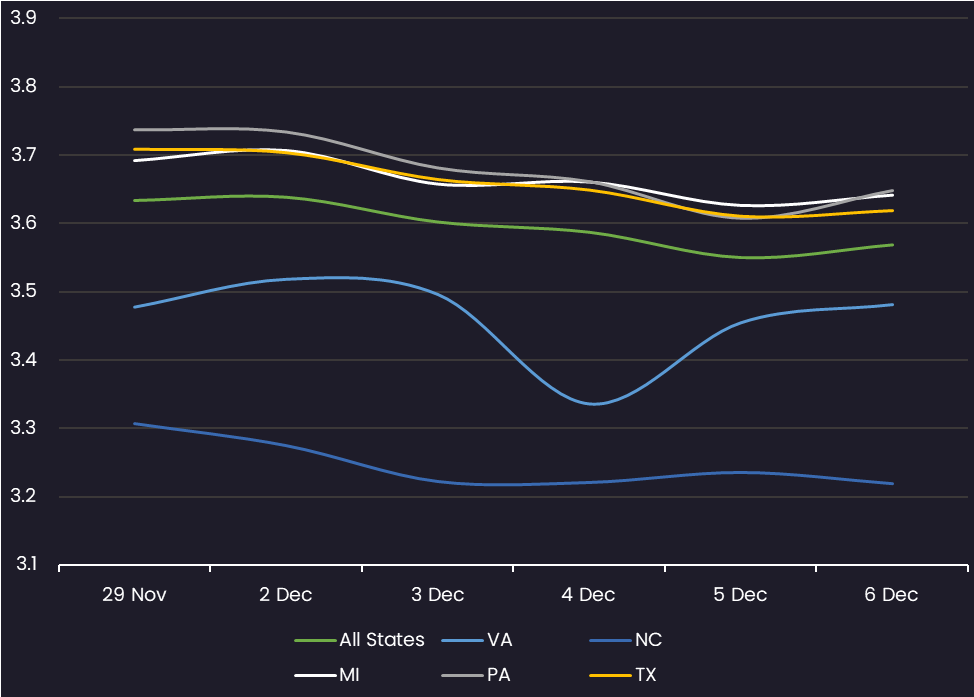

10 Year Yield by State – All

Displays the average Muni 10 year yield by state between 11/29/24-12/6/24 (General Obligation and Revenue Bonds) Results are based on 5 select states, however, we offer data across all 50 states and U.S. territories

10 Year Yield by State – GO Only

Displays the average Muni 10 year yield by state between 11/29/24-12/6/24 (General Obligation Bonds only) Results are based on 5 select states, however, we offer data across all 50 states and U.S. territories

10 Year Yield by State – Rev Only

Displays the average Muni 10 year yield by state between 11/29/24-12/6/24 (Revenue Bonds only) Results are based on 5 select states, however, we offer data across all 50 states and U.S. territories

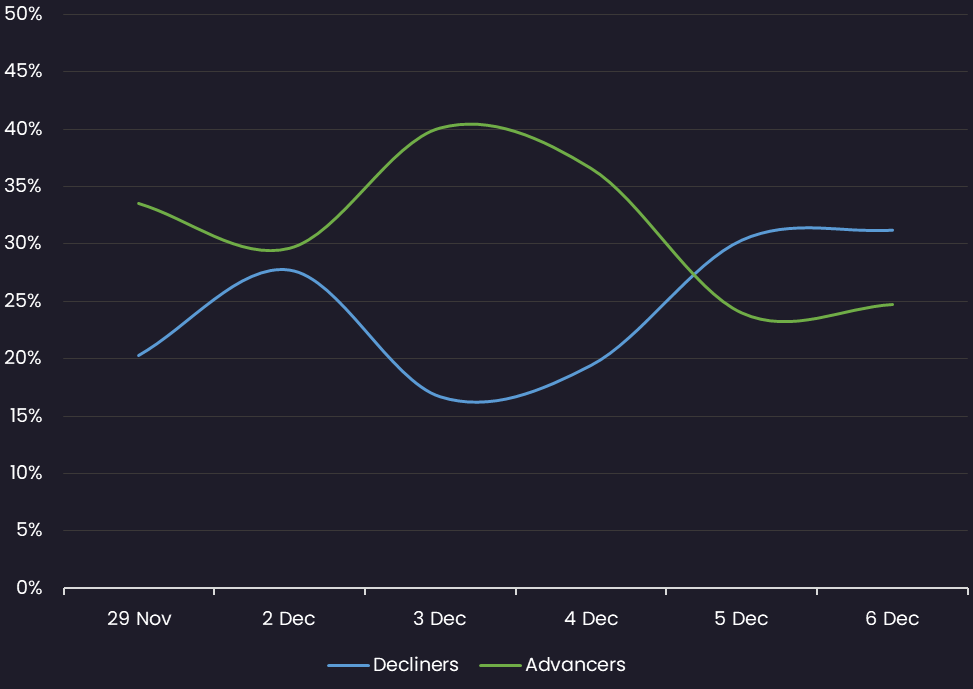

Sentiment

Reveals the percent of Muni bonds increasing in price (advancers) vs. decreasing in price (decliners) between 11/29/24-12/6/24

Top Quote Volume Movers: This Week vs Last Week

Exhibits the Munis with the largest increase in quote volume for the week ending 11/29/24 vs. the week ending 12/6/24

| RANK | TRANCHE | COUPON | MATURITY | PRIOR WEEK | THIS WEEK | INCREASE | % INCREASE |

|---|---|---|---|---|---|---|---|

| 1 | NJ ECON DEV AUTH-QQQ | 4.000% | 06/15/50 | 10 | 106 | 96 | 960% |

| 2 | CALIFORNIA ST | 4.000% | 10/01/33 | 42 | 121 | 79 | 188% |

| 3 | NY ST URBAN DEV CORP | 3.000% | 03/15/50 | 10 | 87 | 77 | 770% |

| 4 | NYC TRANSITIONAL-C-1 | 5.000% | 05/01/50 | 119 | 190 | 71 | 60% |

| 5 | PORT AUTH OF NEW YORK | 4.000% | 07/15/51 | 3 | 69 | 66 | 2200% |

| 6 | FAIRFAX CO | 4.000% | 10/01/42 | 20 | 82 | 62 | 310% |

| 7 | NEW JERSEY ST TURNPIK | 5.000% | 01/01/28 | 30 | 90 | 60 | 200% |

| 8 | CALIFORNIA ST | 5.000% | 09/01/33 | 120 | 177 | 57 | 48% |

| 9 | NEW YORK -C-3 -REF | 2.490% | 08/01/34 | 3 | 60 | 57 | 1900% |

| 10 | MIAMI-DADE WTR SWR | 4.000% | 10/01/51 | 24 | 79 | 55 | 229% |

Most Quoted Munis

Ranks the Munis that were quoted by the highest number of dealers between 11/29/24 – 12/6/24

| RANK | TRANCHE | COUPON | MATURITY | DEALERS |

|---|---|---|---|---|

| 1 | MA CMWLTH-E | 5.000% | 08/01/54 | 44 |

| 2 | E MONTGOMERY IMPT DT | 4.250% | 08/15/54 | 41 |

| 3 | MONTGOMERY ISD-B | 4.000% | 02/15/54 | 40 |

| 4 | NYC TRANSITIONAL-C-1 | 5.000% | 05/01/50 | 38 |

| 5 | NYC MUNI WTR FIN-AA1 | 5.250% | 06/15/53 | 38 |

| 6 | NY TRANSITIONAL FIN-D | 4.250% | 05/01/54 | 38 |

| 7 | DIST OF COLUMBIA-A | 5.000% | 08/01/49 | 36 |

| 8 | NYC MUNI WTR FIN-AA1 | 4.000% | 06/15/54 | 36 |

| 9 | CALIFORNIA ST | 5.000% | 09/01/33 | 36 |

| 10 | LOS ANGELES-SER QRR | 4.000% | 07/01/49 | 35 |

Stay up-to-date with weekly summaries.

Related Resources

About SOLVE

SOLVE is the leading market data platform provider for fixed-income securities, trusted by sophisticated buy-side and sell-side firms worldwide. Founded in 2011, SOLVE leverages its AI-driven technology and deep industry expertise to offer unparalleled transparency into markets, reduce risk, and save hundreds of hours across front-office workflows. With the largest real-time datasets for Securitized Products, Municipal Bonds, Corporate Bonds, Syndicated Bank Loans, Convertible Bonds, CDS, and Private Credit, SOLVE empowers clients to transform the way they bring new securities to market, trade on secondary markets, and value highly illiquid securities. Headquartered in Connecticut, with offices across the globe, SOLVE is the definitive source for market pricing in fixed-income markets.