Syndicated Bank Loans

GET OUR BANK LOAN MARKET SUMMARIES STRAIGHT TO YOUR INBOX. LEARN MORE

Syndicated Bank Loan Market Summary:

Week Ending 3/17/23

Our newsletter presents key trends derived from observable Syndicated Bank Loan pricing data over a weekly period.

![]()

New Issues

Loans issued during the week ending 3/17/23

| ISSUER | AMOUNT (MM) | LOAN TYPE | MATURITY | RATE |

| Safety-Kleen Systems Inc. | 490 | Term Loan | 11/1/2028 | L+500 |

| Catalina Marketing Corp. | 10 | Term Loan | 12/31/2022 | S+1200 |

| Imagina Media Audiovisual SL | 500 | Term Loan | 7/27/2027 | SN+750 |

| Celsa Group | 750 | Term Loan | 10/31/2022 | E+325 |

forward calendar

Forward calendar during the week ending 3/17/23

| Issuer | Deal Information | Banks | Expected Issue Date |

| DSM Engineering Materials | €2.9B TLs | GS, BCLY, UBS, BNP | Q1 2023 |

| Maxlinear Inc. | $3.5B credit facilities: $250MM RC; $512.5MM TLA; $2.7375 TLB | WF, BMO, CTZ, TRS | Q1 2023 |

| Mitratech | $255MM credit facilities | GLB | Q1 2023 |

| Moneygram International Inc. | $850MM credit facilities: $150MM RC; $700MM TL | GS, DB, BCLY, WF | Q1 2023 |

| Reladyne | $350MM TLB2 | RBC, BMO, KEY, MACQ | Q1 2023 |

| Tegna Inc. | $4B credit facilities: $500MM RC; $3.5B TL | RBC, BofA, GS, TRS, BNP, CS, JEFF, MIZ, TD, BCLY, DB, MUFG, CTB, SMBC | Q1 2023 |

| Tricor/Vistra | $1.66B TLs | GS, BCLY, DB, HSBC, BNP, CITI, CA, MS, MUFG | Q1 2023 |

| US Silica Holdings Inc. | $950MM TLB (B+) | BNP | Q1 2023 |

Largest Loans

Highlights the weekly price movements and quote depth for the 20 largest bank loans between 3/10/23 – 3/17/23

| RANK | SIZE (MM) | NAME | CHANGE | PX | PX-1W | DEALERS |

| 1 | 8,572 | GEO GROUP TL1 | -0.26% | 100.77 | 101.04 | 12 |

| 2 | 5,000 | QWEST CORPORATION TL B | -5.70% | 69.67 | 73.88 | 10 |

| 3 | 5,000 | UNITED CONTINENTAL TL B | -1.70% | 98.05 | 99.75 | 13 |

| 4 | 4,750 | ZAYO TL | -4.00% | 79.98 | 83.31 | 15 |

| 5 | 4,559 | TRANSDIGM INC. TL I | -0.98% | 98.76 | 99.74 | 15 |

| 6 | 3,900 | DIRECTV TL | -1.88% | 95.51 | 97.34 | 14 |

| 7 | 3,600 | CDK GLOBAL TL | -0.98% | 98.74 | 99.72 | 11 |

| 8 | 3,600 | NORTONLIFELOCK TL B | -1.21% | 98.09 | 99.29 | 10 |

| 9 | 3,582 | MISYS TL B | -2.54% | 91.99 | 94.39 | 14 |

| 10 | 3,515 | LIFEPOINT HOSPITALS TL B | -1.29% | 93.00 | 94.21 | 10 |

| 11 | 3,500 | AMERICAN AIRLINES TL B | -2.58% | 100.24 | 102.90 | 12 |

| 12 | 3,500 | PILOT TRAVEL TL B | -0.41% | 99.00 | 99.40 | 11 |

| 13 | 3,450 | GOLDEN NUGGET INC TL B | -2.74% | 95.42 | 98.11 | 12 |

| 14 | 3,420 | RCN GRANDE TL | -2.42% | 81.21 | 83.23 | 11 |

| 15 | 3,380 | SOLERA TL B | -2.08% | 87.70 | 89.56 | 16 |

| 16 | 3,325 | CINEWORLD TL B | -4.50% | 12.79 | 13.39 | 12 |

| 17 | 3,312 | HUB INTL LTD TL B | -0.96% | 98.66 | 99.62 | 13 |

| 18 | 3,300 | NTL CABLE PLC TL N | -1.36% | 96.53 | 97.87 | 12 |

| 19 | 3,190 | INTELSAT EXIT TL B | -2.37% | 96.38 | 98.72 | 10 |

| 20 | 3,100 | TRANSUNION TL B6 | -0.84% | 98.77 | 99.60 | 13 |

| AVERAGE | 3,978 | -2.04% | 89.56 | 91.25 | 12.3 |

Top 10 Performers

Showcases the top 10 loan performers based on the largest bid price increases between 3/10/23-3/17/23

| RANK | NAME | CHANGE | PX | PX-1W | DEALERS |

| 1 | 0 | 0.00% | 0.00 | 0.00 | 0 |

| 2 | 0 | 0.00% | 0.00 | 0.00 | 0 |

| 3 | 0 | 0.00% | 0.00 | 0.00 | 0 |

| 4 | 0 | 0.00% | 0.00 | 0.00 | 0 |

| 5 | 0 | 0.00% | 0.00 | 0.00 | 0 |

| 6 | 0 | 0.00% | 0.00 | 0.00 | 0 |

| 7 | 0 | 0.00% | 0.00 | 0.00 | 0 |

| 8 | 0 | 0.00% | 0.00 | 0.00 | 0 |

| 9 | 0 | 0.00% | 0.00 | 0.00 | 0 |

| 10 | 0 | 0.00% | 0.00 | 0.00 | 0 |

Bottom 10 Perfromers

Showcases the bottom 10 loan performers based on the largest bid price decreases between 3/10/23-3/17/23

| RANK | NAME | CHANGE | PX | PX-1W | DEALERS |

| 1 | LUCKY BUCKS TL B | -12.54% | 32.95 | 37.67 | 9 |

| 2 | HDT GLOBAL TL B | -12.50% | 71.05 | 81.19 | 4 |

| 3 | HEALTHCHANNELS TL | -11.38% | 62.55 | 70.59 | 5 |

| 4 | CITY BREWING TL B | -10.50% | 40.00 | 44.69 | 12 |

| 5 | WORLD KITCHEN TL | -7.15% | 40.00 | 43.08 | 8 |

| 6 | CASINO GUICHARD EUR TL B | -7.03% | 75.46 | 81.16 | 12 |

| 7 | DELL SOFTWARE GROUP TL B | -6.13% | 80.47 | 85.72 | 12 |

| 8 | FOREST CITY ENTERPRISES TL B | -5.78% | 85.93 | 91.20 | 5 |

| 9 | QWEST CORPORATION TL B | -5.70% | 69.67 | 73.88 | 9 |

| 10 | ICP GROUP TL | -5.06% | 79.01 | 83.22 | 5 |

| 11 | PROMONTORY TL | -4.90% | 93.42 | 98.23 | 9 |

| 12 | RACKSPACE HOSTING TL B | -4.32% | 59.41 | 62.09 | 15 |

| 13 | MISYS 2ND LIEN TL | -4.30% | 81.17 | 84.82 | 15 |

| 14 | CANO HEALTH TL B | -4.17% | 75.78 | 79.08 | 7 |

| 15 | APOLLO COMMERCIAL REAL ESTATE TL B | -4.15% | 91.11 | 95.05 | 2 |

| 16 | IHEART TL B | -4.02% | 90.11 | 93.88 | 5 |

| 17 | EDELMAN FINANCIAL TL B | -4.01% | 92.72 | 96.60 | 13 |

| 18 | ZAYO TL | -4.00% | 79.98 | 83.31 | 15 |

| 19 | CITRIX TL B | -3.90% | 88.97 | 92.58 | 8 |

| 20 | LEVEL III TL B | -3.87% | 84.36 | 87.76 | 8 |

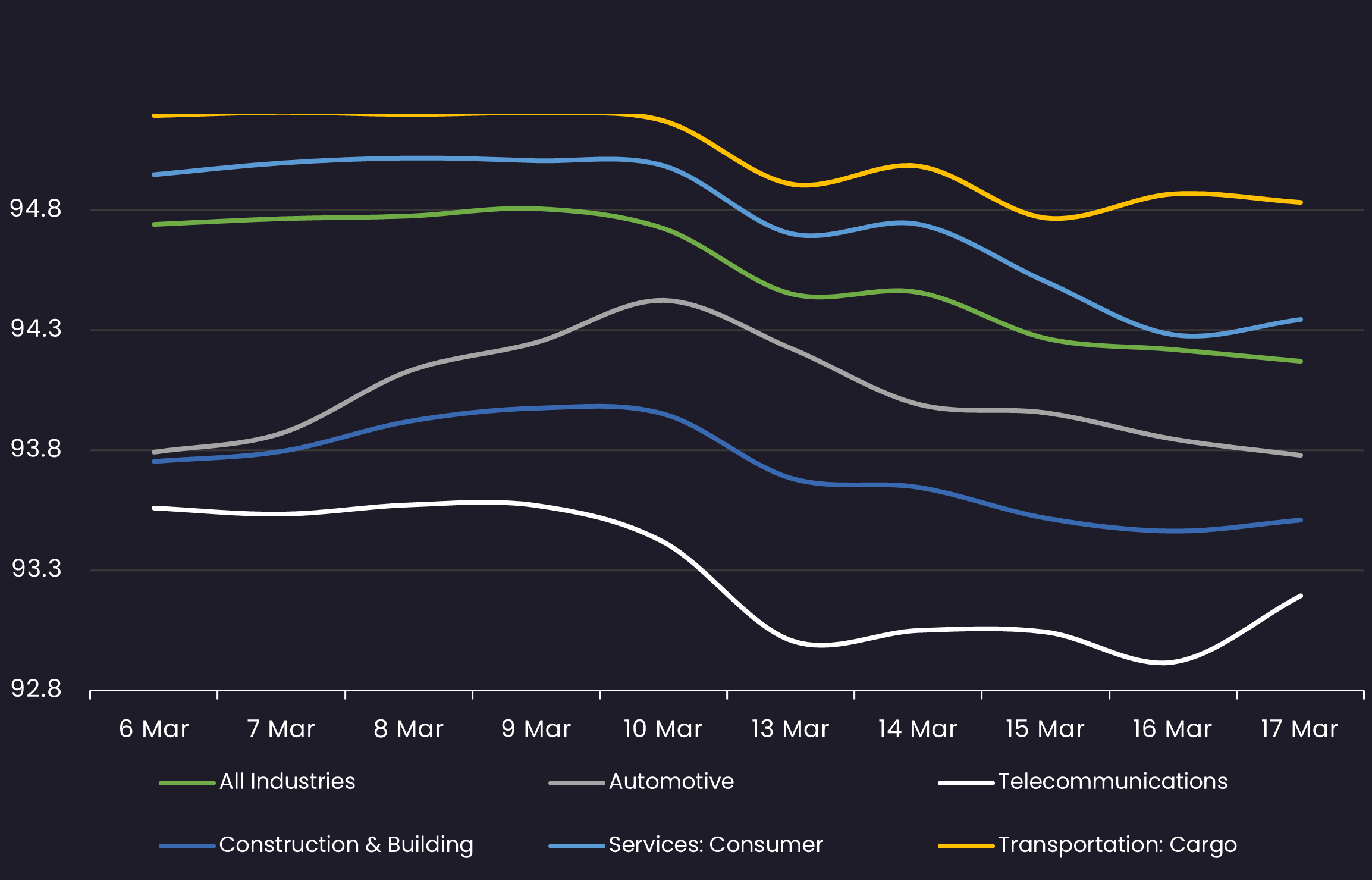

Avg Bid PX by Sector

Displays the average loan bid price by sector between 3/10/23-3/17/23

Results are based on 5 select industry sectors, however, we offer data across 36 sectors

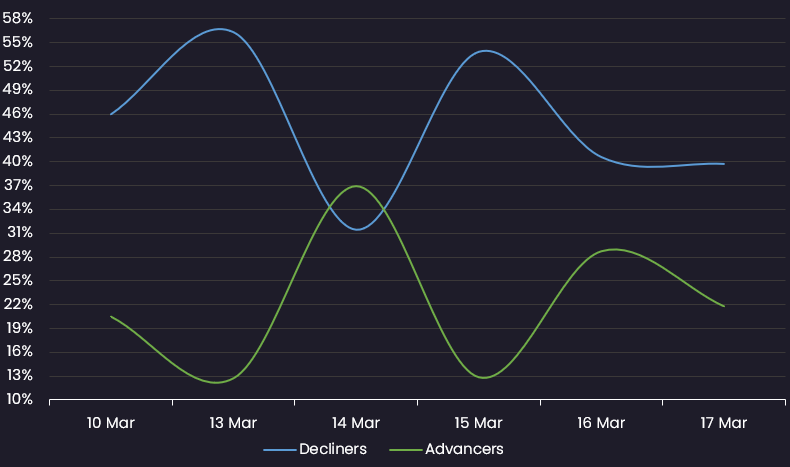

Sentiment

Reveals the percent of loans increasing in price (advancers) vs. loans decreasing in price (decliners) between 3/10/23-3/17/23

Top Quote Volume Movers: This Week vs Last Week

Exhibits the loans with the largest increase in quote volume for the week ending 3/10/23 vs. the week ending 3/17/23

| RANK | TRANCHE | PRIOR WEEK | THIS WEEK | INCREASE | % INCREASE |

| 1 | MAUSER TL B | 22 | 52 | 30 | 136% |

| 2 | AVOLON TL B3 | 61 | 84 | 23 | 38% |

| 3 | ACCOLADE WINES GBP TL B | 8 | 28 | 20 | 250% |

| 4 | AMC ENTERTAINMENT TL B1 | 42 | 60 | 18 | 43% |

| 5 | HUB INTL LTD TL B | 68 | 86 | 18 | 26% |

| 6 | GENESIS CARE EUR TL B | 13 | 31 | 18 | 138% |

| 7 | ADVISOR GROUP TL B | 34 | 50 | 16 | 47% |

| 8 | VICTORY CAPITAL HOLDINGS INC TL B | 30 | 46 | 16 | 53% |

| 9 | SPRINGS WINDOW TL B | 32 | 48 | 16 | 50% |

| 10 | TAMKO BUILDING PRODUCTS TL B | 14 | 28 | 14 | 100% |

Most Quoted Loans

Ranks the loans that were quoted by the highest number of dealers between 3/10/23-3/17/23

| RANK | TRANCHE | DEALERS |

| 1 | HEARTHSIDE FOODS TL B | 17 |

| 2 | CLEAR CHANNEL OUTDOOR TL B | 17 |

| 3 | CONVERGEONE TL B | 16 |

| 4 | FRONERI TL B | 16 |

| 5 | STAPLES TL B1 | 16 |

| 6 | DAE AVIATION TL | 16 |

| 7 | WHEEL PROS TL | 16 |

| 8 | BRAND ENERGY TL | 16 |

| 9 | TELENET EUR TL | 16 |

| 10 | SOLERA TL B | 16 |

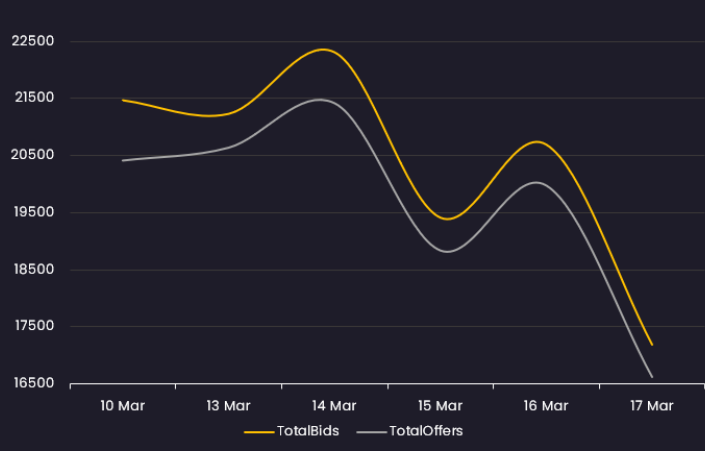

Bid and Offer Volume

Reveals the total number of quotes by bid and offer between 3/10/23-3/17/23

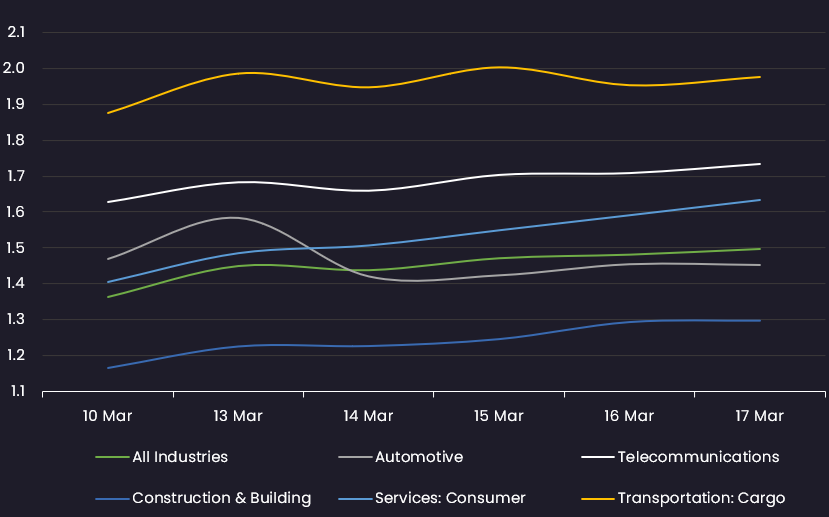

Sector Bid-Offer Spread

Results are based on 5 select industry sectors, however, we offer data across 36 sectors

Stay up-to-date with weekly summaries.